As monetary advisors navigate an more and more advanced funding panorama, the standard 60/40 stock-bond portfolio allocation is dealing with unprecedented challenges. With heightened market volatility, fast market strikes and evolving shopper expectations, various investments have emerged as a vital element in trendy portfolio development. Understanding how you can successfully combine these non-traditional belongings can improve your potential to ship superior risk-adjusted returns in your shoppers.

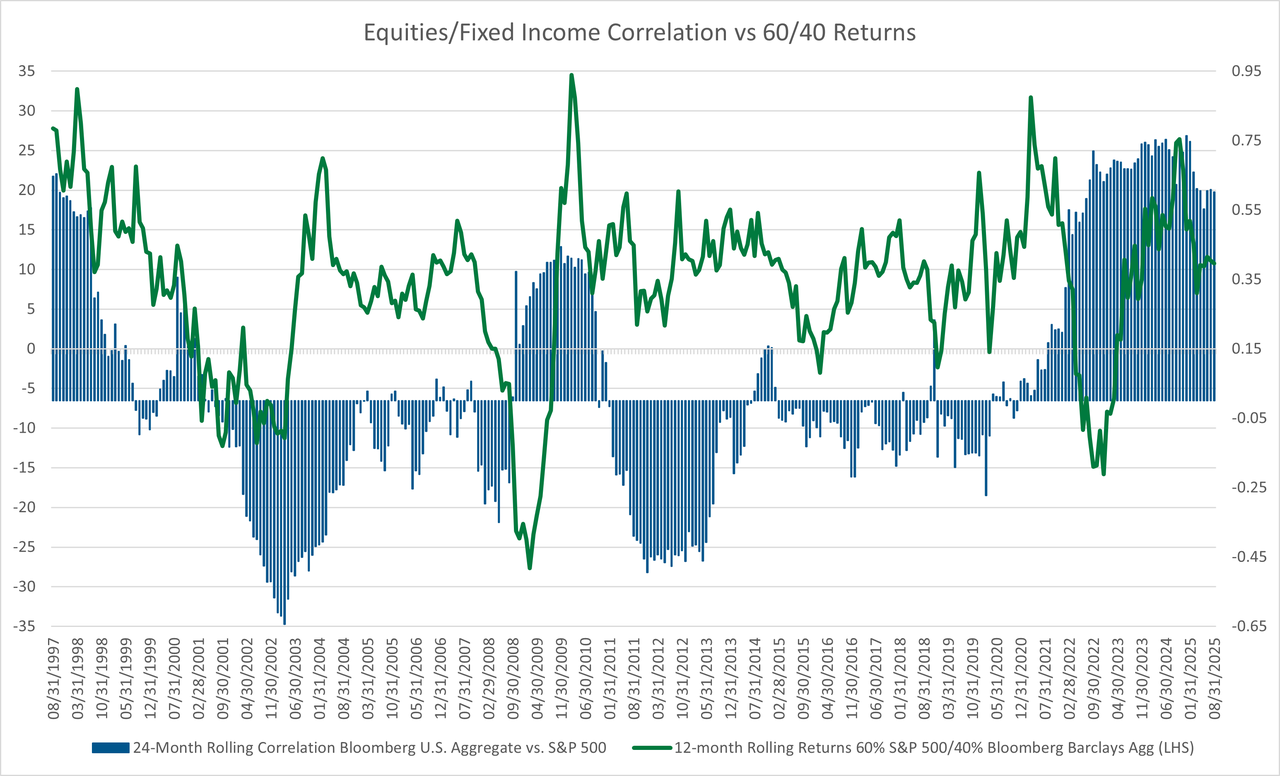

Diversification has come underneath the microscope throughout occasions of disaster just like the Nice Monetary Disaster and the Pandemic lockdown. Portfolios that had been historically thought of diversified couldn’t stand up to the worldwide attain of the 2 crises and protections failed after they had been wanted most. Moreover, the baseline 60/40 portfolio has come underneath scrutiny as a result of ending of the mounted earnings bull market which has additionally coincided with the steep fairness market sell-off in 2022. The 2022 twin sell-off in each mounted earnings and equities has bolstered the notion that to extend portfolio diversification one ought to take into account together with various investments. Just like what we’ve skilled in 2022, correlations between equities and stuck earnings enhance throughout occasions of disaster. It’s no coincidence that in these occasions of accelerating correlations, the 60/40 portfolio (60% S&P 500 index/40% Bloomberg Barclays U.S. Mixture index, rebalanced month-to-month) returns falter, which is displayed in Determine 1.

