There are repeating episodes in world macroeconomics that reveal the absurdity of the mainstream mind-set. One, clearly is the recurring debt ceiling charade within the US, the place over a interval of months, the assorted events make threats and faux they may shut the federal government down by failing to cross the invoice. Others assume up what they assume are ingenious options (just like the so-called trillion greenback coin), which simply offers the stupidity oxygen. One other instance is the European Union ‘finances’ deliberations which contain excruciating, drawn out negotiations, which at the moment are in practice in Europe. One of many controversial bargaining features because the Member States negotiate a brand new 7-year deal is the fairly important amount of joint EU debt that was issued throughout the pandemic to assist nations via the disaster. How that’s repaid is inflicting grief and resulting in fairly ridiculous ideas of additional austerity cuts and extra. My suggestion to chop via all this nonsense is that the ECB takes over the debt and insulates the Member States from reimbursement. In any case, the debt wasn’t issued as a result of the Member States have been pursuing irresponsible and profligate fiscal methods.

The talk in Europe is nearly parallel to actuality.

First, some context.

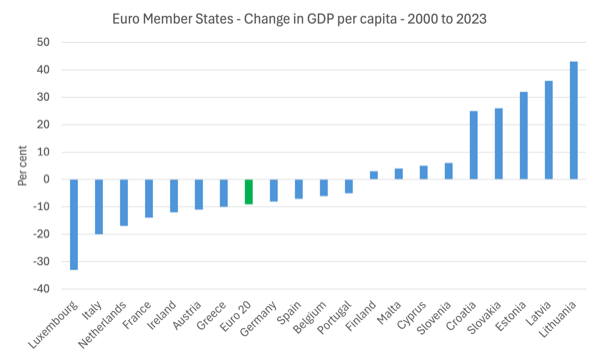

The next graph exhibits the share change in actual GDP per capita within the Euro 20 Member States in addition to the general combination (in inexperienced) from 2000 to 2023 (newest information from Eurostat).

The vast majority of Member States are on common poorer on this respect, some considerably so.

The general frequent forex space declined by 9 per cent over the interval that the Euro has been in use (as much as 2023).

When this information is out there for 2024, the state of affairs could have worsened slightly, given the more moderen nationwide account figures.

I may assemble many indicators that will reinforce the conclusion that in financial phrases, the adoption of the frequent forex has been disastrous for a lot of nations, together with the bigger conventional EU Member States resembling France and Germany.

The outdated Baltic satellites have fare higher than these conventional EU states however they have been coming off a really low base.

Second, bear in mind Mario Draghi’s speech at CEPR on December 18, 2024 – Coverage Perception 137: Europe: Again to Home Progress – the place he did all the pieces however admit that the structure of the financial union was dysfunctional.

He opened that tackle with this:

Productiveness, incomes, consumption, and funding have been structurally weak in Europe because the flip of the millennium and have considerably diverged from the US.

It was not all the time this fashion. After the second world warfare, Europe’s labour productiveness converged from 22% of the US degree in 1945 to 95% in 1995. And for many of this era, home demand as share of GDP within the euro space stood in the course of the vary of superior economies.

He then claimed that the expertise shock (Web) and the GFC meant that from the “mid-Nineties onwards, relative progress within the US and euro space was pushed aside”.

He declined to say a bigger actuality within the mid-Nineties.

That the signatories to the Treaty of Maastricht had begun their so-called convergence course of to make sure they could possibly be included in Stage 3 of the Treaty introduction (the shift to the euro).

That convergence course of noticed these nations start the austerity push which largely set in movement the stagnation that has adopted.

Draghi tried to assert the GFC was someway instrumental in making a divergence between the US and the Euro space by way of materials prosperity:

… the good monetary disaster and sovereign debt disaster, following which the orientation of the euro space shifted away from home demand.

That is true.

However why did the Euro space undergo a sovereign debt criis and impose austerity when the US and different superior nations averted such turmoil?

The reply lies within the flawed financial structure that the neoliberals led by Jacques Delors foisted on the Member States which not solely noticed them give up their forex sovereignty in favour of utilizing a overseas forex (the euro) – the supply of the sovereign debt disaster – but additionally coerced them into accepting fiscal guidelines that meant they didn’t have adequate flexibility to defend home demand and financial exercise in opposition to unfavorable cyclical shocks.

