A reader asks:

What do you do if this can be a bubble? Sit it out? And perhaps miss 2-3 years of 30% features earlier than it will get minimize by 70%? I imply I feel it’s too expensive to not be within the recreation in case your horizon is 8 plus years. I feel I’m going to let my cash sit. I’m 35. If this isn’t a bubble, timing it means lacking out on important features in my portfolio. If it’s a bubble, I’ll simply preserve shoveling cash in. If I had been older, I’d most likely be extra apprehensive.

Right here’s one thing I wrote in Every thing You Have to Know About Saving For Retirement:

I’ve someplace within the order of 4 or extra many years remaining to organize for financially over the remainder of my life.

Within the coming 40-50 years I’m planning on experiencing a minimum of 10 or extra bear markets, together with 5 or 6 that represent a market crash in shares. There may also most likely be a minimum of 7-8 recessions in that point as effectively, perhaps extra.

I’d prefer to amend that assertion. Possibly I used to be too excessive on the variety of recessions (we’ll see). I additionally ought to have added that there’ll most likely be 4-5 monetary asset bubbles, perhaps extra.

Take into consideration the entire bubbles we’ve seen previously 30 years or so.

Within the late-Nineteen Nineties we had the dot-com bubble. After we couldn’t settle for the ache of these good occasions ending we instantly began a housing bubble within the early aughts like hopping from one dangerous relationship immediately into one other.

The 2008 monetary disaster was brought on by a credit score bubble. We had been comparatively well-behaved within the 2010s when there was extra of an anti-risk bubble with damaging rate of interest bonds.

The 2021 memestock mania was a mini-bubble of speculative exercise.

And now we’ve the AI capex bubble.

We simply can’t assist ourselves.

As a younger investor, do you have to care about bubbles? Or do you have to do something about it?

You’ll be able to’t management your emotions and feelings however you’ll be able to management the way you react to them. The identical is true of your portfolio and and intervals of extra within the markets.

It additionally is dependent upon the next:

- Do you could have an funding plan in place?

- Do you could have an affordable asset allocation in place?

- Are you investing usually out there?

- Do you could have the intestinal fortitude to carry onto your shares AND preserve shopping for once they inevitably fall?

With purchase and maintain generally the holding half is harder and generally the shopping for half is harder. For purchase and maintain to work greatest it’s good to do each even when it doesn’t really feel proper.

Try to be extra involved about bubbles in the event you’re 65 than 35. At 65 you could have extra to lose and never as a lot time to avoid wasting and wait out market turmoil. That’s why diversification will increase in significance as you age.

In case you’re 35, it’s best to hope shares crash so you should buy extra at decrease costs.

Attempting to time these cycles is almost inconceivable. You’re prone to make pointless errors timing the market.

You’re higher off constructing the occasional mania into your plan and investing accordingly.

In order that’s one facet of the bubble investor sentiment.

Right here’s one from one other reader:

I do know my judgement may be clouded by the final 15 years however I’ve such sturdy conviction in regards to the upcoming technological development and income over the following 10-15 years (which aligns with my investing time horizon) that may come because of AI, quantum computing, robotics, and so on. and this has precipitated me to significantly mirror on my portfolio allocations. VGT is at the moment 10% of my portfolio and I lately made it a objective to extend that allocation to twenty%. Discuss me out of an allocation to 30%…. If I can abdomen the volatility and have sturdy conviction in the way forward for tech, why would I not do it?

Some individuals fear shares are going to go bust. Different fear they’ll miss even additional upside. That’s what makes a market.

The Vanguard Data Know-how ETF (VGT) has been on a tear for fairly a while now:

Ten thousand {dollars} invested on this fund again in 2010 would have was practically $165,000. That’s a complete return of greater than 1500% which interprets into annual returns of greater than 19% per 12 months.

The largest query I might ask when contemplating going extra closely into tech is that this: What do you already personal?

In case you personal an S&P 500 index fund, the highest 10 shares make up round 40% of the holdings. 9 of these 10 names are tech shares.1

In case you personal a Nasdaq 100 fund, the highest 10 shares make up 54% of the holdings, all of them expertise names.

Principally, in the event you personal something market cap weighted within the U.S. inventory market you have already got heavy tech publicity.

