A reader asks:

I do know it’s not precisely market speak however I’d recognize you all speaking about the way you personally take a look at emergency funds in money equivalents. I discover it extraordinarily arduous to maintain money in markets that preserve going up. I do know the 3-6 month rule of thumb however I’m curious the way you guys personally deal with emergency funds.

I agree that your emergency fund shouldn’t be an funding resolution.

It’s a private finance resolution. These are the components it is best to think about relating to constructing the fitting emergency fund:

- Liquidity

- Volatility

- Different sources of funds/entry to credit score strains

- Variability of your earnings

- Profession danger

And an important variable is your sleep-at-night stage. Some folks can’t sleep at evening with out 9-12 months of bills in money. Others assume that’s an unrealistic purpose that leaves an excessive amount of cash on the desk.

There’s no proper or mistaken reply. This one is all about private choice.

Personally, I fall on the shorter finish of the vary as a result of I’ve a diversified earnings stream and loads of money sources to faucet in a pinch (HELOC, brokerage account, Roth IRA contributions, and many others.). If our emergency money steadiness goes past a sure threshold, I put it to work within the markets.

Nevertheless, a part of this query does need to do with the markets. You discover it “arduous to maintain money in markets that preserve going up.”

That is actually extra of an asset allocation query. Money equivalents over and above your emergency fund stage generally is a strategic asset class.

Some folks maintain extra cash of their portfolios to be opportunistic. Some maintain extra cash as a result of they should take withdrawals from their portfolio and don’t need to promote when shares are down. Others maintain extra cash to hedge in opposition to rising rates of interest and/or inflation. And a few folks maintain extra cash as a result of they want it as a shock absorber in opposition to volatility.

Money shouldn’t be an awesome long-term funding as a result of it barely retains up with inflation over the lengthy haul. But when you have to preserve an allocation to money as an emotional hedge I don’t have an issue with it.

You simply have to know the trade-offs.

