The Australian Bureau of Statistics (ABS) launched the newest – Client Worth Index, Australia – for the June-quarter 2025 right this moment (July 30, 2025). The quarterly information confirmed that the inflation charge rose by 0.7 factors within the quarter however over the 12 months and on an annual foundation fell from 2.4 per cent to 2.1 per cent. Nonetheless, the month-to-month measure for June 2025 reveals annual inflation at 1.9 per cent – which the RBA must be stating is ‘too low’ given the decrease certain of their targetting vary is 2 per cent. The inflation charge has been throughout the RBA’s inflation focusing on vary for 4 successive quarters and inflationary expectations are falling or benigh. There are not any vital wage pressures evident. Utilizing the RBA’s personal logic, its coverage rate of interest ought to now be lower.

The abstract, seasonally-adjusted Client Worth Index outcomes for the June-quarter 2025 are as follows:

| Part | Quarter % | Annual % |

| All teams CPI | 0.7 (final 0.9) | 2.1 (final 2.4) |

| Trimmed imply collection | 0.6 (0.5) | 2.7 (2.9) |

| Weighted median collection | 0.6 (0.7) | 2.7 (3.0) |

The next Desk reveals the charges of inflation for the foremost parts of the CPI:

| Part | Present quarter % | Final 12 months % | Course |

| All teams CPI | 0.7 | 2.1 | Falling |

| Meals and non-alcoholic drinks | 1.0 | 3.0 | Falling |

| Alcohol and tobacco | 0.7 | 5.7 | Falling |

| Clothes and footwear | 2.6 | 1.2 | Falling |

| Housing | 1.2 | 2.0 | Falling |

| Furnishings, family gear and providers | 1.1 | 1.0 | Rising |

| Well being | 1.5 | 4.1 | Falling |

| Transport | -0.7 | -2.6 | Falling |

| Communication | 0.1 | 0.9 | Falling |

| Recreation and tradition | 0.5 | 1.7 | Rising |

| Schooling | 0.0 | 5.5 | Falling |

| Insurance coverage and monetary providers | 0.5 | 3.1 | Falling |

The ABS Media Launch – CPI rises 0.7% within the June 2025 quarter

Media Launch – famous that:

The CPI rose 0.7 per cent within the June quarter, decrease than the 0.9 per cent rise within the March 2025 quarter …

Annual inflation to the June 2025 quarter of two.1 per cent was down from 2.4 per cent to the March quarter. That is the bottom annual inflation charge because the March 2021 quarter …

The principle contributors to the quarterly rise had been Housing (+1.2 per cent), Meals and non-alcoholic drinks (+1.0 per cent), and Well being (+1.5 per cent). Partially offsetting the rise was a fall in Transport (-0.7 per cent).

The quarterly development in Housing was pushed by Electrical energy (+8.1 per cent). The second instalments of each the Commonwealth Power Invoice Reduction Fund and State authorities rebates in Perth had been used up by households within the earlier quarter. Rebates have the impact of decreasing electrical energy prices for households. This has meant larger out-of-pocket electrical energy prices this quarter as rebates have been used up …

The principle contributor to the slowing of annual inflation was a big fall in Automotive gasoline costs (-10.0 per cent) …

Observations:

1. The annual inflation charge continues to say no and is now on the backside finish of the RBA’s targetting vary.

2. The month-to-month measure reveals annual inflation at 1.9 per cent – which the RBA must be stating is ‘too low’ given the decrease certain of their targetting vary is 2 per cent.

3. The principle drivers mirror worth gouging by privatised electrical energy suppliers and seasonal shortages in meals.

4. The fiscal assist supplied by the federal authorities to offset the value gouging by electrical energy corporations, which has been a really efficient anti-inflationary coverage, is now being withdrawn and so electrical energy costs are rising sooner than the overall worth stage. The coverage put paid to the notion that defeating a supply-side inflationary spiral requires fiscal austerity.

5. The hire inflation is moderating as rates of interest have began to fall. The inflation was largely pushed by the RBA’s personal charge hikes as landlords in a good housing market have been passing on the upper borrowing prices – so the so-called inflation-fighting charge hikes had been a major pressure in driving inflation.

6. The principle drivers over this complete inflationary interval have been associated to the pandemic or different international influences that the RBA’s financial coverage had no affect over. The one factor the RBA has carried out is to punish low-income mortgage holders and intentionally oversee the switch of their revenue to rich Australians with monetary belongings (who benefited from the rising rates of interest).

