One of many points that emerges when one is learning undergraduate macroeconomics is that there’s a curious disregard for the position that earnings and wealth distribution play in figuring out the combination outcomes, which might be on the centre of the examine. Most college students in my cohort didn’t take into consideration that and the curriculum actually didn’t encourage such digressions. For me, a pupil of Marx principally, I used to be extraordinarily within the subject and skim rather a lot outdoors the usual curriculum, which took me into the work of Sidney Weintraub and others, for instance, who demonstrated how combination spending was not simply influenced by earnings but in addition how that earnings was distributed. I’ve been excited about this difficulty in relation to the best way the Australian debate at current is being dominated by the productiveness query and the crucial for a degrowth technique to emerge. This considering can be in relation to the Federal authorities’s – Financial Reform Roundtable – which they’re operating in Canberra this week, led by the Treasurer. The overarching theme is ‘Making our financial system extra productive’ so we are able to develop sooner. Precisely the alternative of a dialogue about degrowth.

With the ‘Financial Reform Roundtable’ beginning tomorrow the discuss within the media and so forth is ‘development, development, development’.

Folks sometimes conflate extra output development and better productiveness development, regardless that the 2 ideas are fairly distinct.

However the motivation for growing productiveness development is to push the general GDP development fee up.

The mainstream economists which might be getting a number of media consideration within the lead as much as the occasion are claiming that the one manner our materials residing requirements can improve is thru productiveness development which can permit GDP development to speed up.

And, after all, they’re joined by the throng of company shills who demand much less regulation to ‘pace issues up’, which is code for making jobs much less safe and permitting issues like building codes to be watered down.

The issue is evident – there is no such thing as a recognition in any respect within the public debate surrounding the Roundtable of the truth that Australia’s – Ecological footprint – is effectively above the worldwide common of 1.7, which in itself is unsustainable.

In per capita phrases, Australia’s 2024 footprint was 6.1 (inside the prime 10), which implies that the crucial is to not discover methods to develop sooner, however, slightly, how we are able to nonetheless operate with a degrowth technique.

Which leads me to consider earnings and wealth distributions, one other difficulty that received’t get a glance in at this week’s occasion in Canberra.

After we discuss enhancing materials residing requirements, the standard mainstream answer is that productiveness development – that’s, development in output per unit of enter – should rise.

Which means a given set of productive assets is ready to produce extra and that elevated actual calls for on the earnings distribution by the house owners of these productive assets could be accommodated with out inflationary pressures.

And because it stands, that proposition is right.

The extra we are able to produce with much less the extra is out there for distribution to every particular person within the society.

Notice additionally that I’m not desirous to have a dialogue right here about what constitutes productiveness development – given I’ve a much wider view of the idea than the mainstream place that eschews a number of social exercise as being a waste of productive time.

So I’m simply accepting the usual method right here.

Nevertheless, that proposition doesn’t actually issue within the biosphere, except the claims on that useful resource are explicitly included within the output and enter estimates.

And, after all, the mainstream method by no means actually contains the unfavorable penalties for our biosphere of increasing output development, which implies the figures they chase by way of productiveness development are biased in the direction of non-sustainability.

However there’s one other manner that materials residing requirements for almost all of individuals could be improved whereas pursuing a degrowth technique.

And that includes coverage shifts oriented in the direction of altering the earnings and wealth distributions, that are linked.

The most recent Australian Bureau of Statistics (ABS) knowledge on – Family Revenue and Wealth, Australia – was launched on April 28, 2022 and relies on data gathered within the Survey of Revenue and Housing 2019-20.

So it’s now considerably dated however the state of affairs won’t have modified that a lot as time has elapsed.

The earnings distribution in Australia has, actually, been very secure over the last decade to 2019-20.

The quintile shares have barely modified, the bottom 20 per cent had 7.4 per cent of complete disposable earnings, the second 20 per cent had 12.6 per cent, the third quintile had 17.2 per cent, the fourth quintile had 23 per cent and the highest 20 per cent had 39.8 per cent.