And, furthermore, the enforcement of the fiscal guidelines via the – Extreme Deficit Process (EDP) – by the technocrats within the European Fee, aided and abetted by the ECB and the IMF, meant that the capability to provide revenue progress was decimated.

The GFC was because the identify suggests ‘world’ in affect.

However it was the Europeans and different nations that insisted on imposing such austerity as the automated stabilisers drove up deficits (as non-government spending declined and unemployment rose) elevated.

The European economies signed as much as that harmful response and have by no means actually recovered since.

Draghi understands clearly the state of affairs:

With funding stalling and financial coverage changing into contractionary, each the company and authorities sectors shifted to being in surplus. Because of this, home demand as a share of GDP within the euro space fell to backside of the vary of superior economies …

The relative stance of fiscal coverage was an essential driver. From 2009 to 2019, the collective cyclically-adjusted fiscal stance within the euro space averaged 0.3%, in contrast with -3.9% within the US.

Financial institution loans additionally dried up within the Euro space between 2009 and 2016 as a result of the demand for credit score dried up.

The ECB claimed the dearth of financial institution lending was as a result of they didn’t have adequate reserves and launched into a QE program.

However it was by no means a few lack of reserves and all about insecurity.

Draghi additionally had a veiled shot at Germany in his speech:

Furthermore, European insurance policies tolerated low wage progress as a method to extend exterior competitiveness, compounding the weak income-consumption cycle. Since 2008, annual common actual wage progress has been nearly 4 occasions greater within the US than the euro space.

The chief within the ‘low-wage cost’ was Germany, who through the Hartz assaults on labour market circumstances, thought they have been being intelligent by gaming the opposite Member States and guaranteeing their export sector would growth.

Please learn my latest weblog put up – Germany’s sectoral decline and its obsession with fiscal austerity (February 3, 2025) – for extra dialogue on the place that technique has landed Germany.

Draghi recognised that the coverage mannequin deployed inside Europe that suppressed home demand through fiscal austerity and low-wages and sought progress through export markets (significantly to China) is “not seems sustainable”:

For a while now, the Chinese language market has been turn out to be much less beneficial for European producers as progress slows and native operators turn out to be extra aggressive and transfer up the worth chain. Exports to China have stagnated since 2020.

The issue is that the ideological mindset of the European polity and the macroeconomic insurance policies that they envisage:

… are nicely positioned to fill the hole left by exterior demand.

That abstract actually quantities to a devastating critique of the entire construction of the financial union, of which Draghi was a central determine in implementing.

Of relevance to the subsequent a part of this dialogue is the truth that Draghi realises that:

If the EU have been to situation debt collectively, it may create extra fiscal house that could possibly be used to restrict intervals of below-potential progress …

If EU bonds traded like equal protected property in the present day, the comfort yield would push borrowing prices under progress charges.

This differential would permit the EU to situation extra debt – probably as much as 15% of GDP – and roll it over indefinitely with out requiring funds from the Member States.

In different phrases, Europe ought to abandon the notion that the key counter-cyclical macroeconomic coverage capability ought to stay on the Member State degree, that are constrained by the truth that their debt is topic to credit score danger (as a result of they’re issuing debt in a forex overseas to them) and the fiscal rule displays are watching them like hawks able to shunt them into the EDP and drive austerity cuts on their governments.

In my 2015 ebook – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (revealed Might 2015) – I argued that the best way out for Europe was to create a real federation which a federal fiscal capability that will dominate the Member State coverage capability in monetary phrases.

That choice was intentionally eschewed by the founders as a result of they knew Germany, for one, would by no means signal as much as it they usually additionally desired to restrict the capability of nationwide governments – they have been neoliberals in spite of everything.

The idea of EU joint debt or debt issued by the European Fee fairly than the Member States is now dominating the present discussions concerning the subsequent EU ‘finances’.

Politico carried a narrative earlier this week (February 11, 2025) – The EU’s ticking debt bomb — and why it issues for its subsequent finances – which captures the European mentality within the headline.

“Ticking debt bomb”.

A buddy despatched me the hyperlink with the E-mail heading ‘Ticking’.

I laughed.

The EU Member States are embarking on the torturous technique of designing the subsequent 7-year fiscal coverage (finances) with a fairly substantial pandemic hangover within the type of the joint debt that must be repaid from 2028 (the finances interval runs from 2028 to 2034).

