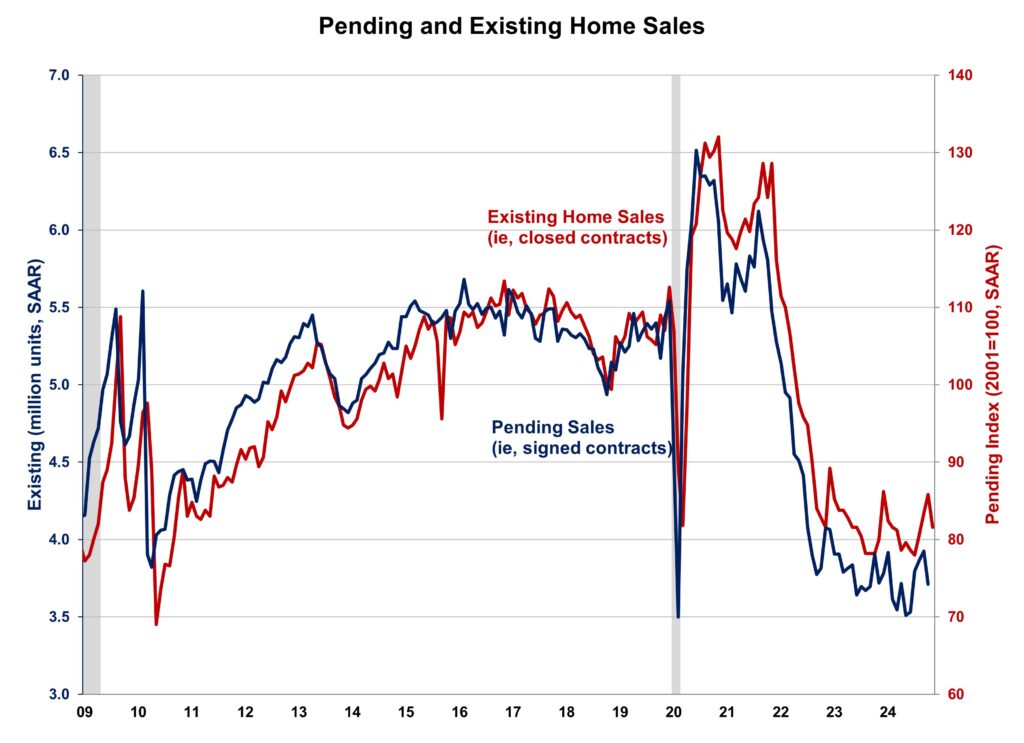

After three months of will increase, present house gross sales retreated in January from the 10-month excessive final month, in line with the Nationwide Affiliation of Realtors (NAR). Gross sales continued to be suppressed by larger mortgage charges, which remained above 6.5% regardless of the Fed reducing charges by 100 foundation factors final 12 months. The persistent excessive mortgage charges largely replicate coverage uncertainty and issues about future financial development.

Whereas present house stock improves and the Fed continues decreasing charges, the market faces headwinds as mortgage charges are anticipated to remain above 6% for longer on account of an anticipated slower easing tempo in 2025. The extended charges could proceed to discourage owners from buying and selling present mortgages for brand new ones with larger charges, maintaining provide tight and costs elevated. As such, gross sales are more likely to stay restricted within the coming months on account of elevated mortgage charges and residential costs.

Complete present house gross sales, together with single-family houses, townhomes, condominiums, and co-ops, fell 4.9% to a seasonally adjusted annual fee of 4.08 million in January. On a year-over-year foundation, gross sales have been 2.0% larger than a 12 months in the past. This marks the fourth consecutive month of annual will increase.

The primary-time purchaser share was 28% in January, down from 31% in December however unchanged from January 2024.

The present house stock degree rose from 1.14 million in December to 1.18 million models in January and is up 16.8% from a 12 months in the past. On the present gross sales fee, January unsold stock sits at a 3.5-months’ provide, up from 3.2-months final month and three.0-months a 12 months in the past. This stock degree stays low in comparison with balanced market situations (4.5 to six months’ provide) and illustrates the long-run want for extra house building.

Houses stayed in the marketplace for a median of 41 days in January, up from 35 days in December and 36 days in January 2024.

The January all-cash gross sales share was 29% of transactions, up from 28% in December 2024 however down from 32% in January 2024. All-cash patrons are much less affected by modifications in rates of interest.

The January median gross sales value of all present houses was $396,900, up 4.8% from final 12 months. This marked the nineteenth consecutive month of year-over-year will increase. The median condominium/co-op value in December was up 2.9% from a 12 months in the past at $349,500. This fee of value development will sluggish as stock will increase.

Geographically, three of the 4 areas noticed a decline in present house gross sales in January, starting from 5.7% within the Northeast to 7.4% within the West. Gross sales within the Midwest remained unchanged. On a year-over-year foundation, gross sales grew in three areas, starting from 1.4% within the West to five.3% within the Midwest. Gross sales have been unchanged within the South from a 12 months in the past.

The Pending House Gross sales Index (PHSI) is a forward-looking indicator primarily based on signed contracts. The PHSI fell from 78.5 to 74.2 in December on account of elevated mortgage charges. This marks the primary decline since August 2024. On a year-over-year foundation, pending gross sales have been 5.0% decrease than a 12 months in the past, per Nationwide Affiliation of Realtors knowledge.

Uncover extra from Eye On Housing

Subscribe to get the newest posts despatched to your e-mail.