With the favored 60/40 portfolio inclined to a market disaster, one ought to take into account the implications of taking a broader view of diversification to extend your portfolio’s potential to face up to market sell-offs. Beneath we take a deeper have a look at diversification and the affect various investments have on a portfolio and whether or not they’re doing their supposed job or not.

Determine 1 – Supply: Zephyr

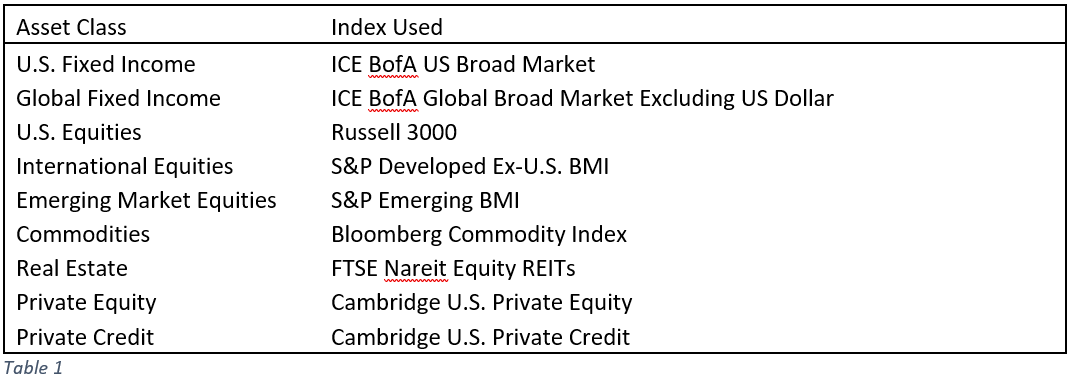

Earlier than we get began it’s necessary to reveal the asset courses and corresponding indexes used to run the imply variance optimization evaluation. Desk 1 shows the fundamental asset courses, along with the 4 various belongings used – commodities, actual property funding trusts (REITs) and personal fairness and credit score.

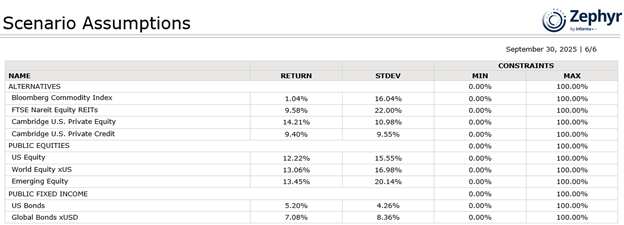

With the above data in hand, we are able to transfer ahead with setting up an environment friendly frontier to find out the affect options have on a conventional asset allocation consisting of the core asset courses. To find out the forecasted returns for the core asset courses (U.S. and International equities and stuck earnings), we use the Black Litterman forecasting mannequin, whereas for the choice asset courses (commodities, actual property and personal fairness and credit score) we use the historic returns. Desk 2 shows the forecasted returns and danger based mostly on the time interval between March 2005 – March 2025 that had been used on this evaluation.