Nothing is fast within the EU.

Politico notes that:

Deliberations are much more tough this time round as a result of the Fee’s €300 billion joint debt program to rescue the EU economic system after the Covid pandemic is up for reimbursement from 2028. With no new plan, that might take an enormous chunk — between 15 p.c and 20 p.c, based on the Fee’s estimates — out of the bloc’s spending energy.

So designing a “reimbursement plan bore 2028” is occupying the technocrats and politicians.

The 4 most uncovered nations face important ‘worst-case’ contribution situations – Germany (€35.8 billion), France (€28.6 billion), Italy (€19.6 billion), and Spain (€13.4 billion).

All these economies are in decline and a few would possibly say structurally so.

The primary Commissions technique was to make use of “levies on carbon emissions, imports and earnings of multinationals” to repay the debt however that was rejected by the Member States as a result of it could have diverted an important income for themselves.

The fact is that:

The default choice consists of nationwide governments filling the outlet by sending extra money to Brussels.

However that’s extremely problematic given the fiscal guidelines and the dearth of solidarity throughout the so-called Union.

Politico notes that:

Nations from Northern Europe — which have acquired a comparatively small share of the EU’s post-Covid assist — are loath to pay extra into the finances …

Which works to the center of the issue of the structure.

The on-going hostility of the wealthy Northern Member States to creating unconditional transfers throughout the Union to assist different Member States cope with uneven shocks and poor financial efficiency is why the financial union ought to by no means have been created within the first place.

Member States inside useful federations (say Australia) know that the federal fiscal capability has to have the ability to make uneven fiscal transfers when the necessity arises.

Simply this morning, the Australian authorities introduced a big fiscal bundle that can assist Northern Queensland cope with the latest main flooding episode that has devastated areas and city in that a part of the nation.

No-one within the Southern States blinks and calls for fee in return.

However the Northern European states are arguing they need cuts to help to different states throughout the Union if they’re compelled to contribute to paying off the Covid debt.

They clearly don’t see a ‘federal’ system and are suspicious of the Southern Member States.

Which is among the causes the dysfunctional structure was put in within the first place – Germany publicly said its distrust of Italian officers, for instance.

In truth, throughout the late Nineties convergence course of, German officers argued that Italy must be excluded from Stage 3 as a result of its public debt to GDP ratio was too excessive (exterior the SGP parameters).

It was solely when it was identified that Belgium, was in an identical state of affairs, that the Germans realised that tack wouldn’t work.

Politico experiences that:

However Germany and its fiscally conservative allies see this as a slippery slope towards a fiscal union, wherein the Fee completely takes on the money owed of its 27 members.

And Germany won’t ever permit that to occur.

Right here is my suggestion with the present design parameters of the system (noting I advocate abandoning the entire frequent forex):

1. The duty for the joint debt be taken off the European Fee and handed over to the ECB. That might simply be carried out.

2. The ECB then pays the debt off when funds fall due with a stroke of a pc keyboard. It’s the forex issuer and has infinity minus one euro penny capability to do that.

3. No legal responsibility or conditional can be imposed on the Member States.

No fiscal disaster.

No austerity crucial when the alternative (as Draghi notes) is required.

QED.

Critics would declare this method would simply gas so-called ethical hazard and encourage the Member States to spend up large and situation stacks of debt.

First, they can’t beneath the fiscal guidelines ‘spend up large’.

Second, the bond market yields would rise earlier than they might situation ‘stacks of debt’.

Third, and extra importantly, the joint debt that’s inflicting all of the controversy and heartache was not issued on account of fiscal profligacy by the Member States.

Nations around the globe have been dealing with a pandemic, which we had no actually understanding of and no certainty of what was going to occur.

Governments needed to act in a major method to supply some surety to their residents in such an unsure interval.

So the European officers may simply make the case that this joint debt was one thing fairly completely different (which it was) relative to nationwide authorities debt issued to cowl fiscal deficits which are, partially, the product of discretionary fiscal selections they’ve taken (good or dangerous, prudent or irresponsible).

Conclusion

Such an instantaneous and easy answer is just too apparent for the tortured souls within the European Fee.

That’s sufficient for in the present day!

(c) Copyright 2025 William Mitchell. All Rights Reserved.