It has been 15 years since I first addressed why the “Wealth Impact” is a straightforward correlation error:

“The fundamental premise of the wealth impact is well-known: As the worth of inventory portfolios rise throughout bull markets, traders take pleasure in a sense of euphoria. This psychological state makes them really feel extra snug — about their wealth, about debt, and most of all, about spending and indulgences. The online outcome, goes the argument, is that customers spend extra, stimulate the financial system, thus resulting in extra jobs and tax revenues. A virtuous cycle is created. The issue is, the idea is usually nonsense.” The Huge Image, Nov 16, 2010

It’s superb that the Federal Reserve continues to make coverage primarily based on what I argue is a basic misunderstanding of each economics and psychology.

No, spending doesn’t go up as a result of shares are up; reasonably, the components that underpin increased shopper spending – will increase in employment, wages, credit score, and even modest inflation, plus anything underpinning financial enlargement1 – are likely to additionally drive up revenues, income, investor sentiment, and due to this fact inventory costs.2

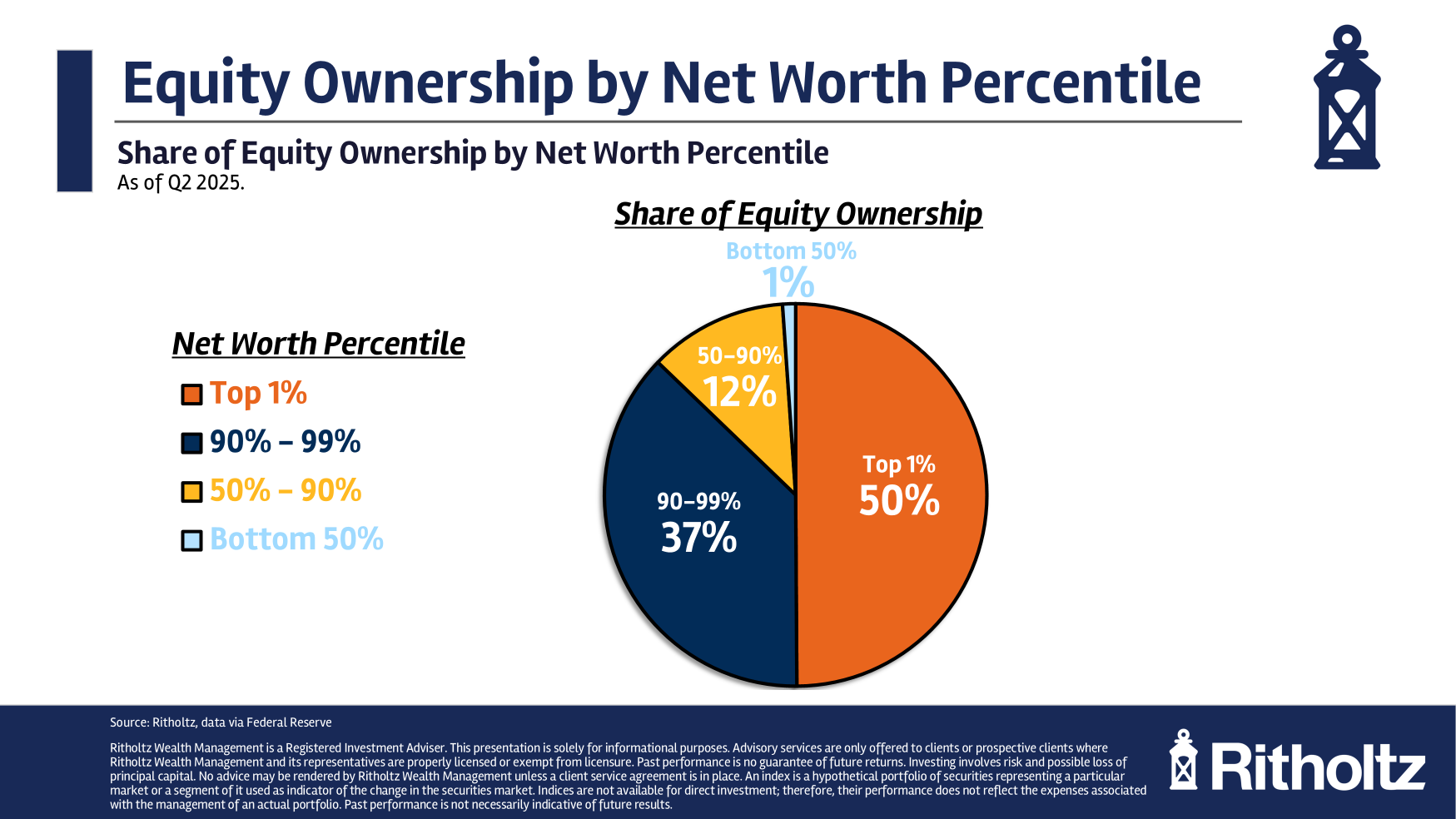