Desk 2 – Supply: Zephyr

Alternate options Improve Threat-Adjusted Returns

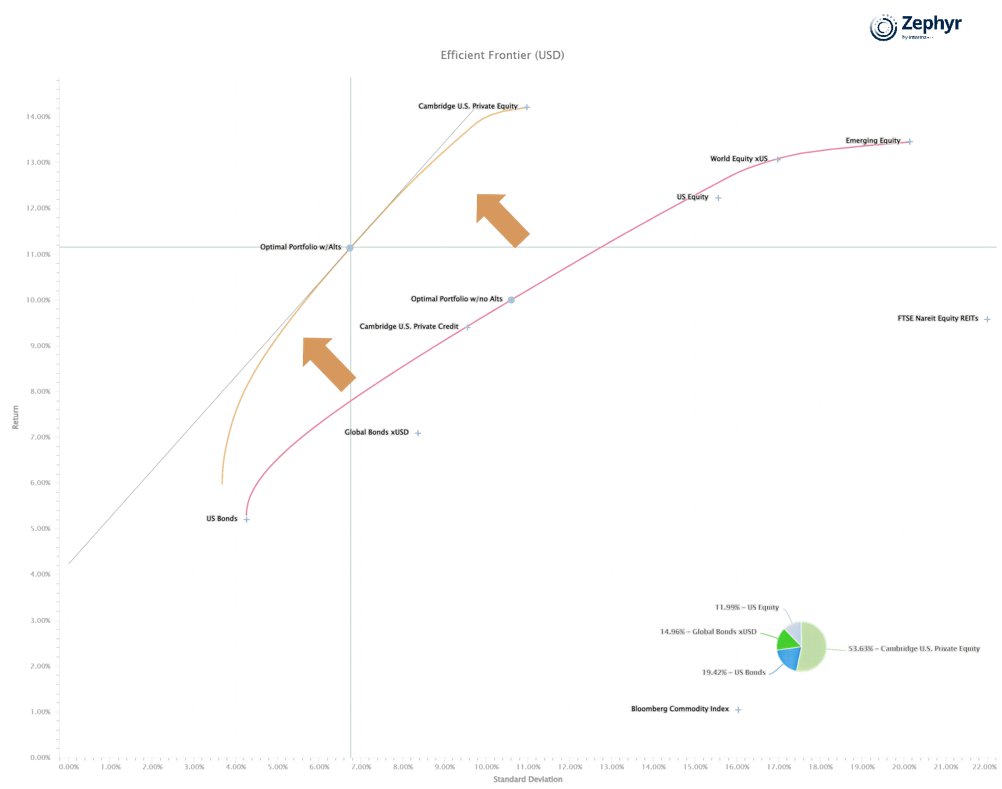

As you’ll be able to see in Determine 2, by including the 4 options listed above to an allocation case which incorporates the 5 core asset courses, the environment friendly frontier shifts to the northwest (orange line), which represents increased returns and decrease danger. That is the supposed results of including options to an allocation.

Determine 2 – Supply: Zephyr

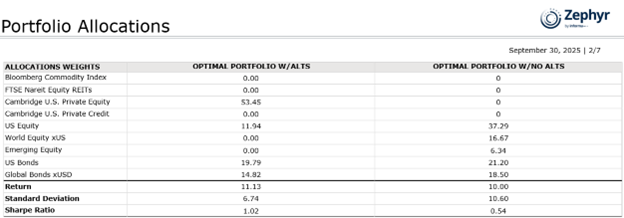

The rise in return per unit of danger by including options to the combination of asset courses is evidenced by evaluating the 2 hypothetical portfolios listed in Desk 3. These two hypothetical portfolios, one composed solely of the core belongings (Optimum Portfolio w/no Alts) and one portfolio that features options (Optimum Portfolio w/Alts), signify essentially the most optimum portfolios, or portfolios exhibiting the very best Sharpe Ratio, alongside the 2 environment friendly frontiers. It’s also value noting that these two hypothetical portfolios are simply that, hypotheticals, which are created utilizing mean-variance-optimization with no human alterations. These portfolios are for illustrations functions solely to indicate the affect of options and is probably not applicable in your shoppers. Essentially the most optimum portfolio alongside the environment friendly frontier consisting of simply core asset courses has a Sharpe Ratio of 0.54. Conversely, the Optimum Portfolio w/Alts portfolio has a Sharpe Ratio (1.02) that’s almost double that of the portfolio with no options.