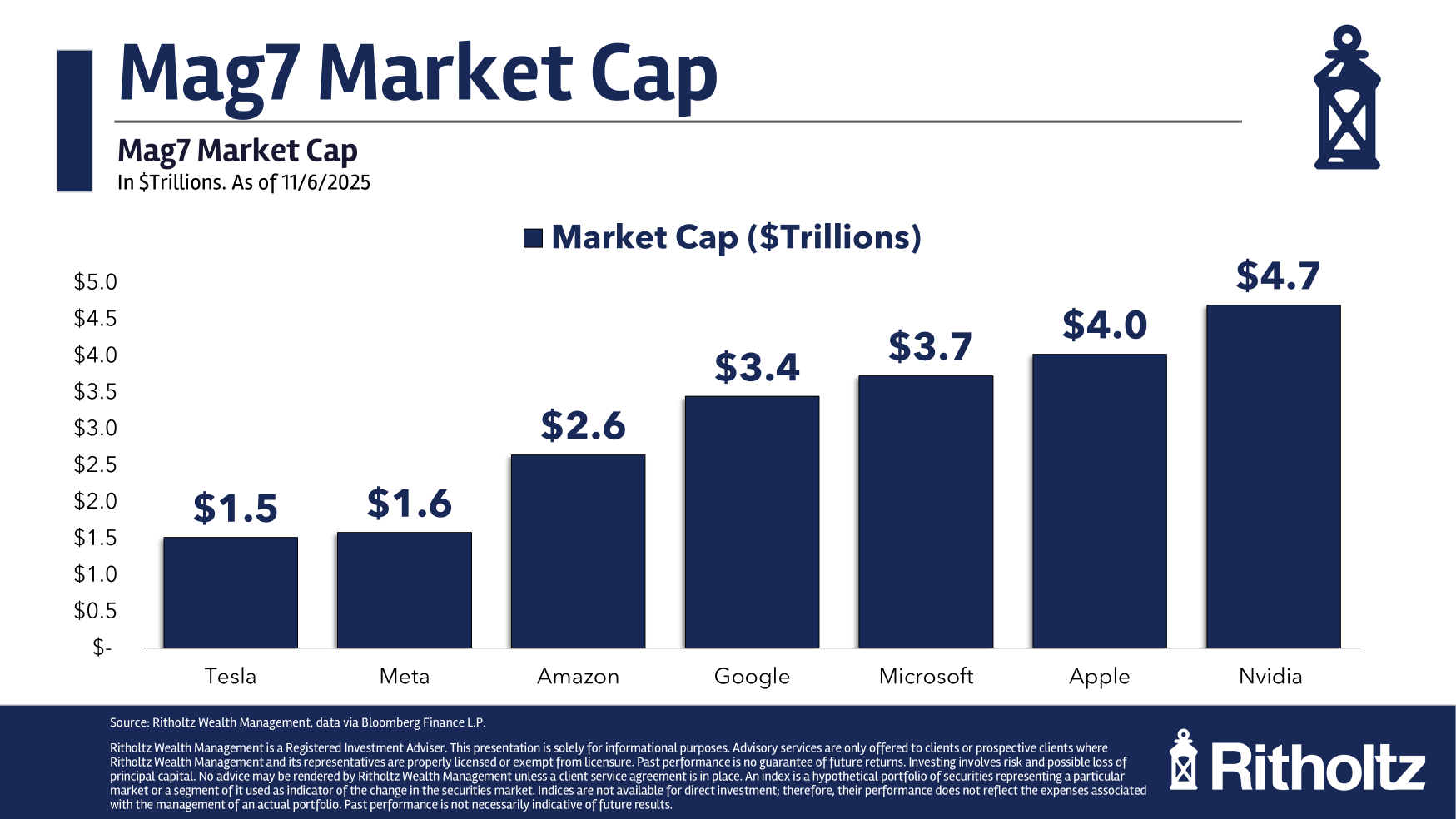

Simply take a look at how massive the market caps are on these corporations at the moment are:

That’s about $22 trillion in market cap for the Magazine 7. The sheer measurement is breathtaking.

