I really like following the markets.

The craziness. The businesses. The historic returns. The dangers. The investor habits. The numbers. The psychology. All of it.

However the stuff that basically issues on the subject of constructing wealth occurs earlier than you even get to fascinated about easy methods to make investments.

Investing is vital however saving has to return first. If you happen to don’t have the power to earn, save and retain cash to take a position it doesn’t matter when you’re the subsequent Warren Buffett. You may’t construct wealth with out some financial savings.

The excellent news is there has by no means been a greater time to be a saver-turned-investor. Know-how makes it simple to automate your financial savings into any variety of totally different funding accounts and platforms. Simply activate computerized contributions to your 401k, IRA, brokerage account, HSA, 529 or excessive yield financial savings account.

The cash comes proper out of your paycheck or checking account so you may get on along with your life. You make one good determination now that units you up for a lot of extra good choices sooner or later.

I additionally assume the power to avoid wasting in a tax-deferred account is an excellent manner to enhance your funding habits. Why?

There are guardrails in place. Positive, you’ll be able to withdraw cash out of your retirement accounts nevertheless it’s not simple. There are guidelines, laws, and penalties in place that make it tougher to interrupt your compounding.

You hand over some flexibility within the short-run however retirement property are meant for the long-run.

In 2026, buyers can save much more cash of their tax-deferred retirement accounts.

In keeping with the IRS, these are the brand new contribution limits for 2026:

- 401k/403b/457: $24,500 (up from $23,500)

- IRA: $7,500 (up from $7,000)

- SEP IRA: $72,000 (up from $70,000)

If you happen to’re 50 or older you’ll be able to contribute $32,500 to your 401k with a catch-up provision. If you happen to’re 60-63 it’s $35,750 in your office retirement plan.

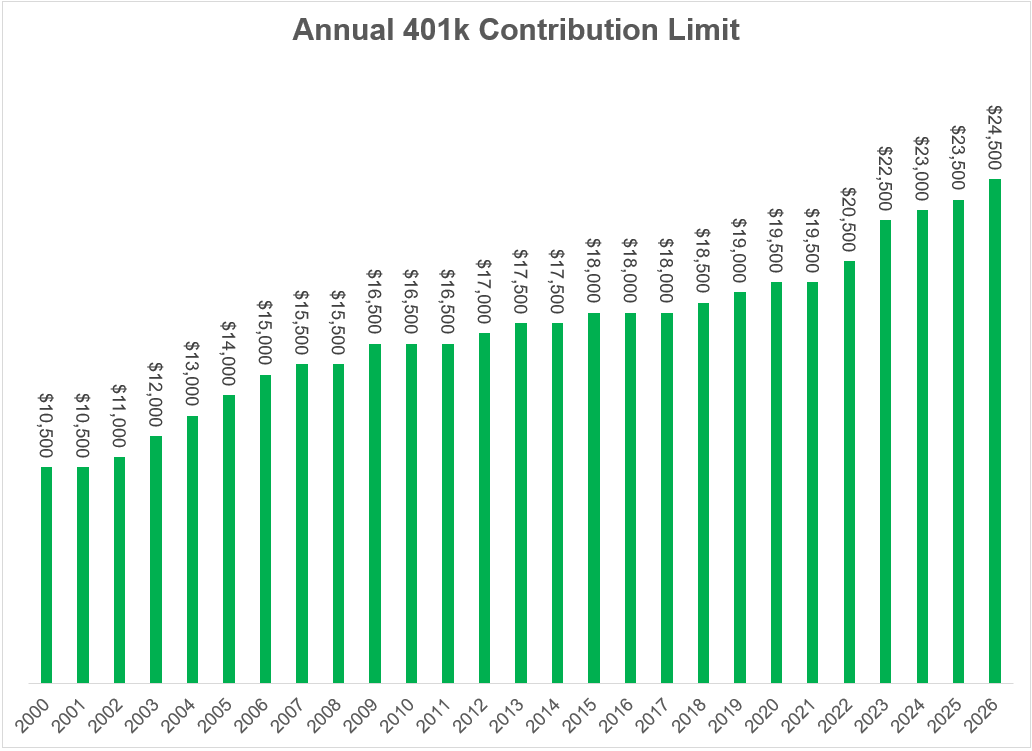

The federal government doesn’t all the time do an amazing job indexing its tax insurance policies to inflation however retirement contribution limits have moved up properly through the years:

