In 2023, practically 6.45 million properties, round 5% of U.S housing inventory, had been labeled as insufficient in response to the American Housing Survey (AHS). Of those, 1.65 million properties had been labeled as severely insufficient, displaying vital considerations over housing high quality. Whereas this reveals ongoing points in nation’s housing circumstances, it alerts possible market development for reworking and residential enhancements within the yr forward.

The U.S. Division of Housing and City Improvement (HUD) defines bodily adequacy based mostly on whether or not a house meets the essential customary of “an honest dwelling and an acceptable dwelling setting”. Properties are severely insufficient in the event that they exhibit main deficiencies, reminiscent of uncovered wiring, lack of electrical energy, lacking scorching or chilly operating water, or the absence of heating or cooling methods. Moreover, properties with not less than 5 vital structural issues reminiscent of water leaks, massive open cracks or holes within the flooring additionally belong to this class. Reasonably insufficient properties have three or 4 vital structural points, or have issues reminiscent of incomplete kitchen services, lack of vented heating tools, or extended bathroom breakdowns.

Housing inadequacy has remained a persistent concern over the previous decade, proven in Determine 1. In 2023, round 6.5 million households lived in reasonably or severely insufficient housing. Whereas the entire variety of insufficient properties declined barely from 6.9 million in 2015 to six.0 million in 2019, it rebounded to six.7 million in 2021 and remained elevated in 2023. The bulk, round 4.8 million, of insufficient properties had been reasonably insufficient, whereas 1.65 million households lived in severely insufficient circumstances in 2023.

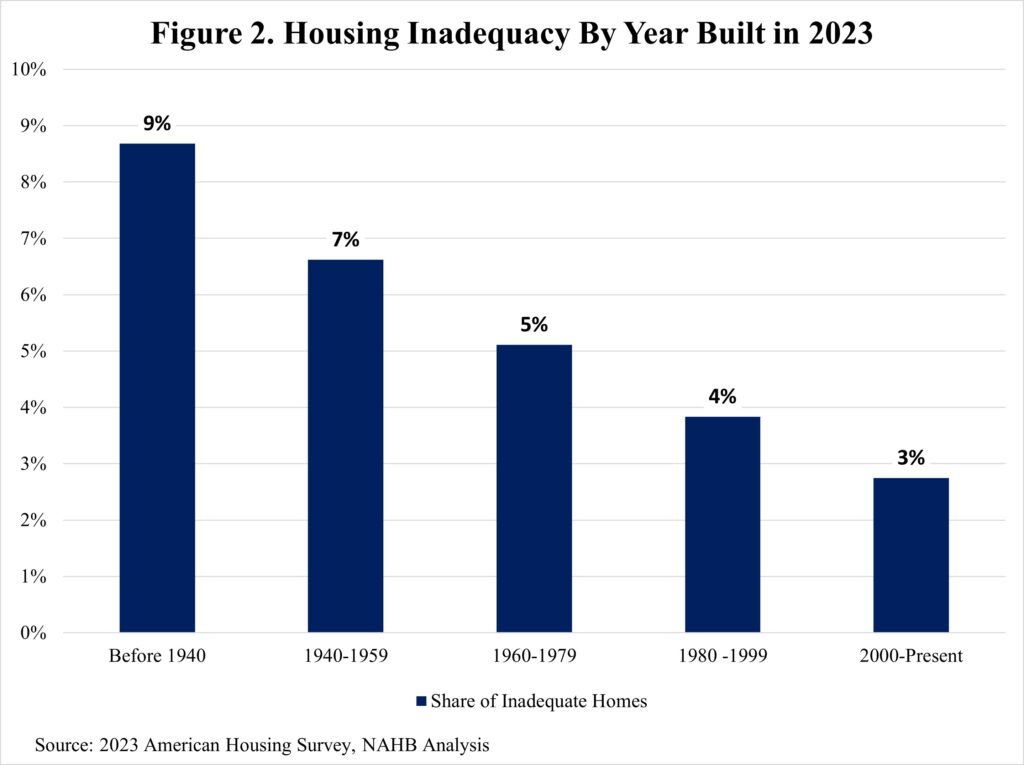

The share of insufficient properties varies considerably by the age of the house (Determine 2). Older properties have increased charges of inadequacy. Properties constructed earlier than 1940 have the best inadequacy fee at 9%, adopted by these constructed between 1940 and 1959 at 7%. Whereas housing items from 1960 to 1979 present a reasonable inadequacy fee of 5%, they account for the biggest variety of insufficient properties, with 1.2 million labeled as reasonably insufficient and 465,000 as severely insufficient in 2023. In distinction, newer properties (1980-Current) have decrease inadequacy charges with the share steadily declining from 4% for properties constructed between 1980 and 1999 to three% for these constructed from 2000 to the current.

