On July 22, 2025, the – 2025 Japanese Home of Councillors election – shall be held. I’ve good friend who’s standing for the – Reiwa Shinsengumi – which is a real progressive, Left-wing occasion, not just like the faux progressive events today that masquerade as social democratic events (for instance, British Labour, Australian Labor, US Democrats, to call a number of of many). My good friend is the endorsed candidate for the Kyoto Electoral District (頑張ってね、みなこ). One of many main insurance policies that Reiwa proposes is the abolition of the consumption tax. In truth, this election has spawned widespread opposition to the consumption tax from different events as nicely. It has been a extremely contentious situation in Japan for a number of a long time and its introduction and common will increase to the current degree of 10 per cent displays the dominance of neoliberal misinformation in regards to the fiscal capacities of the Japanese authorities. Maybe, this election we are going to see some extra wise outcomes.

Background studying

I offered detailed evaluation of those historic shifts in these weblog posts (amongst others):

1. Japan thinks it’s Greece however can’t keep in mind 1997 (August 12, 2012).

2. Japan’s development slows below tax hikes however the OECD need extra (September 16, 2014).

3. Japan returns to 1997 – idiocy guidelines! (November 18, 2014).

4. Japan – indicators of development however gray clouds stay (Might 21, 2015).

5. Japan about to stroll the plank – once more (September 30, 2019).

6. Japan nationwide accounts – gross sales tax rise, development collapses – as night time follows day (February 18, 2020).

Transient historical past of the gross sales tax in Japan

- January 1979 – Liberal Democrat authorities proposed a gross sales tax to ‘repair public funds’ however was deserted after the October nationwide election catastrophe that originally noticed the LDP lose the outright majority. The coverage was extensively condemned.

- February 1987 – As soon as once more the LDP proposed new gross sales tax laws to the Weight loss plan nevertheless it was deserted within the face of huge opposition.

- December 1988 – LDP (with PM Noburu Takeshita – the so-called ‘shadow shogun’ of Japanese politics on account of his means to behave as a ‘puppet grasp’ – manipulating outcomes within the background) lastly was in a position to push a gross sales tax invoice by way of the Weight loss plan although the coverage was deeply opposed by the folks. Takeshita could be pressured to resign the next June on account of his involvement in a corruption scandal (insider-trading).

- April 1989 – the three per cent consumption tax turns into operational.

- November 1994 – the speed rises to 4 per cent though the laws additionally included a ‘regional consumption tax of 1 per cent’ on prime which meant that by 1997, the speed could be 5 per cent.

- April 1997 – price will increase to five per cent.

- June 2010 – after being elected in September 2009 to authorities, the Democratic Get together of Japan proposes rising the consumption tax to 10 per cent prematurely of the election of the Home of Councillors (higher home). The DPJ is trounced within the election.

- June 2012 – LDP laws proposes to extend the consumption tax to eight per cent in 2014 after which to 10 per cent in 2015, which passes on August 10, 2012.

- April 2014 – the 8 per cent price comes into impact.

- November 2014 – the federal government of Shinzo Abe postpones the rise to 10 per cent due in October 2015 till April 2017.

- June 2016 – additional postponement of the ten per cent price to October 2019 amidst huge opposition.

- October 2019 – the ten per cent price comes into impact, with a number of exemptions (some meals and newspapers) which stay at 8 per cent.

The consumption tax is without doubt one of the main points within the upcoming election for the – Home of Councillors – in July.

There has all the time been vital opposition to the tax nevertheless it has ramped up and broadened throughout the political spectrum in Japan because the cost-of-living pressures have elevated.

Many are arguing for adjustments starting from abandonment, to cuts throughout the board, to selective cuts.

The ruling LDP has lengthy resisted the calls for for adjustments and invoke the standard mainstream fiscal considerations – that Japan should cut back its public debt, which implies it has to lift income to scale back its internet spending.

Mainstream economists declare that with the ageing inhabitants, authorities spending is rising whereas income is falling because the inhabitants ages.