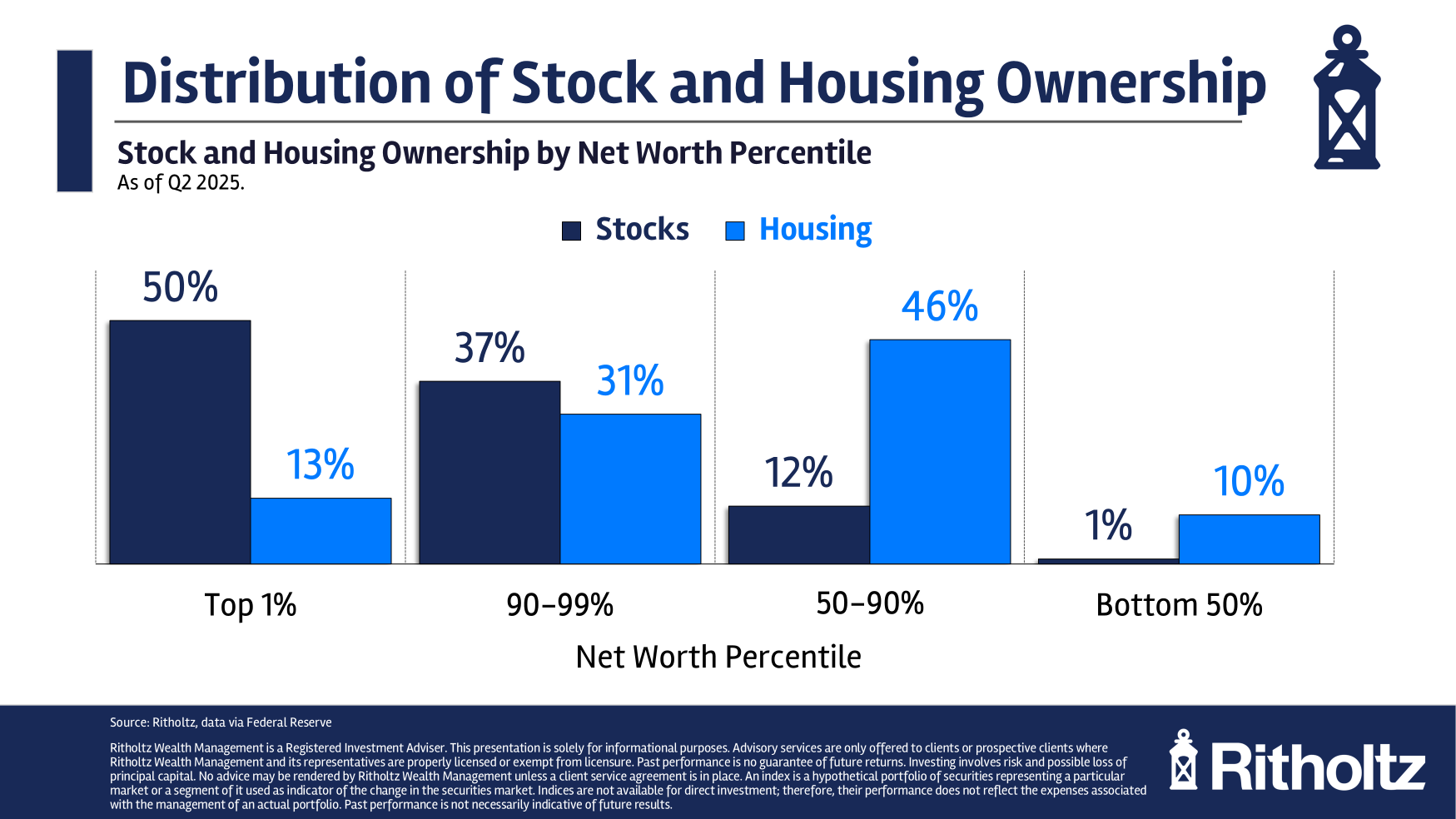

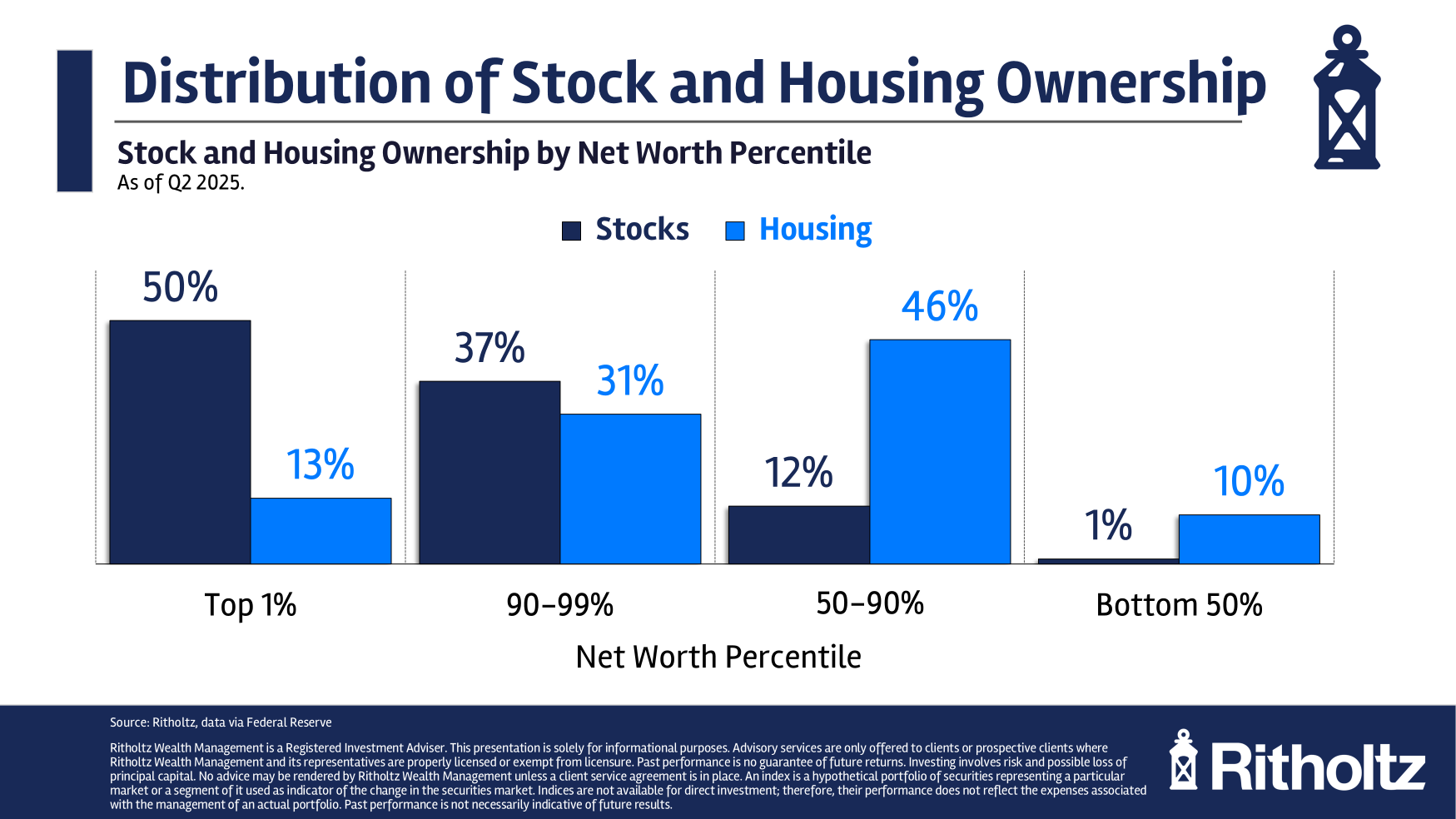

However that’s solely the primary half of the Wealth Impact conundrum; the opposite half is that most individuals within the nation personal little or no in equities. You’ve gotten seen the info earlier than: The highest 10% personal 87% of the inventory market whereas the underside 90% personal simply 13%.

Does anybody actually imagine the inventory market is what drives spending for the 90% who solely personal 13% of equities?

There IS an actual wealth impact with housing – the underside 90% personal 87% of the homes – fairly near what you count on. However even these numbers are skewed; the decrease half of households – AKA renters – solely personal 10% of the housing inventory. So even the wealth impact of housing is considerably muted.

What actually drives shopper spending increased?

Plentiful jobs, wage will increase, financial enlargement, labor mobility, and bountiful credit score availability have defined the previous conduct of shoppers. It isn’t a secular bull market in shares that causes shopper spending to extend; it’s the identical contemporaneous parts that energy a bull market that additionally drive spending.

If anybody has persuasive information displaying that fairness bull markets create an actual wealth impact that’s greater than a correlation, and is genuinely causative, I might like to see it…

Beforehand:

Wealth Impact is a Dangerous Correlation Fantasy (April 25, 2016)

Fed is Too Centered on Wealth Impact, Fairness Markets (February 6, 2014)

Wealth Impact Rumors Have Been Tremendously Exaggerated (November 16, 2010)

See additionally:

Financial system Wall Avenue has a shopper spending downside (Axios, September 9, 2025)

Rich People Are Spending. Folks With Much less Are Struggling. (New York Instances, October, 19, 2025)

Updates weekly U.S. Shopper Confidence Tracker (Morning Seek the advice of, October, 20, 2025)

Washington Might Be Lacking Indicators of Financial Hassle: Why Republicans and Democrats alike get fooled by the inventory market. (Politico, October 21, 2025)

__________

1. You’ll be able to add one other wrinkle to the causation correlation concern: The reversal of unusual spending patterns in items versus providers through the pandemic, adopted by the eventual return to close regular previously few years…

2. I’ve mentioned beforehand that the majority sentiment measures are damaged; regardless, sentiment is helpful primarily at extremes.