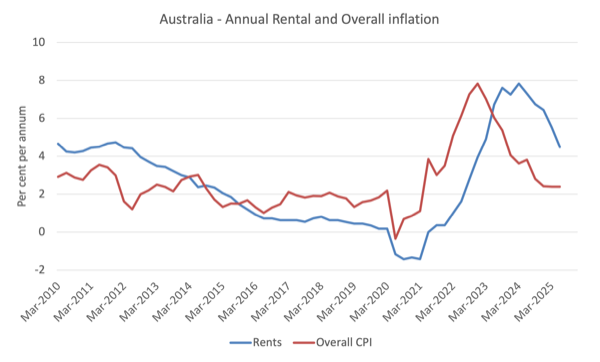

This graph reveals that the general inflation charge peaked within the December-quarter 2022 and has been steadily declining ever since.

Nonetheless, rental inflation lagged the rise in total inflation in 2021 and actually solely took off after the RBA began mountain climbing rates of interest.

As soon as the RBA ended its present mountain climbing cycle, the rental inflation has stabilised and is now falling.

Tendencies in inflation – persevering with to fall

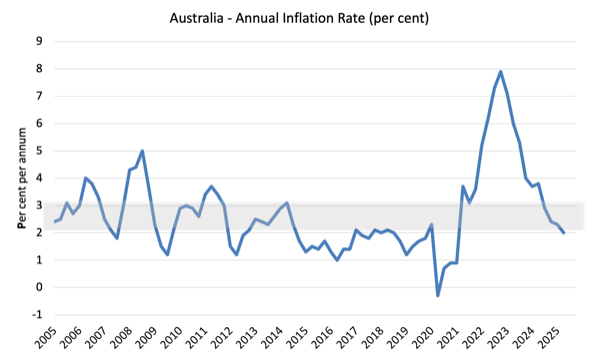

During the last 12 months, the inflation charge was 2.1 per cent (regular).

The height was within the December-quarter 2022 when the inflation charge was 7.9 per cent.

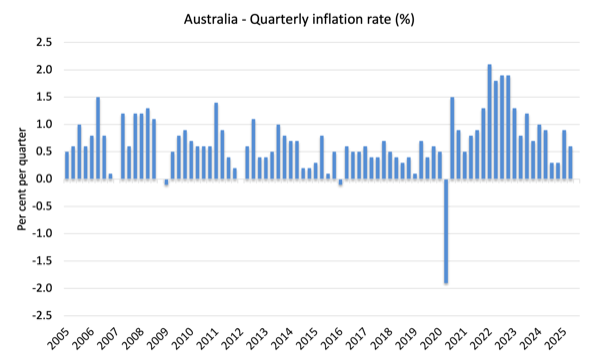

The next graph reveals the quarterly inflation charge because the December-quarter 2005.

The subsequent graph reveals the annual headline inflation charge because the first-quarter 2005. The shaded space is the RBA’s so-called targetting vary (however learn under for an interpretation).

What’s driving inflation in Australia?

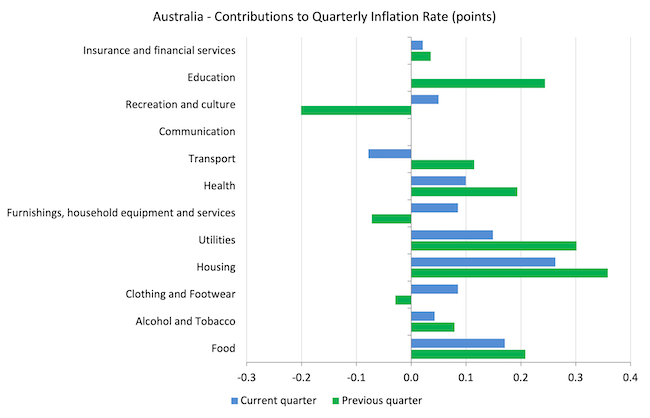

The next bar chart compares the contributions to the quarterly change within the CPI for the June-quarter 2025 (blue bars) in comparison with the March-quarter 2025 (inexperienced bars).

Notice that Utilities is a sub-group of Housing and are considerably impacted by authorities administrative selections, which permit the privatised corporations to push up costs every year, often effectively in extra of CPI actions.

The influence of fiscal coverage on that sub-group through the electrical energy rebates has clearly been vital, which works to indicate that governments can average inflation by way of expansionary fiscal coverage if the drivers are from the supply-side.

It additionally demonstrates that financial coverage is ineffective in coping with this sort of inflation.