Desk 3 – Supply: Zephyr

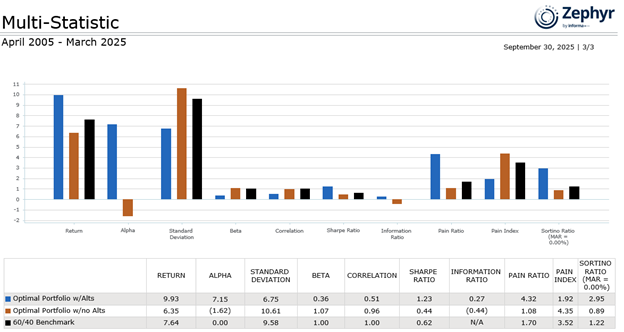

The aim of including options to an funding portfolio is to extend diversification, enhance returns and scale back danger, leading to enhanced risk-adjusted returns. Determine 4 confirms the above notion.

Not surprisingly, the portfolio with 53% in non-public fairness displays superior efficiency analytics in comparison with the Optimum Portfolio w/no Alts and the fundamental 60/40 portfolio. Along with having increased annualized returns and decrease customary deviation, the portfolio with options displays decrease beta and superior alpha. Moreover, the options assist restrict draw back losses, evidenced by the decrease ache index and better ache ratio. Whereas options give the portfolio extra juice by way of increased returns, in addition they assist mitigate danger by way of decrease volatility and decreased drawdowns.

Determine 3 – Supply: Zephyr

What Alternate options Are Doing Their Job

Taking this a step additional, we are able to have a look at the person various investments to find out if they’re including worth to the portfolios. As you’ll be able to see from determine 2 above, non-public fairness clearly provides essentially the most worth to the environment friendly frontier and that is evidenced by the massive allocation to non-public fairness within the Optimum Portfolio with/Alts. On the flip facet, commodity’s low anticipated return and excessive danger has resulted within the asset class being ignored in all portfolios alongside the environment friendly frontier.

Implementation Concerns for Monetary Advisors

Efficiently incorporating various investments requires cautious consideration of a number of components. Liquidity constraints signify maybe essentially the most important problem, as many various investments require longer holding durations than conventional belongings. This illiquidity should be balanced towards shopper wants and total portfolio liquidity necessities.

Due diligence turns into extra advanced with various investments, requiring deeper evaluation of funding managers, underlying methods, and charge buildings. The upper charges related to many various investments should be justified by way of superior risk-adjusted returns or significant diversification advantages.

Consumer training performs a vital function in profitable various funding implementation. Many consumers lack familiarity with these asset courses, making it important to obviously talk the function every funding performs of their total portfolio technique. Setting applicable expectations concerning liquidity, volatility, and return patterns helps forestall misunderstandings throughout market stress durations.

Strategic Allocation Tips

The suitable allocation to various investments varies considerably based mostly on shopper circumstances, danger tolerance, and funding targets. Typically, allocations starting from 10% to 30% of complete portfolio worth can present significant diversification advantages with out overwhelming conventional asset courses.

For conservative buyers, REITs and infrastructure investments may comprise the majority of different allocations, offering regular earnings with modest progress potential. Extra aggressive buyers may embody non-public fairness, hedge funds, and commodity investments to boost return potential whereas accepting increased volatility.

Conclusion

When making a portfolio in your shopper which goals to boost risk-adjusted returns by way of diversification, various investments must be thought of. Understand that not all various investments are created equally, and that every various offers distinctive advantages to a portfolio. It’s necessary to have a look at all components together with what danger(s) you are attempting to guard towards in addition to how correlations fluctuate throughout totally different market cycles.

Ryan Nauman is the Market Strategist at Zephyr, which helps funding professionals make extra knowledgeable funding selections on behalf of their shoppers. Join with Ryan on LinkedIn.

Zephyr, is an award-winning asset and wealth administration software program that provides portfolio development, proposal era, superior analytics, asset allocation, supervisor screening, danger evaluation, portfolio efficiency and extra, remodeling multifaceted knowledge into digestible intel.