A reader asks:

I’d like to see your tackle a concrete financial savings/web price quantity targets by age for a cushty life, with out the hand-wavey “X% of your earnings” that so many different websites give. Earnings at all times adjustments a lot from yr to yr in order that response by no means feels worthwhile to me.

The proportion of earnings method to how a lot cash you need to have saved is sort of prevalent today.

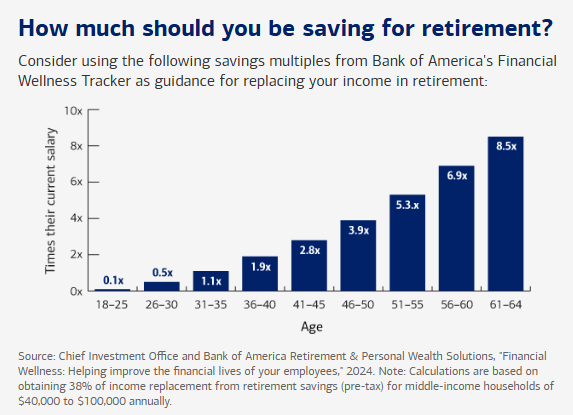

One thing like this one from Financial institution of America:

I perceive why some individuals won’t be comfy utilizing one of these knowledge as a benchmark.

Incomes do change from yr to yr. Some individuals work on a variable earnings versus a wage. Plus, your absolute earnings degree is context-dependent. Making $250k a yr in Iowa is drastically completely different than making $250k a yr in NYC.