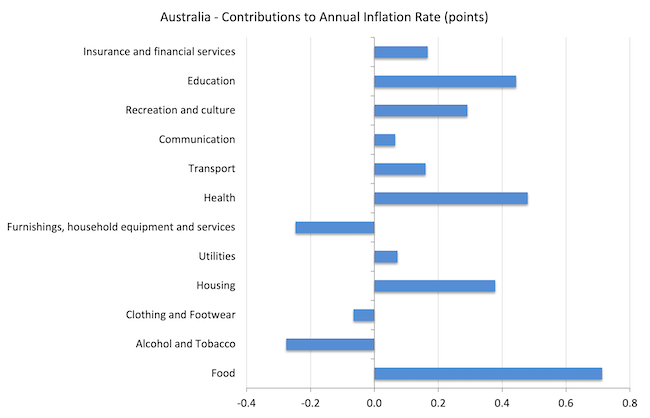

The subsequent graph reveals the contributions in factors to the annual inflation charge by the assorted parts.

The ABS famous that:

Electrical energy rose 8.1 per cent this quarter, following a 16.3 per cent rise within the March quarter.

Regardless of two consecutive quarterly rises in electrical energy, the collection has recorded a fall of 6.2 per cent over the previous 12 months. The annual fall is as a result of introduction of the second spherical of the Commonwealth Power Invoice Reduction Fund (EBRF) rebates from July 2024, which proceed to scale back electrical energy prices in most capital cities. …

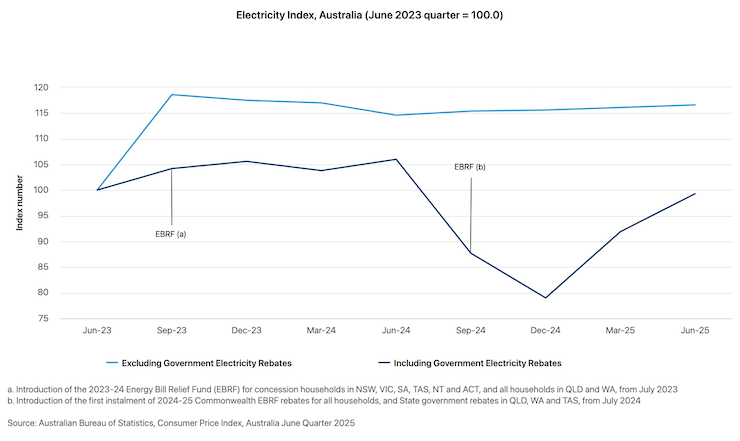

Excluding the rebates, electrical energy costs would have risen by 0.4 per cent within the June 2025 quarter. The next graph reveals the influence the rebates have had on the Electrical energy collection within the CPI because the September 2023 quarter when the EBRF rebates had been first launched.

The subsequent graph is taken from the ABS and reveals the influence of fiscal coverage in decreasing the inflation charge.

EBRF refers back to the authorities’s Power Invoice Reduction Fund.

Inflation and Anticipated Inflation

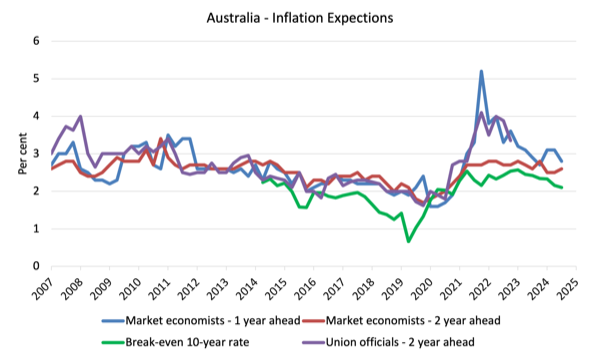

The next graph reveals 4 measures of anticipated inflation produced by the RBA from the December-quarter 2005 to the June-quarter 2025.

The 4 measures are:

1. Market economists’ inflation expectations – 1-year forward.

2. Market economists’ inflation expectations – 2-year forward – so what they suppose inflation will probably be in 2 years time.

3. Break-even 10-year inflation charge – The typical annual inflation charge implied by the distinction between 10-year nominal bond yield and 10-year inflation listed bond yield. This can be a measure of the market sentiment to inflation danger. That is thought-about probably the most dependable indicator.

4. Union officers’ inflation expectations – 2-year forward – this collection hasn’t been up to date because the September-quarter 2023.

However the systematic errors within the forecasts, the value expectations (as measured by these collection) are all effectively throughout the RBA’s targetting vary of 2-3 per cent.

So the RBA can’t declare that fears of accelerating expectations are stopping them from chopping rates of interest additional.

