The COVID-19 pandemic has had a shocking impact on divorce charges within the U.S. Well being and financial considerations in addition to different uncertainties have prompted some sad {couples} to attempt to stick it out, and divorce charges have truly declined. As extra folks get vaccinated

and regularly return to pre-pandemic routines although, the numbers are prone to surge. And in the event you’re an advisor guiding ladies via monetary change after a divorce, this anticipated uptick is one thing to consider.

Divorce is another space the place we’re seeing proof of the pandemic’s influence on ladies. Ladies are typically hit tougher financially after divorce to start with. And since ladies have skilled the best charges of job losses in 2020, a post-pandemic divorce is much more prone to interrupt a lady’s monetary path. The influence could also be most acute for shoppers who discover themselves in a “grey” or late-life divorce. Grey divorce charges have been already outpacing these for youthful {couples} earlier than the pandemic. The choice to finish a wedding after age 50 may imply unraveling belongings and funds which have been shared for many years.

With this in thoughts, as an advisor guiding ladies via monetary change after a divorce, what ought to your conversations embody? There are a number of areas you possibly can deal with to shed some mild—significantly for shoppers who ceded management of main monetary choices to their partner—together with serving to them perceive the division of marital belongings, revenue concerns, and property planning.

Division of Marital Belongings

This subject can turn out to be extremely sophisticated. Belongings acquired throughout marriage are break up in keeping with state regulation. Most states comply with equitable distribution guidelines that may contemplate all marital belongings, and a court docket will decide their distribution between spouses. Within the 9 states which have neighborhood property legal guidelines, belongings acquired throughout marriage are thought of owned 50 p.c by every partner, with sure exceptions. Equally, money owed acquired throughout the marriage are typically attributable to each spouses. In noncommunity property states, money owed often stick with the partner who incurred the debt, until the opposite partner cosigned or in any other case assured it.

Retirement financial savings. Contributions to employer-sponsored retirement plans and IRAs made throughout marriage are typically thought of marital property, with some exceptions. Contributions made outdoors of the wedding could be thought of separate property. Certified plans, akin to pensions or 401(okay)s, needs to be divided pursuant to a professional home

relations order (QDRO). A QDRO permits for a tax- and penalty-free switch to a nonowner ex-spouse. Neither the unique proprietor nor the divorcing nonowner needs to be taxed or penalized if the nonowner rolls the belongings instantly into a professional plan or an IRA. If the nonowner partner receiving the distribution makes use of the funds in another trend, a tax can be imposed on that distribution—however solely to that partner.

Early dialogue of the QDRO could be useful to the nonowner partner, as choices can differ from plan to plan. Pensions, for instance, will typically not pay a lump sum however will make funds to the ex-spouse the identical approach they’d be made to the employee-owner. The

sooner a QDRO is offered to a plan administrator, the clearer the understanding a divorcing partner may have over her choices.

The dialogue about your shopper’s choices also needs to embody creditor safety. As retirement plans lined by ERISA, 401(okay) plans have creditor safety. If the 401(okay) is rolled into an IRA, it is going to proceed to be shielded from chapter collectors, however it is going to

solely obtain normal creditor safety as offered by state regulation.

Dividing an IRA is totally different. ERISA doesn’t cowl IRAs, and the division of an IRA doesn’t require a QDRO. For federal tax functions, if the division follows a court-issued divorce decree and is made as a trustee-to-trustee switch versus an outright distribution, an IRA proprietor can keep away from tax and penalties. As soon as the asset is transferred, every partner turns into solely answerable for tax and penalties of any future distributions.

Household residence. If one partner desires to carry on to the house, the marital property could be equalized from different belongings if mandatory. Present circumstances associated to the pandemic could complicate the equalization, although. As a result of inventories and rates of interest stay low, demand exceeds the provision of properties on the market. On this vendor’s market, we’re seeing properties offered instantly after the Coming Quickly signal is posted. Plus, the rise in values throughout the U.S. will increase the probability that the equalization could contain the trade of extra liquid belongings to maintain the home.

You’ll have to consider ongoing mortgage funds, property taxes, and upkeep bills into your shopper’s present money circulation and long-term monetary plan to see whether or not preserving the house is definitely possible. If not, it could be time to look into options—like refinancing or downsizing.

