I’m a middle-aged particular person so meaning I test Zillow frequently.

I’m not out there for a home. I identical to checking actual property costs. That’s what you do once you grow old. You grow to be excited about actual property.

I do it each time I journey someplace.

Our favourite spring break vacation spot these previous few years has been Marco Island, FL.

So I needed to do some worth checks to see how a lot our Airbnb home was value plus get a way of property values within the space. We’re not planning a transfer to Florida however it’s enjoyable to see how far your cash would go relying on the placement. It’s a reasonably expensive market with a great deal of 7-figure properties on the market.

After the journey Zillow flooded my electronic mail with listings of homes on the market in Marco. It’s a very good gross sales tactic. That is what all of these emails have regarded like:

There are dozens like this. They arrive in day by day. The value cuts are going wild whereas patrons sit on the sidelines ready for higher entry factors and decrease mortgage charges.

This may very well be a Florida phenomenon. The state noticed an enormous inflow of individuals in the course of the pandemic. It’s attainable they pulled demand ahead, worth will increase have been overdone and that is now the correction.

Both manner, it’s a purchaser’s market in Florida proper now.

But it surely’s not simply Florida. That is turning right into a nationwide factor.

Redfin has a brand new report that exhibits sellers now outnumber patrons by a large margin:

Right here’s what they discovered:

There are an estimated 1.9 million residence sellers within the U.S. housing market and an estimated 1.5 million homebuyers. In different phrases, there are 33.7% extra sellers than patrons (or 490,041 extra, to be precise). At no different level in information courting again to 2013 have sellers outnumbered patrons by this huge of a quantity or proportion. A yr in the past, sellers outnumbered patrons by simply 6.5%, and two years in the past, patrons outnumbered sellers.

There haven’t been this many residence sellers since March 2020. There haven’t been this few patrons at any level in information courting again to 2013 apart from April 2020, when the onset of the coronavirus pandemic introduced the housing market to a halt.

That is the primary time in years that homebuyers have acquired some excellent news.

Sellers have had the higher hand for a while now. Costs boomed in the course of the pandemic. There have been bidding wars and gross sales that went by with out contingencies or inspections. Folks have been pressured to pay over asking.

These days ought to be over for now.

That is all good things. Consumers can lastly negotiate in some areas. If I have been out there, I might be placing in some low-ball affords.

Now for the not-so-great information.

Stock remains to be fairly low.

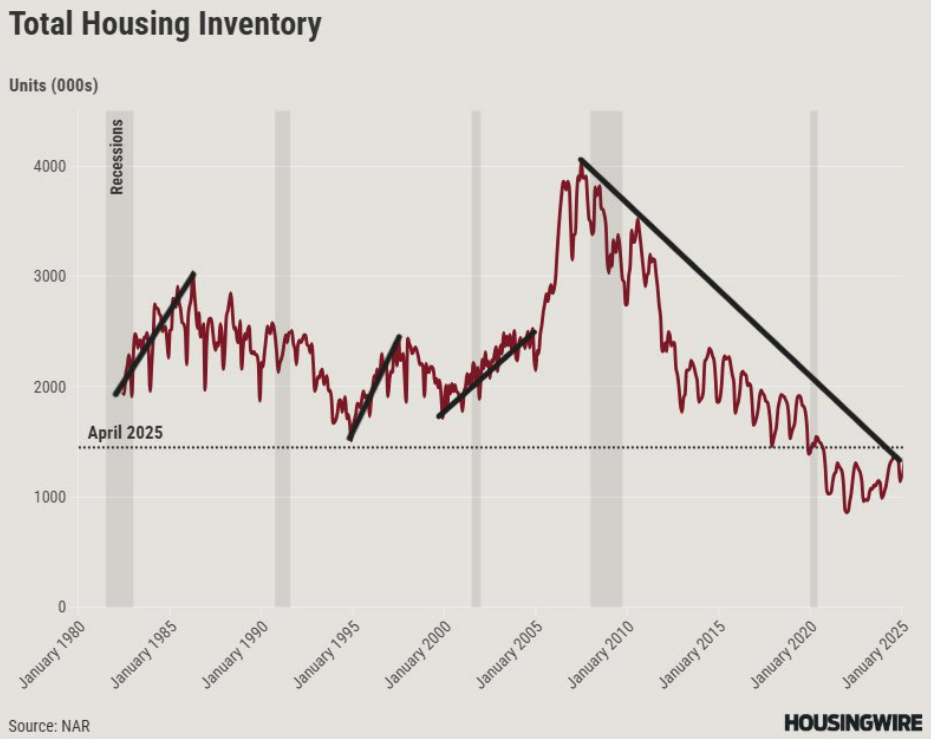

Logan Mohtashami has a chart that exhibits complete housing stock on the market:

It’s nonetheless fairly low relative to historical past. A traditional vary is someplace within the neighborhood of two to 2.5 million homes on the market. We’re simply shy of 1.5 million.

That is an enchancment for certain however the housing market remains to be not regular, if there may be such a factor.

We’re simply witnessing a purchaser’s strike as a result of costs or mortgage charges want to return all the way down to make issues extra reasonably priced.

The excellent news for sellers is there’s a easy answer to this drawback — decrease mortgage charges. My guess is as soon as charges fall we’ll see a number of patrons come off the sidelines.

I’m not a fan of attempting to time the housing market. You can purchase a home once you prefer it, plan on proudly owning it for a few years, and may afford to service the debt and different ancillary prices concerned.

It’s nonetheless very costly to purchase a house versus the all-in prices from only a few years in the past.

However patrons lastly have some leverage on this scenario.

Additional Studying:

How the Housing Market Has Modified America

This content material, which comprises security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here will probably be relevant for any specific information or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “publish” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding advice or provide to offer funding advisory providers. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives fee from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.