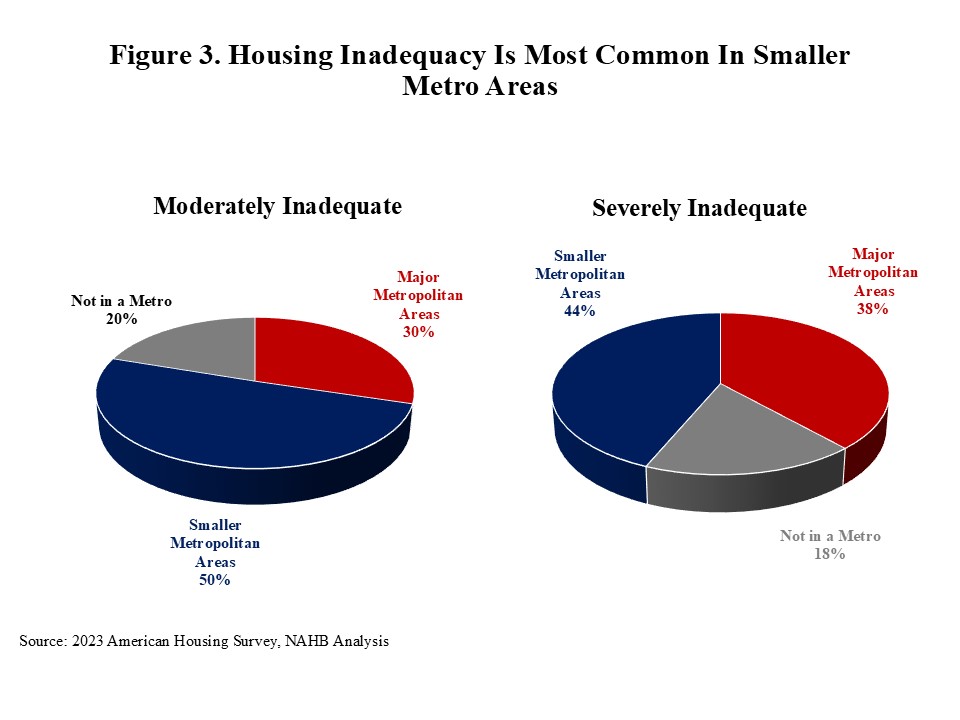

Geographically, insufficient housing is most concentrated in smaller metro areas. Round 50.4% of reasonably insufficient properties (2.4 million items) and 43.6% of severely insufficient properties (720,000 items) are in these areas in 2023. This pattern is probably going pushed by growing older housing inventory and decrease family revenue in comparison with main metro areas. Nonetheless, main metro areas nonetheless have a considerable share of insufficient properties, with 29.7% of reasonably insufficient (1.4 million) and 38.2% of severely insufficient items (631,000). Non-metro areas have the bottom complete numbers, (953,000 reasonably insufficient and 720,000 severely insufficient properties), although challenges persist.

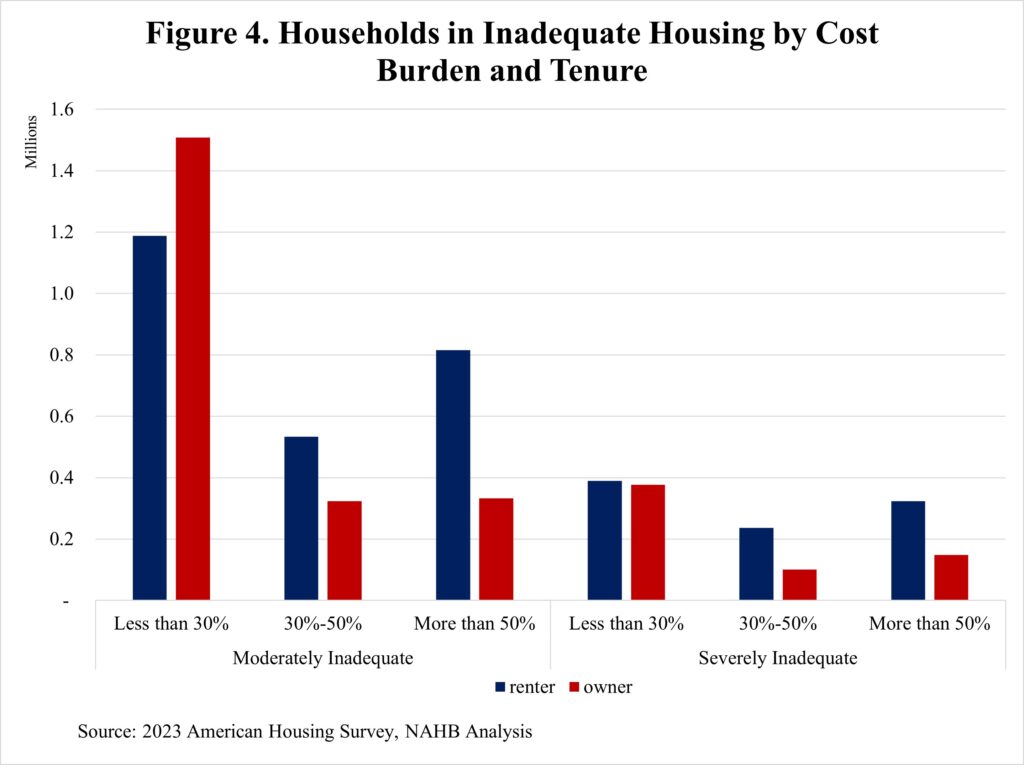

In 2023, round 6.45 million households lived in insufficient housing, with extra renters (3.5 million) than homeowners (2.8 million). Housing price burdens various vastly amongst these two teams: Amongst these households in insufficient properties, 1.9 million homeowners spent lower than 30% of their revenue on housing, in comparison with 1.6 million renters. It means that many householders dwelling in insufficient housing might certainly have the monetary capability to enhance their housing circumstances in the event that they select to take action. In distinction, renters in insufficient housing face better monetary constraints, with 1.1 million spending greater than 50% of their revenue on housing, greater than double the 480,000 cost-burdened homeowners. This disparity highlights the challenges renters are going through, together with restricted reasonably priced housing choices and an absence of management over property circumstances.

Uncover extra from Eye On Housing

Subscribe to get the most recent posts despatched to your electronic mail.