Life insurance coverage. The accrued money worth of a life insurance coverage coverage is topic to division—very similar to another marital asset. Transferring a coverage’s possession could be a part of a divorce decree if it’s essential to divide the money worth. In case your shopper owns a coverage, although, ensure she alters her beneficiary designations if she doesn’t need her ex-spouse to obtain the loss of life profit.

Revenue Issues

Within the division of marital belongings, revenue could should be equalized if one partner was the breadwinner. State household legal guidelines decide any alimony quantities. Whether or not your shopper can be paying or receiving alimony funds, the influence on her month-to-month or annual money circulation needs to be factored into the monetary plan.

Alimony. Below the Tax Cuts and Jobs Act of 2017, alimony funds are now not deductible by the payer, and consequently, the payee can’t embody the cash as taxable revenue. This modification applies to divorce settlements made after December 31, 2018. It might additionally apply to present agreements which can be modified after that date however provided that the modification explicitly states that the brand new rule applies.

Social safety. Your divorced shopper might be able to gather social safety revenue on her ex-spouse’s working report (even when the ex-spouse has remarried) so long as she has not

remarried, the wedding lasted greater than 10 years, and the couple has been divorced for greater than two years. She and the previous partner have to be 62 or older for her to qualify. If she was born earlier than December 31, 1953, she will file a restricted utility permitting her to obtain as much as 50 p.c of her ex-spouse’s full retirement age profit quantity, whereas her personal profit can develop with delayed retirement credit. If she’s hesitant to discover this feature, you

can reassure her that her ex-spouse received’t concentrate on her declare and doesn’t should be concerned.

Youngsters’s social safety advantages could also be obtainable for an single ex-spouse of any age who’s caring for a kid youthful than 16.

Youngster help. Youngster help points, together with monetary help and bodily care, are a extremely delicate matter often resolved in court docket. The divorce decree ought to specify the quantities, if any, of kid help paid from one partner to the opposite, in addition to who can be entitled to assert the youngsters as dependents for tax functions. Whereas the pandemic’s influence on ladies has been largely disproportionate, one constructive outgrowth is a rising consensus that childcare is, in reality, infrastructure. This focus could ease the childcare burden for girls who’re custodial dad and mom.

Property Planning

To accommodate any changes following a divorce, encourage your shopper to replace her property plan. Though most state legal guidelines nullify a beneficiary or fiduciary designation of an ex-spouse, she could have to amend or get new trusts, wills, and powers of lawyer, in addition to change beneficiary designations. If the previous partner was named as her trusted individual or beneficiary in paperwork or on accounts, these designations needs to be modified as quickly as potential. And in case your shopper retains custody, even partial custody, the guardianship of the minor—each the kid and the kid’s property—needs to be addressed in her property planning paperwork.

Taking the Lengthy-Time period View

There’s a burning want for long-term planning when guiding ladies via monetary

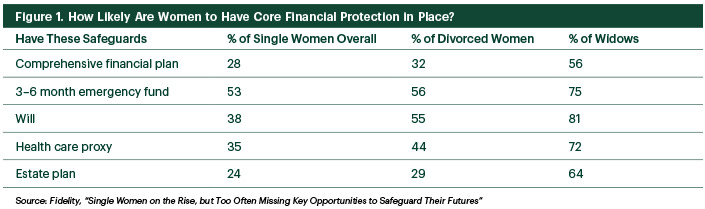

challenges after a divorce. Many married ladies lack a complete view of their funds. In a 2017 Constancy Investments survey, solely about one-third of divorcées felt financially ready for the breakup of their marriage (see the chart beneath).

Along with encouraging property planning, emergency financial savings, and well being care plans, a sophisticated technique ought to guarantee safety towards a lack of revenue with sufficient insurance coverage for well being, life, and incapacity. Incapacity insurance coverage can present mandatory revenue substitute when a single lady has no companion to step in, and a single lady with youngsters can use life insurance coverage to guard the wants of these underneath her care after her loss of life.

Commonwealth Monetary Community® doesn’t present authorized or tax recommendation. You need to seek the advice of a authorized or tax skilled relating to your particular person scenario.

Editor’s Word: This put up was initially revealed in October 2019, however we have up to date it to carry you extra related and well timed data.