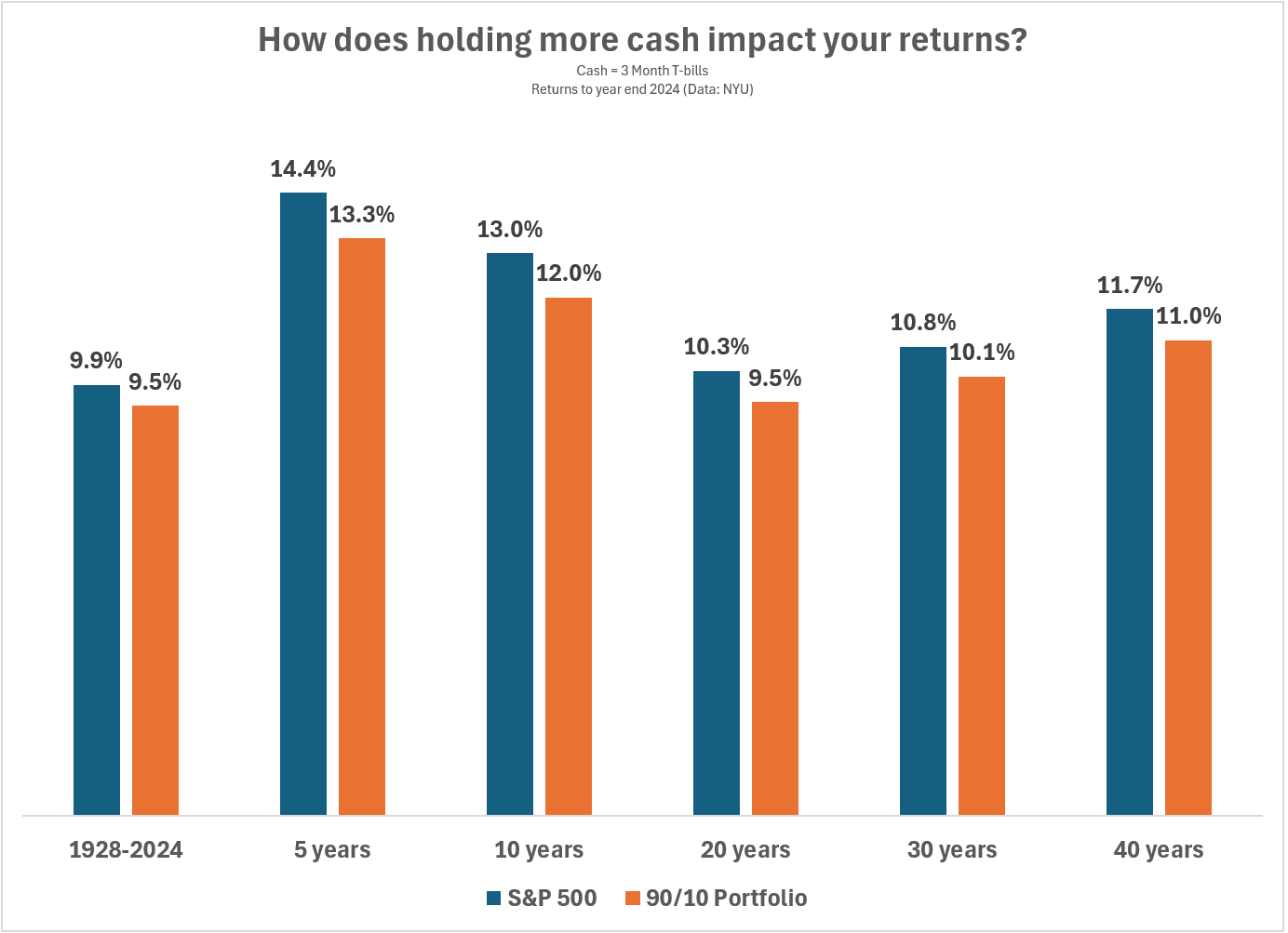

A small strategic allocation to money doesn’t have a huge effect in your returns. I seemed on the variations in annual returns over numerous time frames utilizing a 100% allocation to the S&P 500 and a 90/10 portfolio made up of 90% shares and 10% money (3 month T-bills):

Positive, you’ll be leaving some cash on the desk nevertheless it’s not an enormous distinction in returns.

I don’t know if 10% is an excessive amount of or not sufficient that can assist you sleep at evening. However holding a little bit extra cash in your portfolio since you’re nervous concerning the inventory market or just don’t need to expertise the entire volatility of a 100% fairness portfolio isn’t the top of the world.

Nevertheless, I wouldn’t get into the behavior of making an attempt to do that frequently simply since you often get nervous concerning the inventory market. There’s an enormous distinction between a strategic allocation to money that you simply periodically rebalance again to focus on versus tactically making an attempt to guess when to lift money and when to place it to work.