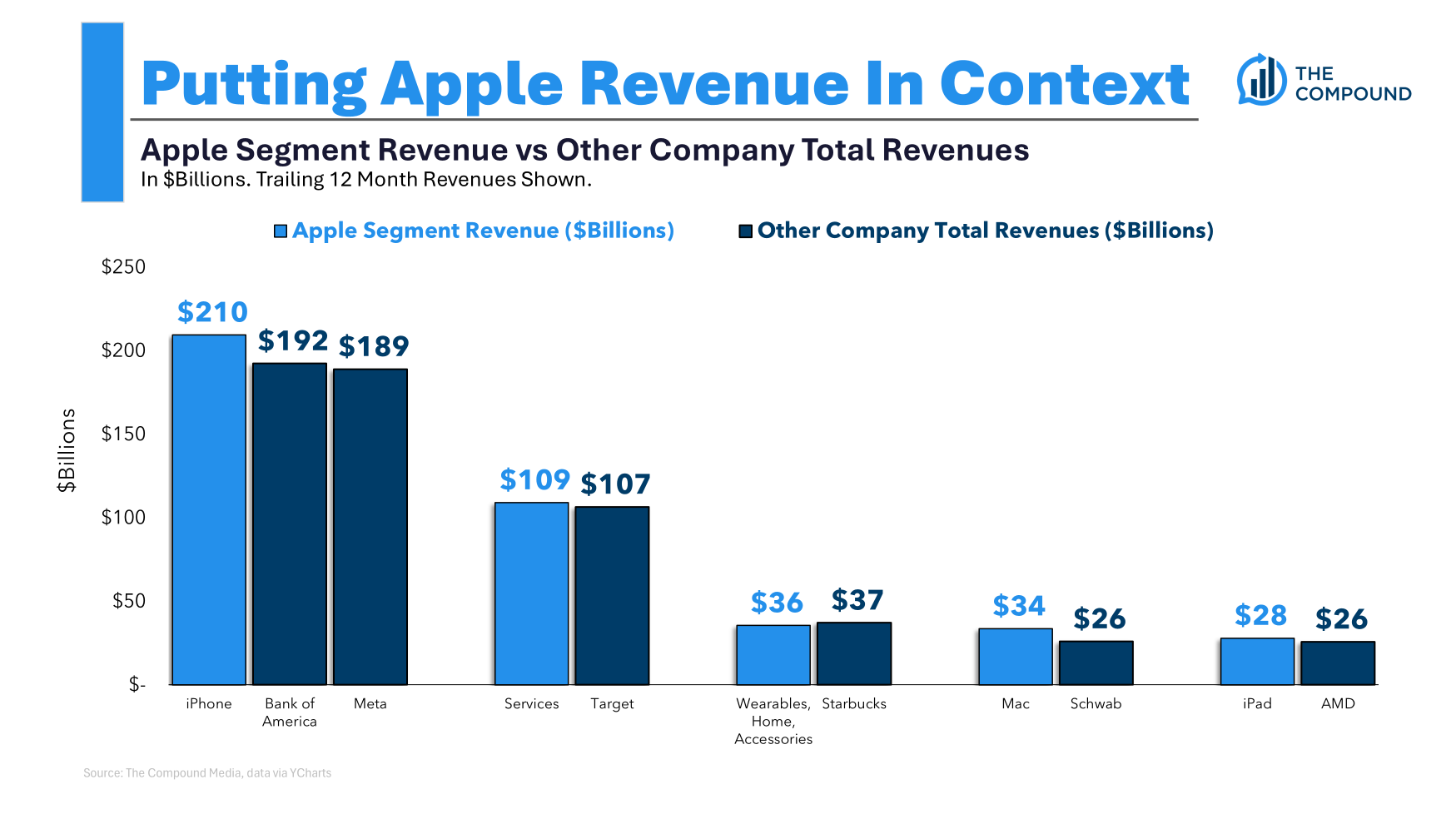

Try this chart2 on the dimensions of Apple’s income by product line in comparison with different companies:

The iPhone produces extra income than Financial institution of America or Meta. The iPad makes more cash than AMD. Know-how corporations at the moment are inextricably linked in all of our day by day lives.

On the one hand, it does really feel like we’ve to be late cycle as a result of the returns have been so otherworldly.

However, we haven’t even seen how transformational AI goes to be. Robots are coming. Self driving automobiles will likely be extra ubiquitous. There will likely be different types of vitality.

Innovation isn’t slowing down anytime quickly.

It feels grasping to go all-in on tech at this level however you can have stated the identical factor in 2017 or 2020 and you’ll have been flawed.