Implications for financial coverage

What does this all imply for financial coverage?

The Client Worth Index (CPI) is designed to mirror a broad basket of products and providers (the ‘routine’) that are consultant of the price of dwelling. You may be taught extra concerning the CPI routine HERE.

The RBA’s formal inflation focusing on rule goals to maintain annual inflation charge (measured by the buyer worth index) between 2 and three per cent over the medium time period.

Nonetheless, the RBA makes use of a spread of measures to establish whether or not they consider there are persistent inflation threats.

Please learn my weblog submit – Australian inflation trending down – decrease oil costs and subdued financial system (January 29, 2015) – for an in depth dialogue about using the headline charge of inflation and different analytical inflation measures.

The RBA claims it doesn’t depend on the ‘headline’ inflation charge.

As an alternative, they use two measures of underlying inflation which try and internet out probably the most risky worth actions.

The idea of underlying inflation is an try and separate the development (the persistent element of inflation) from the short-term fluctuations in costs.

The principle supply of short-term ‘noise’ comes from “fluctuations in commodity markets and agricultural situations, coverage adjustments, or seasonal or rare worth resetting”.

The RBA makes use of a number of completely different measures of underlying inflation that are usually categorised as ‘exclusion-based measures’ and ‘trimmed-mean measures’.

So, you possibly can exclude “a specific set of risky gadgets – particularly fruit, greens and automotive gasoline” to get a greater image of the “persistent inflation pressures within the financial system”.

The principle weaknesses with this methodology is that there could be “massive short-term actions in parts of the CPI that aren’t excluded” and risky parts can nonetheless be trending up (as in power costs) or down.

The choice trimmed-mean measures are common amongst central bankers.

The authors say:

The trimmed-mean charge of inflation is outlined as the common charge of inflation after “trimming” away a sure share of the distribution of worth adjustments at each ends of that distribution. These measures are calculated by ordering the seasonally adjusted worth adjustments for all CPI parts in any interval from lowest to highest, trimming away those who lie on the two outer edges of the distribution of worth adjustments for that interval, after which calculating a mean inflation charge from the remaining set of worth adjustments.

So that you get some measure of central tendency not by exclusion however by giving decrease weighting to risky parts. Two trimmed measures are utilized by the RBA: (a) “the 15 per cent trimmed imply (which trims away the 15 per cent of things with each the smallest and largest worth adjustments)”; and (b) “the weighted median (which is the value change on the fiftieth percentile by weight of the distribution of worth adjustments)”.

So what has been taking place with these completely different measures?

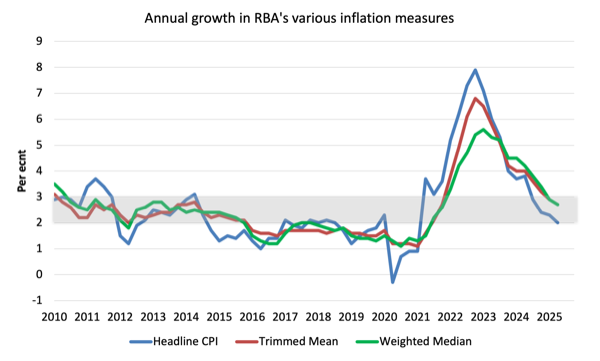

The next graph reveals the three foremost inflation collection printed by the ABS because the December-quarter 2009 – the annual share change within the All gadgets CPI (blue line); the annual adjustments within the weighted median (inexperienced line) and the trimmed imply (purple line).

The newest information for the three measures is summarised within the first desk above.

The next graph reveals the evolution of those collection because the March 2010.

Easy methods to we assess these outcomes?

1. The RBA’s most well-liked measures are actually inside their focusing on vary.

2. There isn’t a wages stress coming from the labour market.

3. Inflationary expectations are benign or falling.

4. All the symptoms assist an extra lower within the coverage rate of interest and recommend that the refusal by the RBA to chop charges at its final assembly and additional punish low-income debt holders was a folly.

Conclusion

The newest CPI information confirmed that the annual inflation charge continues to fall and is now more likely to fall under the RBA’s inflation focusing on vary.

All the symptoms assist an extra lower within the coverage rate of interest.

The evolution of the info over the past a number of years has defied the statements put out by the RBA in its try and justify the 11 rate of interest hikes between Might 2022 and November 2023.

The hikes had been fairly merely unjustified and the inflationary episode was transitory and never pushed by elements that rate of interest hikes may cope with.

That’s sufficient for right this moment!

(c) Copyright 2025 William Mitchell. All Rights Reserved.