That knowledge alone tells us how unequal the distribution is even when the extent of inequality is usually unchanged.

Nevertheless, over the last decade to 2019-20 there was a slight deterioration within the Gini coefficient for disposable earnings which implies the distribution turned considerably extra unequal, however the shift may be very marginal, suggesting there’s some stability within the indicator.

In 2009-10, the P90/P10 ratio was 4.35, which implies that these on the ninetieth percentile of the earnings distribution had simply over 4.35 instances the weekly earnings of households on the tenth percentile.

By 2019-20, that ratio was 4.0, a slight decline however nonetheless indicative of an enormous disparity in weekly nominal outcomes.

I haven’t bought time at present to mannequin what modifications would preserve the ‘All households’ common fixed but redistribute vital earnings to the decrease quintiles to scale back ratios like that.

However given the disparity that exists there’s large scope to scale back the disposable earnings on the prime finish and improve the disposable earnings for the low-paid with out the financial system producing any extra total nationwide earnings.

Such a technique would dramatically improve the fabric well-being of the bigger proportion of residents whereas a degrowth technique may very well be pursued.

So it’s not true that we want extra output development through productiveness development to enhance materials residing requirements.

The ABS additionally publishes “monetary stress indicators” that are computed primarily based on responses to the Survey.

The record of chosen indicators is:

Unable to lift $2,000 in per week for one thing essential

Unable to lift $500 in per week for one thing essential

Spend more cash than obtained

Couldn’t pay electrical energy, gasoline or phone invoice on time

Couldn’t pay mortgage or lease funds on time

Couldn’t pay automotive registration or insurance coverage on time

Couldn’t pay residence or contents insurances on time

Couldn’t make minimal fee on bank card on time

Pawned or bought one thing

Went with out meals

Went with out dental remedy

Have been unable to warmth or cool residence

Sought monetary help from associates or household

Sought help from welfare/neighborhood organisations

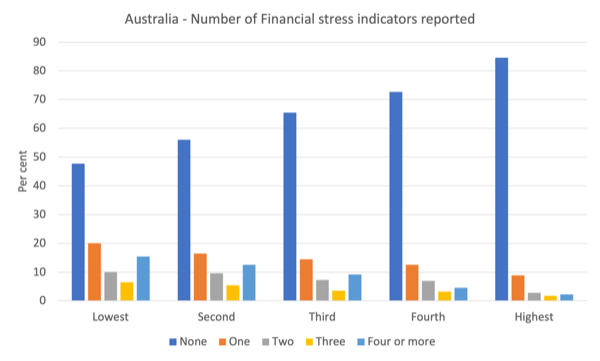

In 2019-20, the distributional biases are clear for this indicator.

The next graph reveals the ‘variety of monetary stress indicators’ reported for every of the quintiles.

For the bottom quintile, the best six indicators had been:

1. Unable to lift $2,000 in per week for one thing essential: 32.8 per cent

2. Unable to lift $500 in per week for one thing essential: 16.1 per cent

3. Spend more cash than obtained: 15.2 per cent

4. Couldn’t pay electrical energy, gasoline or phone invoice on time: 15.0 per cent

5. Sought monetary help from associates or household: 14.4 per cent

6. Went with out dental remedy: 13.4 per cent

20.3 per cent of households within the lowest quintile mentioned they had been ‘Unable to lift $500 in per week for one thing essential’ – which implies they’re very uncovered to the standard calamities that come up that want rapid consideration.

The wealth distribution is way more unequal than that the earnings distribution, partially, as a result of the fiscal system helps cut back the ‘market-based’ earnings outcomes through taxation and transfers, whereas the system reinforces the wealth disparities by giving large concessions, for instance, to property traders (the so-called unfavorable gearing coverage).