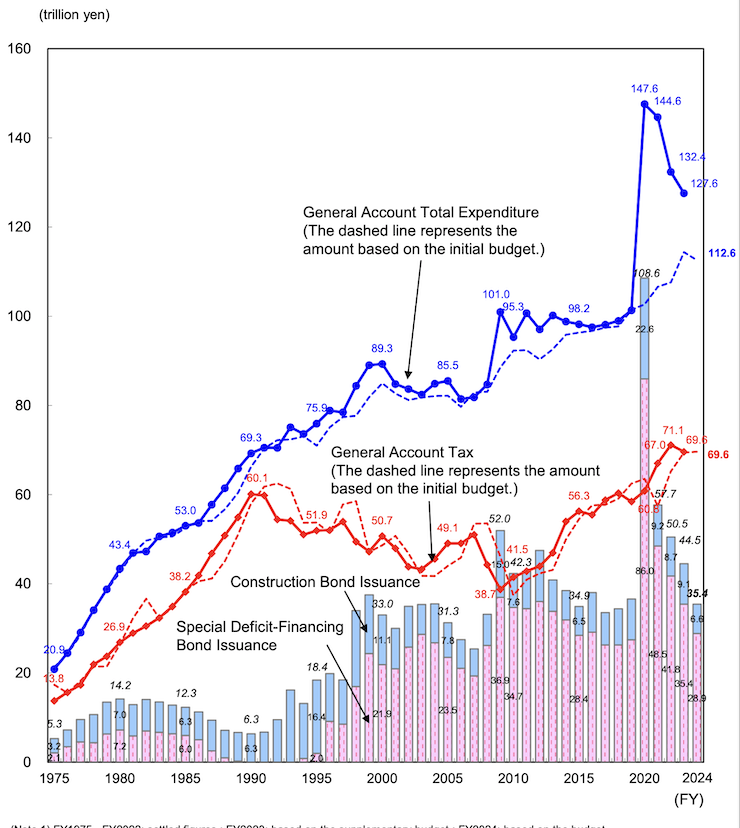

This graph taken from the publication – Japanese Public Finance Truth Sheet (April 2024) – is commonly wheeled out by economists to justify the gross sales tax.

The federal government’s most popular answer to the cost-of-living disaster is to offer targetted fiscal help (subsidies, and so on) to these ‘most in want’ and preserve the consumption tax price unchanged.

Final week, the Japan Instances editorial (Might 16, 2025) – Don’t overreact to the consumption tax debate – quoted the Chief Cupboard Secretary as saying:

The federal government doesn’t suppose it’s applicable to decrease that tax price … it’s an vital funding supply for the social safety system for all generations.

One can see the identical outdated narrative that’s wheeled out in most nations by mainstream economists, notably as societies around the globe are getting older.

The concern mongering that social safety, pension and well being methods will run out of cash if these types of income insurance policies are maintained and strengthened resonate strongly locally as a result of there’s widespread ignorance of the true nature of fiscal capability loved by currency-issuing governments and the position of tax coverage basically.

Most consider taxes as elevating ‘cash’ for governments, which then permits them to spend on mandatory social and infrastructure insurance policies.

After all – Taxpayers don’t fund something (April 19, 2010).

And if you’re combating that notion, then begin with this introductory suite of blogs:

1. Deficit spending 101 – Half 1 (February 21, 2009).

2. Deficit spending 101 – Half 2 (February 23, 2009).

3. Deficit spending 101 – Half 3 (March 2, 2009)

Nevertheless, solely Reiwa Shinsengum, among the many many Opposition Events opposing the tax, get the argument in opposition to it right.

They argue, appropriately, that the Japanese authorities is the currency-issuer and all of the framing of the tax by way of being an “vital funding supply for the social safety system” is spurious.

They be aware how damaging the tax has been for struggling Japanese homeowners and ought to be scrapped in its entirety.

Final Friday, the LDP held a ‘research session’ in Tokyo to think about the federal government’s place on the tax and determined to reject any notion of a discount as a part of the coverage platform they’re taking to the Higher Home election in July.

There have been calls throughout the ruling occasion to at the least exempt all meals objects from the tax, which kind of undermines its benefit as a broad-based tax.

Apparently, a major group of LDP MPs wished the tax on meals scrapped.

The modelling means that this might enhance GDP by 0.43 per cent every year as overburdened households have been in a position to spend extra on requirements.

There’s additionally a rice disaster occurring at current (which I’ll write about later) which can also be strengthening requires a lower within the tax on meals.

One of many excuses that the LDP bosses gave for not tinkering with the tax associated to the alleged disruption to “money registers and accounting methods” (Supply).

That was dismissed as a “pretext” to do nothing by tax critics.

