At a latest investor day presentation, KKR CEO Scott Nuttall talked in regards to the large potential for personal investments in retirement plans like 401ks and targetdate funds:

Apollo’s Marc Rowan made an identical pronouncement on the corporate’s newest earnings name:

There’s something like $15 trillion within the outlined contribution retirement plan house. Apollo envisions a situation the place targetdate funds embrace methods like personal credit score and personal fairness:

I do know this makes some folks nervous.

On the one hand, retirement plans would appear to make quite a lot of sense for these fund buildings. Your time horizon in a 401k plan is usually lengthy, measured in a long time usually. Plus, you don’t want short-term liquidity in a retirement plan the place your cash is actually locked up already. So the illiquidity piece shouldn’t matter as a lot.

However, I do fear in regards to the complexity of those merchandise.

Do 401k buyers have the monetary acumen to know these kind of merchandise? Do they know what the charges are? Do they grasp the illiquidity concerned? Do they get how usually the costs are marked to market?

I’ve some issues.

No matter these issues, it feels like that is coming.

Bloomberg had an extended profile final month on the push from personal funding managers into the wealth administration channel:

Lower than every week earlier than President Donald Trump’s second inauguration, greater than 30 cash managers gathered on Zoom to strategize about methods to pull America’s retirement savers into investments far past shares and bonds.

Through the assembly attended by Blackstone Inc., UBS Group AG, Neuberger Berman and others, individuals assembled a manifesto articulating personal fairness’s rightful place in 401(okay) plans, together with within the default portfolios for staff who don’t choose their very own investments.

I perceive why the trade is doing this. Institutional buyers are roughly tapped out.

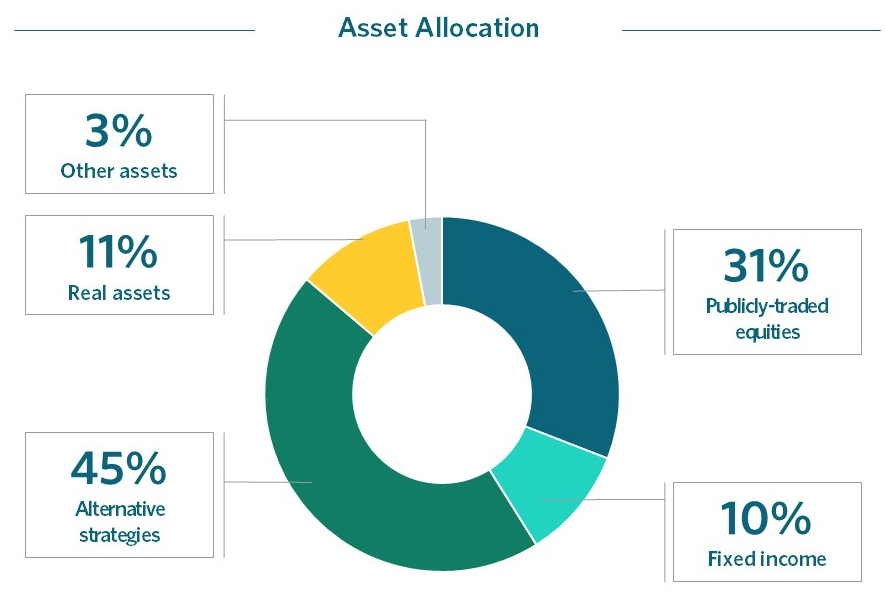

The NACUBO examine of endowment funds appears on the common asset allocation of those large buyers:

Endowments, foundations and pension plans have been including to different property for years now. Certain, there’ll all the time be more cash on this house however the large strikes are basically over.

Non-public asset managers want the wealth administration channel for progress.

RIAs handle greater than $100 trillion in property. Non-public funding managers are salivating on the progress potential in that house.

In his annual letter to buyers, Blackrock’s Larry Fink envisions a future balanced portfolio that appears much less like 60/40 and extra like 50/30/20:

The longer term customary portfolio could look extra like 50/30/20–shares, bonds, and personal property like actual property, infrastructure, and personal credit score.

There are many challenges to get from right here to there. There are new fund buildings that attempt to make entry extra seamless (interval funds, evergreen funds, and so on.) however most buyers don’t have expertise with personal investments.

It’s a complete new world.

I’m not even certain what number of buyers are clamoring for entry to personal investments. A technique or one other, it’s coming. Monetary advisors and retirement plans will provide buyers entry to extra personal market methods within the years forward.

The tutorial element goes to be large right here. We’ll see if the trade is as much as the duty. I’m skeptical however completely satisfied to be confirmed improper.

One factor I’m certain of — in case you don’t perceive one thing you shouldn’t put money into it.

That goes for private and non-private market methods alike.

I had Michael Sidgmore on Ask the Compound this week to debate how personal property will work in wealth administration:

We additionally answered questions on how personal investments work, who ought to and shouldn’t be invested in these methods, illiquidity, personal credit score and extra.

Additional Studying:

How Will Non-public Fairness Work in 401ks?

This content material, which accommodates security-related opinions and/or data, is supplied for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There might be no ensures or assurances that the views expressed right here can be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. You need to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory providers supplied by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or provide to supply funding advisory providers. Charts and graphs supplied inside are for informational functions solely and shouldn’t be relied upon when making any funding resolution. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and will differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For extra commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.