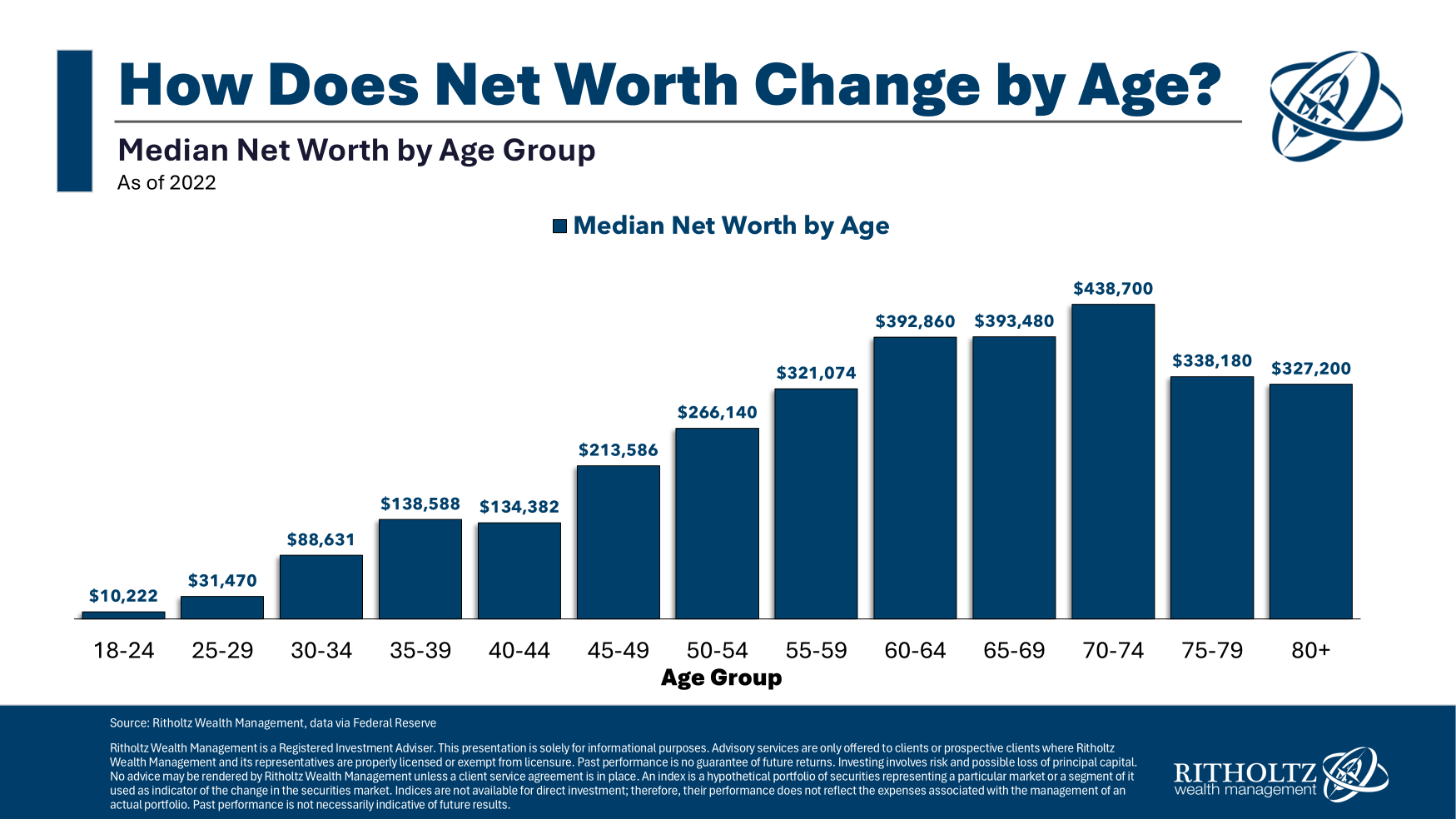

You can additionally benchmark by the precise numbers. Right here’s a take a look at median web price ranges by numerous age teams:

These are the median web price figures from the most recent Federal Reserve Family Survey. They break them out by 5 yr intervals. The issue right here is that there’s a wide selection across the median figures.

For instance, within the 40-44 age group, the median web price is $134k. For the underside 25%, it’s $23k. For the highest 25% it’s $436k. And for the highest 10% and 1%, it’s $1.1 million and $7.8 million, respectively.

One thing for everybody relying on who you want to examine your self with.

Sadly, there actually is not any passable reply right here.

A “comfy” life is subjective. It’s going to be based mostly on:

- How a lot you earn.

- The place you reside.

- How a lot you spend.

- How a lot you save.

- Your objectives in life.

- Your tastes for the finer issues.

These things is and at all times shall be circumstantial.

Nevertheless, you continue to should do one thing for planning functions. You’ll be able to’t simply make a wild guess and hope for one of the best.

I’m a spreadsheet warrior and have been performing a easy monetary planning train since I received my first job out of school and had a detrimental web price. Right here’s what I’ve performed since I entered the funding business 20+ years in the past:

Each 3-4 years I do a list on the place we’re financially:

- What do owe?

- What can we personal?

- What can we make?

- What’s our financial savings charge?

- What’s our web price?

Then I make some assumptions:

- Let’s say our earnings grows by X% within the coming years.

- Let’s say our financial savings charge is X% this within the coming years.

- Let’s say our investments develop by X% within the coming years.

These assumptions embody a baseline, a conservative and an aggressive estimate.

I do know these numbers are made up however what else are you able to do? Because the outdated saying goes, I’d slightly be roughly proper than exactly unsuitable.

Then I map that out over the subsequent 5-10 years.

And each few years I examine the precise outcomes to the estimates.

Possibly the earnings numbers are higher than anticipated, the returns have been about common, and we truly saved lower than deliberate or another mixture of this stuff. Then I determine if any course corrections are mandatory based mostly on the now up to date numbers and present monetary state of affairs.

Which may imply dialing up or down the financial savings charge, altering our asset allocation or making no adjustments (which is what occurs most frequently.)

Our monetary planners at Ritholtz Wealth have a way more detailed method and software program applications to make the most of with purchasers however that is the final method they take as effectively.

Monetary planning requires estimates, assumptions and updates because it’s a course of and never a one-time occasion.

I like the concept of evaluating your self to your self versus peer benchmarks or made-up goalposts.

It’s additionally price remembering that your goalposts will at all times be shifting and that’s OK. My objectives, desires and aspirations are a lot completely different now in my 40s as a household man than they have been in my 20s with no obligations.

One in all my anti-personal finance beliefs is that you simply by no means truly determine what ‘sufficient’ means to you and that’s OK too. It’s extra about discovering a spread you’re comfy and content material with in the interim.

However your private goalposts are the one ones that matter really matter.

Invoice Candy joined me on Ask the Compoud this week to do a deeper dive on this query:

We additionally answered questions from viewers on an investor with an excessive amount of cash in CDs, how the brand new tax invoice will influence your taxes, the brand new $1,000 child accounts and the best way to pay no taxes.

Additional Studying:

How A lot Do People Have Saved For Retirement?