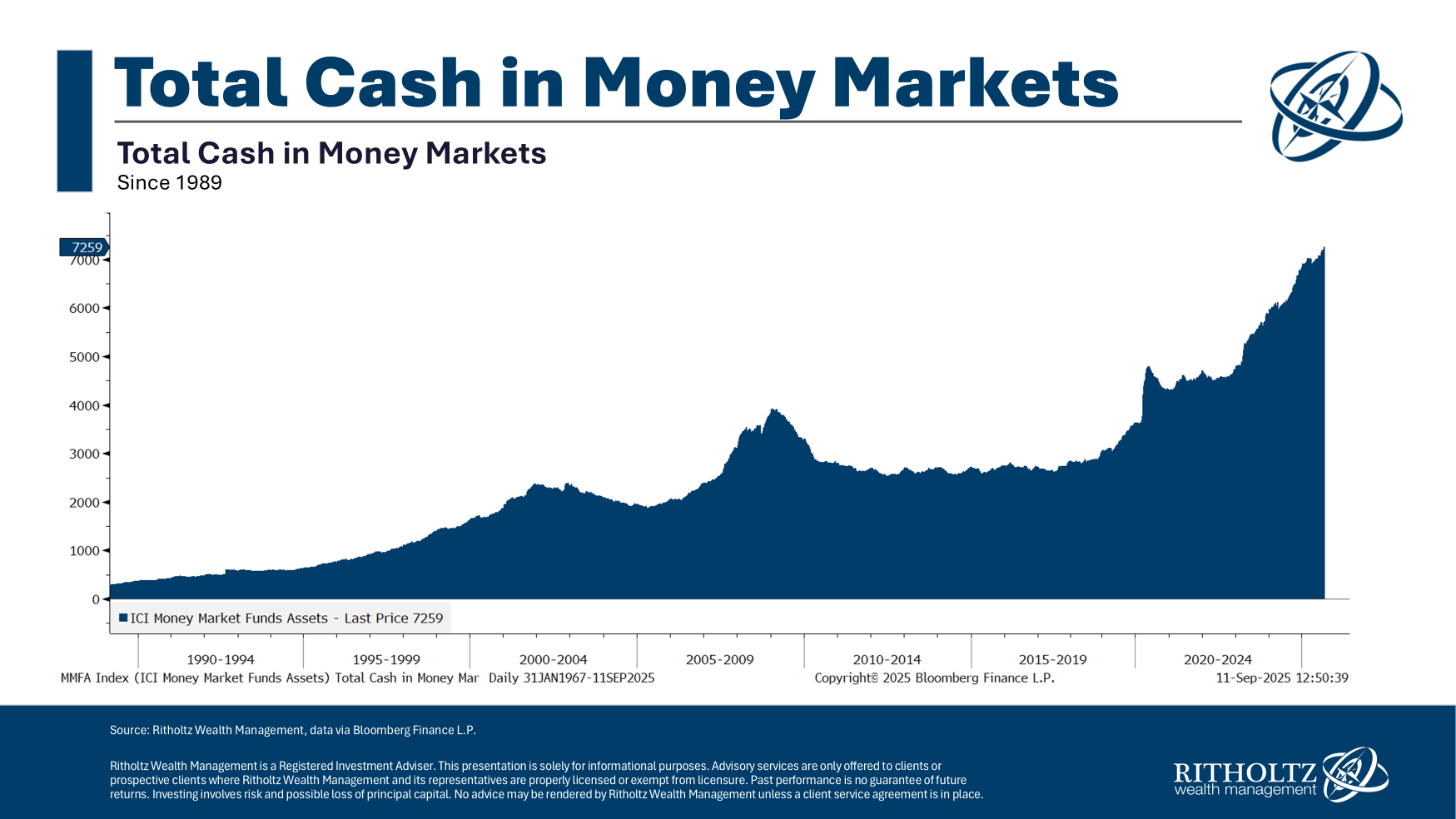

There may be some huge cash sitting in money nowadays.

That’s greater than $7 trillion in cash market funds alone, up from $3 trillion or so earlier than the pandemic.

Money can supply optionality and safety in opposition to short-term swings within the markets however forecasting when these short-term swings will happen is lots tougher than it sounds.

Investing based mostly in your emotions is often a horrible thought. Investing based mostly on a algorithm offers you a a lot greater chance of success in the long term.

Profitable investing boils right down to a repeatable course of, not a guessing sport.

I talked about this query on an all new episode of Ask the Compound:

We additionally answered questions on diversifying past rental properties, when it is smart to chop again on saving, how to consider RSUs (with assist from Joey Fishman) and the Nice Wealth Switch.

Additional Studying:

The $84 Trillion Elephant within the Room

This content material, which accommodates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here might be relevant for any explicit info or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your personal advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding advice or supply to offer funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for commercials in affiliated podcasts, blogs and emails. Inclusion of such commercials doesn’t represent or indicate endorsement, sponsorship or advice thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the chance of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.