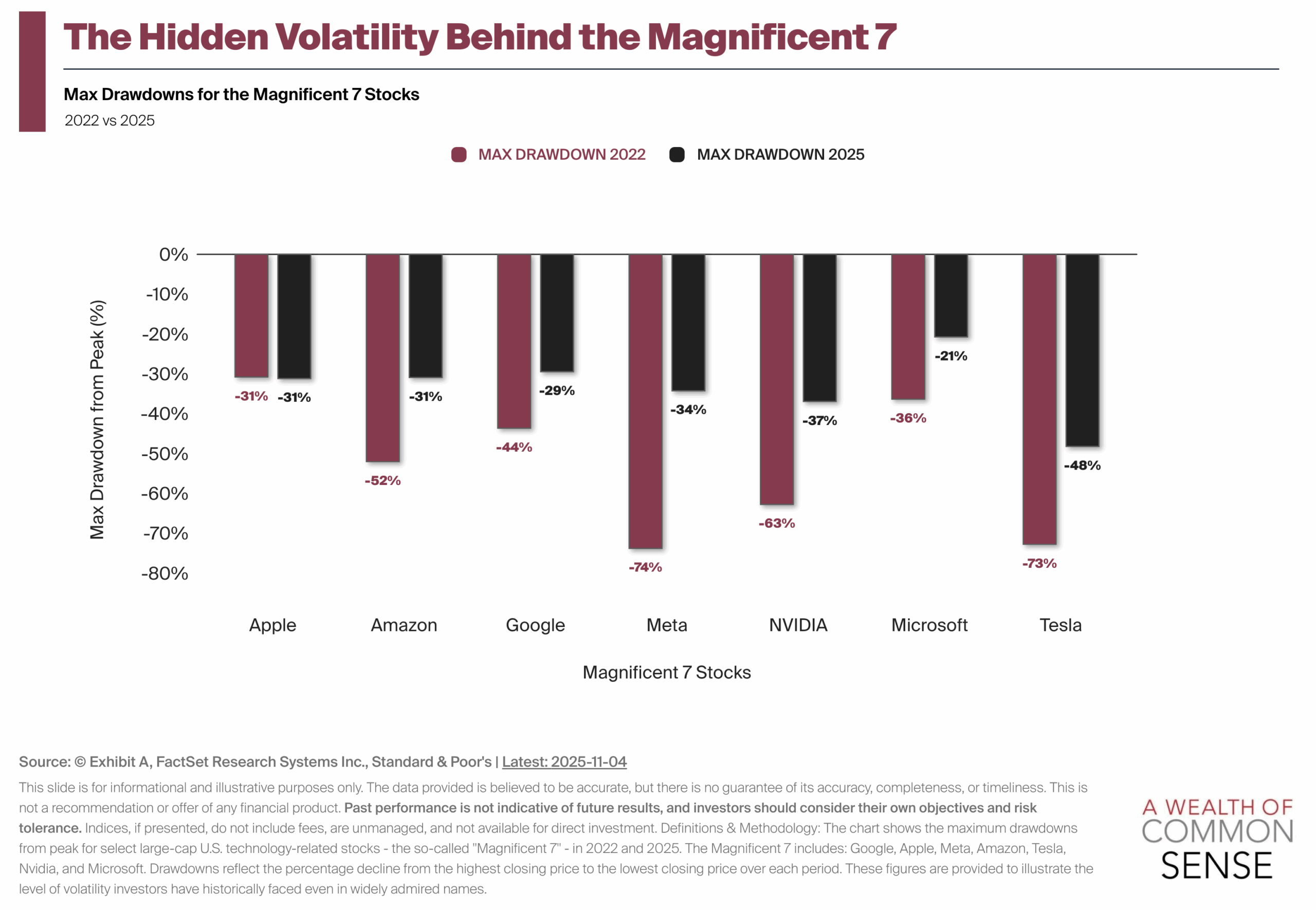

In case you’re going to do that you do need to have a abdomen for extra volatility.

These shares can and can get crushed at occasions:

If you would like extra tech publicity, measurement it appropriately and be sure you can deal with extra volatility in each instructions.

No ache, no acquire.

And generally, a lot of ache with no acquire.

I answered each of those questions in larger element on the most recent version of Ask the Compound:

We additionally tackled questions on when to repay your mortgage early, utilizing money in your fastened earnings allocation and the distinction between the buyside and the sellside.

Additional Studying:

The Soften-Up

1The opposite one is Berkshire Hathaway.

2This one was Michael’s thought with some assist from Chart Child Matt on the execution.