Final week introduced continued progress within the battle towards the pandemic, and people phrases would work for this week as effectively. As we’re initially of a brand new month, nevertheless, let’s check out the progress because the begin of April. Whereas weekly knowledge is beneficial, the pandemic has now continued on for lengthy sufficient that we now have the information to ascertain a broader context—and that broader context is surprisingly optimistic.

Pandemic Slowing Even Additional

Development fee. You’ll be able to see from the chart under that the brand new case development fee went from greater than 15 p.c per day initially of April to the current stage of about 2 p.c per day. Put one other manner, the variety of new circumstances was doubling in lower than per week in the beginning of April; as we enter Could, that doubling fee has gone to greater than 5 weeks. This shift is a major enchancment—we now have succeeded in flattening the curve at a nationwide stage.

Each day testing fee. We have now additionally made actual progress on testing, with the day by day check fee up from simply over 100,000 per day in the beginning of April to effectively over 200,000 per day in the beginning of Could. Whereas this stage continues to be not the place we’d like it to be, it represents actual progress.

Optimistic check outcomes. One other manner of seeing this progress is to have a look at the share of every day’s checks which can be optimistic. Ideally, this quantity can be low, as we need to be testing everybody and never simply those that are clearly sick. The decrease this quantity will get, the broader the testing is getting. Right here once more, we will see the optimistic stage has halved from the height. Extra individuals are getting checks, which suggests we now have a greater grasp of how the pandemic is spreading.

New circumstances per day. The development in new circumstances per day is much less dramatic, down from 30,000-35,000 to about 25,000. However this quantity is healthier than it appears to be like. With the broader vary of testing and with the variety of checks doubling, different issues being equal, we’d anticipate reported circumstances to extend in proportion to the variety of checks. The truth is, we now have seen the variety of day by day circumstances ebb and movement with the testing knowledge. However general the pattern is down—by greater than 20 p.c from the beginning of April—regardless of the doubling within the variety of checks.

We proceed to make progress on controlling the coronavirus pandemic, however the level this week is how a lot progress we now have made. We’re not out of the woods but. However we’re on the finish of the start of the method and shifting in the suitable path.

Financial system Could Have Bottomed in April: Reopening Begins

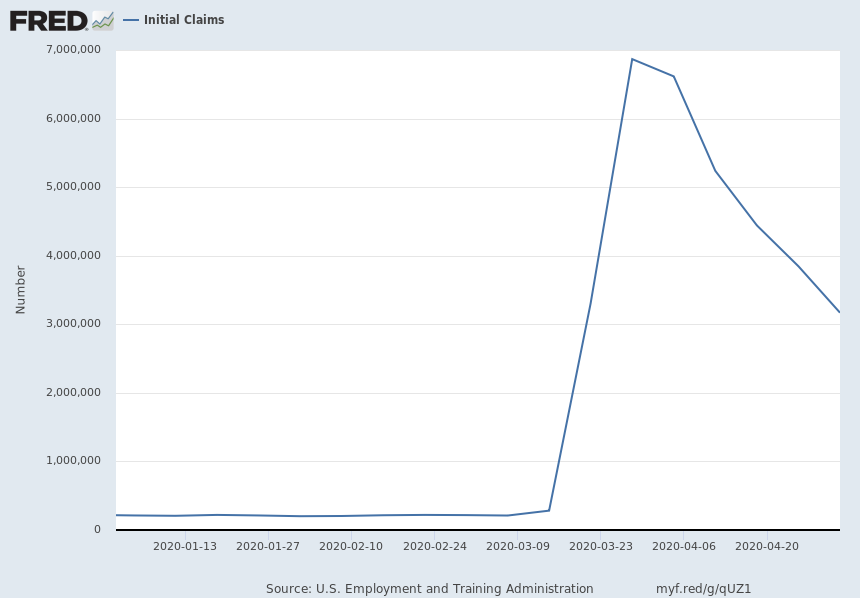

Whereas layoffs proceed, there are indicators that the harm could have peaked and is beginning to recede. Weekly preliminary unemployment claims are down by greater than half from the height, suggesting that a lot of the harm has already been executed. If the decline continues at this tempo, we might see layoffs normalize within the subsequent month. That decline doesn’t imply the economic system is nice. It does imply the economic system is getting much less dangerous, which is a essential step in attending to good.

Federal help. Even because the financial harm mounts, the federal help can also be mounting. Initially of April, the packages weren’t in place. Now, substantial quantities of money are flowing into the economic system by way of the stimulus funds, expanded unemployment insurance coverage, and mortgage packages for companies, which ought to assist maintain demand alive till the economic system reopens (which could not be that lengthy).

Advantages of reopening. A number of European nations have began to reopen their economies because the begin of Could, and quite a few U.S. states are opening as effectively. As we reopen, we definitely face dangers, however there are additionally actual advantages. First, the rising indisputable fact that the lockdown does certainly have an finish ought to assist assist shopper confidence, which is a essential ingredient of any restoration. Second, it would assist employment and spending, bringing a few of these laid-off staff again to work. Third, we are going to study rather a lot about how the reopening works, which is able to considerably cut back uncertainty going ahead.

Are there dangers? Actually, the largest of which is a second giant wave of the pandemic. Reopening means loosening the social-distancing restrictions and exposing extra individuals to an infection threat, which might definitely inflate case counts. On the identical time, if individuals proceed to do issues like put on masks and keep distance, that extra case development may be minimal. That will probably be one thing we are going to study, and it appears possible that most individuals will act in a protected method.

One other potential threat is that, even with the reopening, shoppers will probably be sluggish to return and spending development is not going to return to what was regular any time quickly. This consequence appears possible, particularly within the early phases. Right here once more, that is one thing that might find yourself doing higher than anticipated.

We must reopen in some unspecified time in the future. If we will achieve this with out an excessive amount of extra an infection threat, that will probably be price discovering out. And, the bigger-picture perspective right here is that in the beginning of April, we didn’t know whether or not we’d management the pandemic or not. And a month later? We’re planning to reopen in lots of areas. That is actual progress.

Market implications. For the monetary markets, proper now the idea is that the reopening and restoration will go effectively and shortly. Markets are priced for a speedy finish to the pandemic and a V-shaped financial restoration. If the Could reopening goes effectively, these assumptions will look a lot much less unsure—to the seemingly additional advantage of the markets.

Dangers within the Rearview?

Wanting again over a month, the stunning factor is simply how a lot progress we now have made and the way we now have moved from one thing approaching panic to a measured method to reopening the economic system. We’re not but out of the woods, and there are definitely vital dangers going ahead, with a second wave of infections being the largest. However the factor to bear in mind is that lots of the largest dangers are shifting behind us.

Editor’s Notice: The unique model of this text appeared on the Impartial

Market Observer.