Your provide was accepted!

I used to be over the moon and jumped for pleasure when our realtor referred to as (actually, I get that excited in regards to the smallest of issues so I virtually touched the sky this time). My pleasure shifted virtually instantaneously although to panic and I second guessed the choice arduous! Had been we actually leaving our first house behind?

We began our life collectively on this home, two youngsters, two careers, we would had numerous adventures, all of the whereas making reminiscences and (wahoooo!) a complete bunch of fairness due to a booming actual property market.

It was that fairness that allowed us to plan the transfer to our “perpetually house.” Dumping all that fairness into our new handmade the mortgage affordable. Even so, the brand new mortgage was nonetheless quite a bit greater than the final one. Had been we biting off greater than we might chew?

Making our home a house

As soon as we settled in (and obtained used to a complete new set of latest payments), we went to work on some main enhancements. We planted grapevines in honor of Nonna and Papa’s backyard. A fence let our new pet Jake run round safely within the yard. Changing the tired-out oil boiler allow us to make the most of low-cost pure fuel costs. Moreover, heating oil deliveries had been an actual ache to maintain up with, and I knew it will enhance resale worth (and ding ding, that translated to extra fairness)!

The advance that introduced us essentially the most pleasure was opening up partitions so we might host our Huge Fats Italian Birthday Events! And I’m speaking enormous! We packed 75 individuals on the property each fall and summer time.

These events at all times jogged my memory that individuals had been the purpose of all of it. With every house enchancment and mortgage cost, we made investments within the place the place our children become adults, the place we celebrated holidays, the place Sunday morning bacon pancakes grew to become the reminiscences we would treasure. We had been fortunate that the fairness was constructing, positive, however so was the life that made this home our house.

.png)

A consolation in a attempting time

However life, because it tends to do, took an sudden flip. Publish-divorce, I discovered myself the only real proprietor of that perpetually house. I nonetheless beloved my house, however with a lot shifting under my toes, I used to be asking myself, “Might I afford all this alone?”

That is after I began utilizing YNAB. One of many first issues I did in my new spending plan was to trace my house’s worth in YNAB together with the mortgage quantity. Seeing my web value quantity instantly shift up gave me respiratory room.

Immediately, these fairness {dollars} weren’t simply tied to reminiscences—they had been my monetary basis, my largest asset, and actually, my safety blanket throughout a time when all the things else felt fairly unsure. For the primary time, I might see precisely what this home meant to our monetary image.

Each month, watching that web value quantity replace jogged my memory that at the same time as I used to be rebuilding life with my teenagers by my facet, I had stable footing within the house that was now ours differently.

Organising your private home worth account

After I determined to start out monitoring my house’s worth in YNAB, it was fairly easy.

This is the right way to do it ➡️

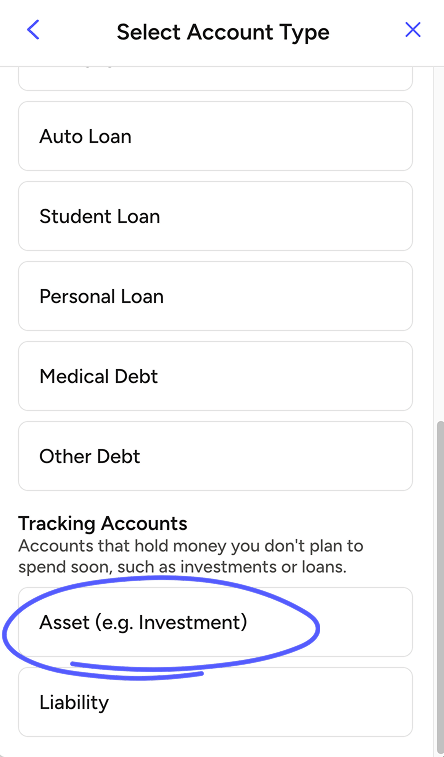

You may create a monitoring account – this lives separate out of your common Money or Credit score accounts, so it will not mess along with your month-to-month plan. Click on ‘Add Account,’ then ‘Unlinked,’ and this is the necessary half: select ‘Asset (e.g. Funding)’ as your account kind. This ensures your private home worth exhibits up in your web value reflection, once more with out affecting your spending plan.

You possibly can title it one thing clear like ‘Main Residence’ or you’ll be able to roll like I do and title it one thing extra private and simply plain enjoyable ‘House Candy Our House 💛💛💛 Worth’. Enter your private home’s present estimated worth because the beginning steadiness. I went with Zillow’s Zestimate—not 100% correct, however adequate to get began.

When you save that account, your web value report will replace. For me, seeing that up to date quantity was eye-opening—all these mortgage funds had been quietly constructing actual wealth, and now I might really monitor it.

The quarterly ritual that retains you grounded

I goal to replace my house’s worth and the steadiness of my mortgage account each three months or so. However I will be sincere—I am extra of a go-with-the-flow individual, so typically it occurs after I really feel prefer it or get impressed to examine. Like after I see a home go up on the market within the neighborhood and I ponder what ours might promote for. Or after I’m daydreaming about how a lot fairness I might faucet if I wanted it for one thing huge—like serving to one in every of my youngsters, changing our roof, taking up sudden medical bills or lastly taking that cross nation highway journey I have been dreaming about.

I normally time it with updating my funding monitoring account balances too. That makes it really feel like I am getting an entire monetary snapshot suddenly. The method itself is fairly easy: I pull up Zillow, examine the present Zestimate, then hop into YNAB to make a steadiness adjustment. If the worth went up, it is a constructive adjustment; if it went down, it is unfavorable. And because it’s a monitoring account there’s no class wanted right here. The brand new transaction merely updates the steadiness.

What I actually take pleasure in about this course of is the way it connects me to the chances.

What I actually take pleasure in about this course of is the way it connects me to the chances. It is not nearly monitoring numbers—it is about understanding what choices I’ve, what goals is perhaps inside attain, and the way this home continues to be a part of our households’ monetary story.

There’s one thing grounding about how my home worth contributes to my web value and the way it jogs my memory that if the time comes to maneuver on, I can extra freely resolve the place the following reminiscences can be made.

Far more than a quantity

After we took the plunge to purchase this home, our toddlers had been barely speaking in full sentences. It’s now 20 years later and so they’re launching into their very own lives and dreaming about shopping for their first properties 🤯.

After I began penning this I supposed to write down solely in regards to the fairness {dollars} that we constructed up via the years and the act of monitoring that worth in YNAB. However as I dug in, I saved fascinated with how the worth constructed over many years actually represents a lot greater than a greenback quantity. That quietly-building asset account in YNAB gave me much-needed peace of thoughts, however that quantity tells a narrative of a lot extra. A narrative of pleasure and transformation. Of sticky-fingered toddlers and messy rising youngsters. Of Sunday bacon pancakes and 75-person birthday events. Every greenback is one other treasured second in our household’s story.