The influence

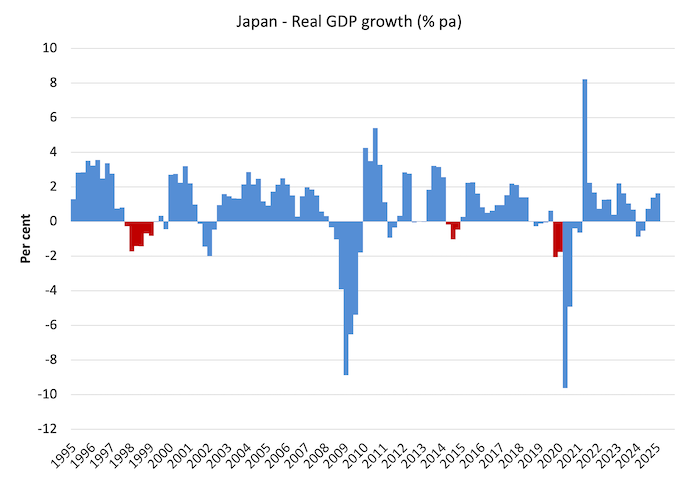

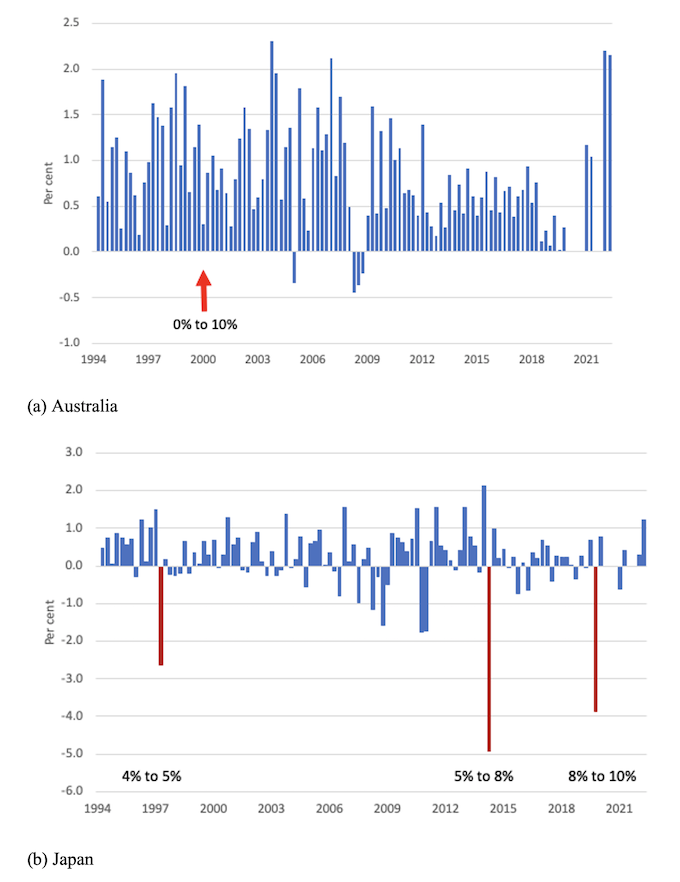

The next graph traces the historical past of actual GDP development from the March-quarter 1995 to the March-quarter 2025 and denotes the quarters when the successive gross sales tax hikes got here into impact (as per the earlier itemizing above).

The crimson areas denote gross sales tax pushed recessions.

Within the three episodes proven, these recessions have been adopted by a renewed bout of fiscal stimulus (financial coverage was ‘unfastened’ all through).

And in all of the episodes, there was a speedy return to sustained development on account of the fiscal enhance.

Nothing could possibly be clearer.

Within the March-quarter 1997, the financial system was lastly exhibiting indicators of restoration from the bubble collapse and grew by 2.8 per cent.

After the Gross sales Tax hike to five per cent in April 1997, development fell dramatically – minus 0.3 per cent within the December-quarter 1997, then -1.7 per cent March-quarter 1998, -1.4 per cent June-quarter 1997, -1.4 September-quarter 1998, and destructive for additional two quarters till fiscal stimulus resumed.

Then after the hike to eight per cent in April 2014, actual GDP development went from 2.6 per cent within the March-quarter, to -0.2 per cent within the June-quarter, -1.0 per cent within the September-quarter, and -0.5 per cent within the December-quarter.

Following the October 2019 hike to 10 per cent, the December-quarter 2019 GDP shrunk by 2.1 per cent, adopted by an extra fall of 1.8 per cent within the March-quarter, all earlier than the COVID-19 influence actually started.