Additional, the dominance of financial coverage because the precept counterstabilisation macroeconomic coverage sometimes works for the wealthy.

The current rate of interest hikes (as much as November 2022) redistributed large quantities of earnings from low-income mortgage holders into the palms of these with monetary property (wealth), which allowed the latter cohort to broaden their wealth holdings on the expense of the previous.

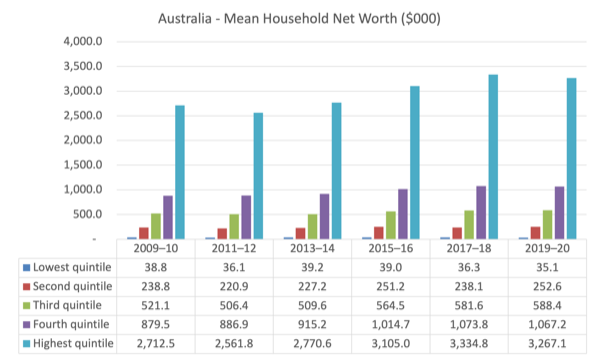

By way of the Wealth distribution, the next graphs inform the story.

First, the ‘Imply family web value between 2009-10 and 2019-20’ are proven by quintile.

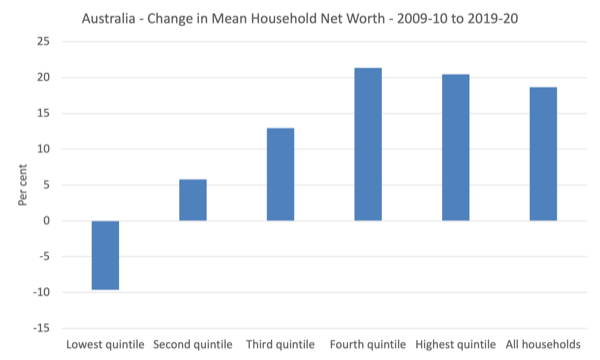

Second, the proportion change in imply web value over that interval is proven within the subsequent graph.

The bottom quintile has gone backwards whereas the highest two quintiles have moved additional forward.

In 2009-10, the P90/P10 ratio was 49.16, which implies that these on the ninetieth percentile of the wealth distribution had simply over 49 instances the online value of households on the tenth percentile.

By 2019-20, that ratio had grown to 61.13, which reveals an enormous wealth disparity and an enormous capability to redistribute wealth to enhance the fabric fortunes of these on the backside finish of the distribution.

Is that this a tax the wealthy argument?

It’s however with a nuance.

And to be clear as soon as once more, we aren’t advocating taxing the wealthy in order that the federal government can acquire funds to spend on low-income households.

Clearly, that’s what would be the end result.

The federal government might simply increase the weekly incomes of the low-income households with out doing something to the higher-income households by merely introducing some money stipend or different interventions, reminiscent of free baby care and so forth.

However the level is that it should obtain extra fairness with out including any further spending stress to the financial system if it needed to pursue a degrowth technique.

In that case it has to take buying energy off the upper earnings earners and switch it to the decrease earnings earners understanding that their spending propensities (for every further greenback) are totally different.

So we have to tax the wealthy to deprive them of spending capability to create the useful resource house for the decrease earnings cohorts to get pleasure from the next materials lifestyle by means of their further spending.

There are different causes to tax the wealthy – for instance, to scale back their capability to affect the political course of and management the media.

However at present I contemplate a fairly separate motive.

Conclusion

Whereas productiveness development is clearly a method to broaden output and nationwide earnings for a given set of productive assets, blindly pursuing actual GDP development will worsen our already unsustainable calls for on the biosphere.

A degrowth-consistent technique to enhance materials residing requirements should embody vital redistribution of wealth and earnings, which can make it much more tough to realize, given all the opposite facets that should be put in place as effectively.

That’s sufficient for at present!

(c) Copyright 2025 William Mitchell. All Rights Reserved.