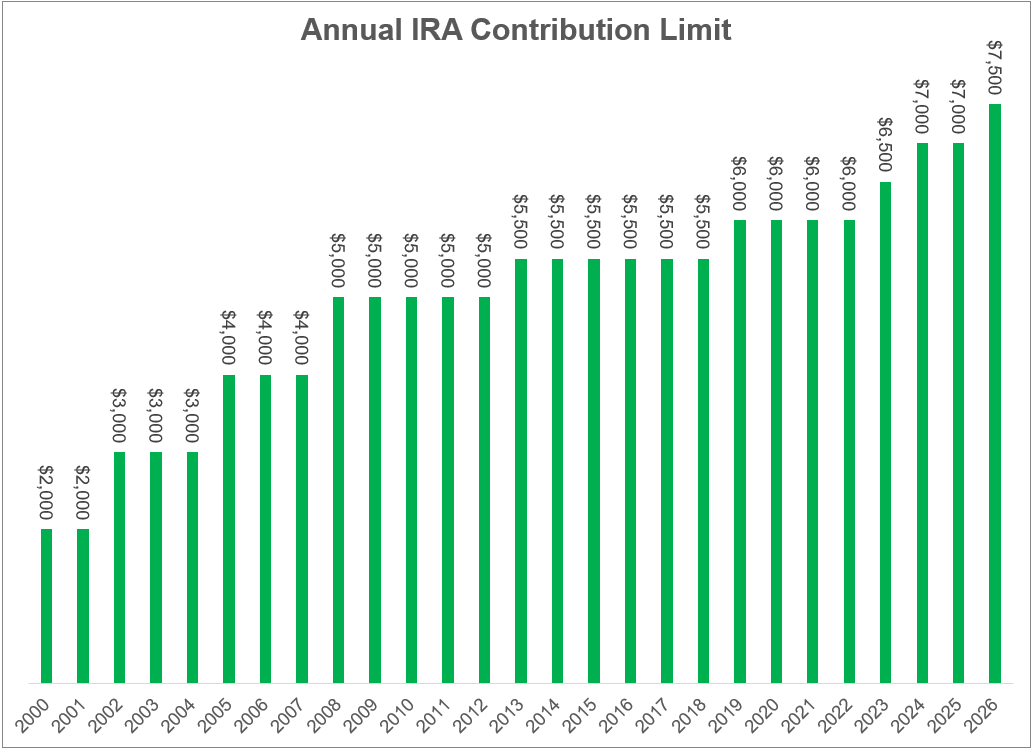

IRA contribution limits have risen as nicely:

Within the 2020s alone, the 401k contribution restrict is up almost 30% whereas IRA limits have elevated by 25%. Within the twenty first century, the bounds have gone up by 133% and 275%, respectively.

That is great information for savers.

Let’s say you had the power to max out your 401k contributions yearly beginning in 2000. By the tip of this yr that quantities to rather less than $440k in complete financial savings or round $16,800 a yr in annual financial savings on common.

If you happen to put that cash to work dutifully over the course of this century into the S&P 500 on a month-to-month foundation, you’d be sitting on round $2.2 million by the tip of October. In a world inventory market allocation (MSCI ACWI), it will be extra like $1.7 million.

That’s fairly good for 26 years of financial savings.

After all, not everybody has the abililty to max out their retirement contribututions.

That is the share of employees who max out their 401k by age in Vanguard defind contribution retirement plans (through The WSJ):

It’s tough for younger folks to max out their retirement financial savings for apparent causes however the older age teams are approaching a 20% share that max out. My guess is that this quantity will proceed to rise through the years since younger buyers are extra extremely educated about these things from an early age.

I didn’t max out my 401k till I used to be 34 years previous. My preliminary contribution quantity was small-ish once I was simply beginning out. Yearly I elevated the quantity till I lastly reached my objective. It took a while.

If you happen to can’t max out your 401k contribution, save sufficient to get your organization match at first after which enhance your financial savings fee just a little yearly.

If you happen to don’t have a office retirement plan, max out your IRA and save the remaining in a taxable brokerage account.

If you happen to’re 50 or older and behind on retirement financial savings, reap the benefits of the catch-up provisions.

The antidote to each market threat is saving more cash.

You may’t make investments when you don’t save.

The way you behave will typically decide your success or failure as an investor. An important habits on the subject of constructing wealth is saving cash.

Additional Studying:

The Automated Investing Revolution