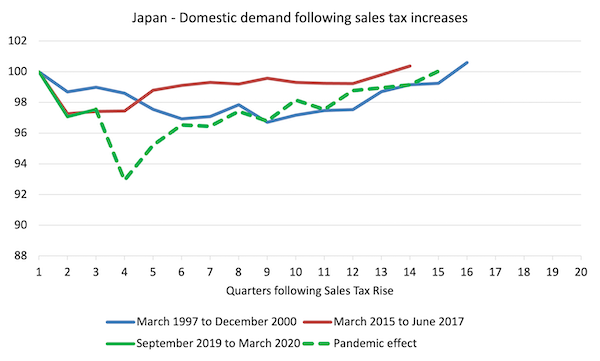

The next graph reveals indexes for home demand with the index set to 100 within the quarter earlier than the gross sales tax hike had taken impact traced out till home demand reached the respective pre-sales tax hike degree (100 in index quantity phrases).

It’s clear how damaging the tax hikes have been.

The influence of the 2014 and 2019 have been nearly an identical, though the pandemic got here instantly on prime of the 2019 downturn.

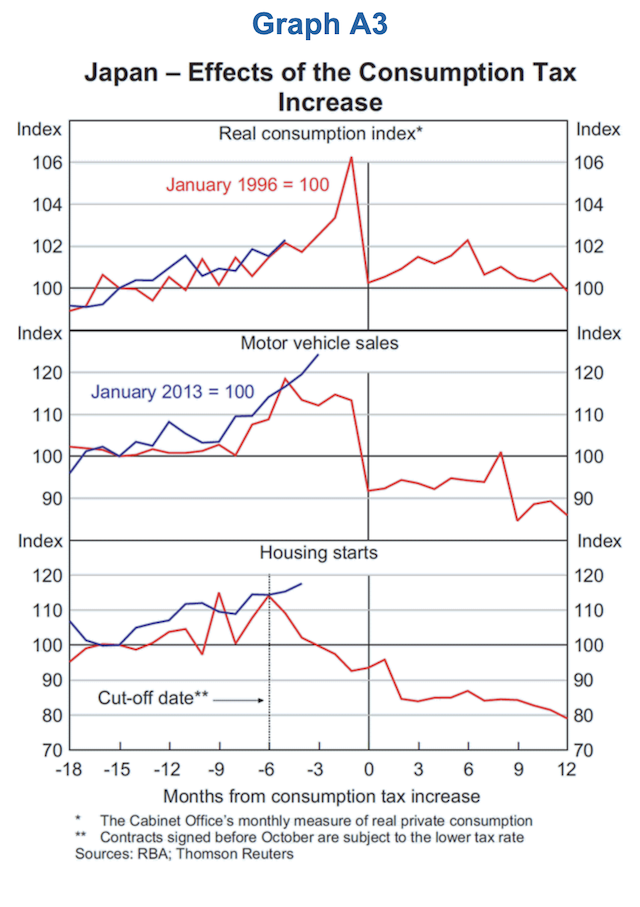

This graph from the Reserve Financial institution of Australia’s evaluation in its – Assertion of Financial Coverage – February 2014 – is attention-grabbing.

The RBA wrote that after the April 1997 tax hike:

Consumption then contracted after the tax was elevated … This sample was most evident for sturdy items, for which there’s extra discretion within the timing of purchases. For instance, motorized vehicle gross sales elevated by round 10 per cent within the six months main as much as the tax improve and fell by nearly 20 per cent within the following month. Residential funding was additionally affected by the tax improve (contracts signed earlier than 1 October 1996 weren’t topic to the upper tax price) …

Comparisons with Australia

The subsequent graph compares the quarterly development in family consumption spending from the March-quarter 1994 to the June-quarter 2022 for Australia (prime panel) and Japan (backside panel).

It comes from a e book I wrote with my Kyoto colleague Professor Satoshi Fujii that was revealed final yr in Japan (in Japanese).

I overlooked a number of quarters within the early interval of the Covid-19 pandemic from the graph as a result of they have been excessive outliers and distorted the graphs.

The typical quarterly development over this era was 0.85 per cent for Australia and 0.17 per cent for Japan – a substantial distinction.

The decrease panel for Japan is only a barely completely different model of the up to date graph above.

The gross sales tax rises have been pushed by the political strain mounting on the federal government from commentators who claimed the federal government’s fiscal deficit was too giant and the nation risked insolvency.

The Japanese authorities bowed to the strain and invoked tax cuts to appease the ‘markets’.

As famous above, the outcomes have been fully predictable.

After setting the financial system again on a brand new development path after the 1991 bubble burst, the choice to raise gross sales tax in April 1997, instantly noticed family consumption spending and GDP development contract.

The identical sample of injury adopted the hikes in 2014 and 2019 and demonstrated that development in Japanese family consumption expenditure just isn’t solely, modest relative to, say, Australia (as above), but additionally extremely delicate to gross sales tax adjustments.

By means of distinction, development in family consumption expenditure in Australia is far stronger relative to the Japanese expertise.

The arrow with the annotation 0% to 10% represents the introduction of the Items and Providers Tax (GST) in July 2000, which noticed a brand new tax on many consumption items and providers levied at a beginning price of 10 per cent.

The GST was thus a gross sales tax akin to the tax rises in Japan.

The introduction of the GST instantly had a destructive influence on family consumption development however nothing just like the influence that gross sales tax will increase in Japan had.

What would possibly clarify the completely different sensitivity of family consumption expenditure to gross sales tax will increase in Australia and Japan?

Why do Japanese households react so adversely to comparatively modest gross sales tax rises by comparability to the best way Australian households react?

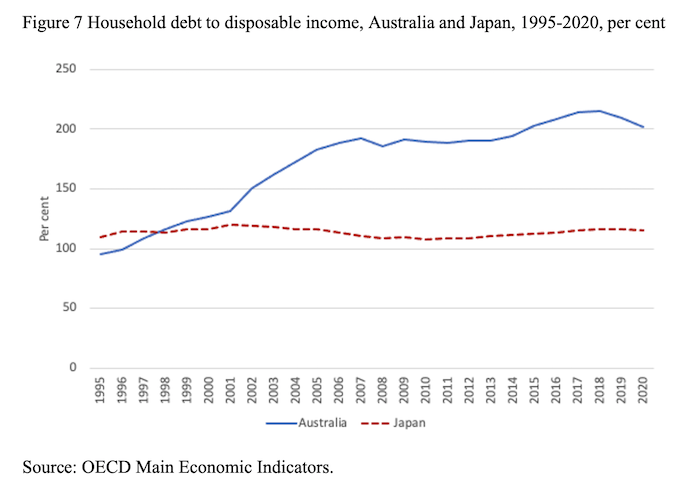

The subsequent graph offers the clue and reveals family debt as a proportion of disposable earnings for Australia and Japan from 1995 to 2020 and helps us perceive why the tax sensitivity of family consumption expenditure varies throughout these two nations.

Australia ranks excessive among the many OECD nations on this measure and family debt has risen from round 67 per cent in 1990 to 188.5 per cent in September 2022.

By means of stark distinction, family debt to disposable earnings in Japan is extremely steady at simply over 100 per cent.

Additional, in each nations, wages development has been very low over the interval proven within the graph.

What turns into clear is that Australian households saved spending when the GST was launched, whereas Japanese households dramatically lowered consumption spending, as a result of the previous are rather more prepared to extend their debt publicity when their disposable earnings is squeezed.

Australians borrow to take care of spending capability whereas Japanese households in the reduction of spending.

Whereas the rising burden of debt can have destructive penalties (for instance, it makes family solvency rather more delicate to rate of interest adjustments), it stays that the higher propensity to tackle family debt renders the Australian financial system with a higher means to soak up these kind of gross sales tax will increase relative to Japan.

It’s stunning, due to this fact, that the Japanese authorities used gross sales tax will increase to spice up income when they need to have recognized that Japanese households weren’t going to make use of will increase in debt to soak up the impingements on their disposable earnings.

It’s pretty clear, that gross sales tax will increase in Japan will all the time push the financial system in the direction of recession.

Which means that when designing optimum coverage interventions in Japan, the selection of gross sales tax variations would appear to be a poor coverage selection as a result of the likelihood that stagnation will observe may be very excessive.

Conclusion

The gross sales tax is a really efficient device in Japan if the federal government wished to suppress home demand and generate a recession.

The requires the abandonment of the gross sales tax are applicable as a result of the tax is just too damaging given the cultural propensities militating in opposition to giant family debt will increase.

That’s sufficient for right this moment!

(c) Copyright 2025 William Mitchell. All Rights Reserved.