.bh__table_cell { padding: 5px; background-color: #dddddd; }

.bh__table_cell p { coloration: #222222; font-family: ‘Helvetica’,Arial,sans-serif !necessary; overflow-wrap: break-word; }

.bh__table_header { padding: 5px; background-color:#dddddd; }

.bh__table_header p { coloration: #222222; font-family:’Trebuchet MS’,’Lucida Grande’,Tahoma,sans-serif !necessary; overflow-wrap: break-word; }

Commercial

A double benefit in fastened revenue

Vanguard institutional high quality bond funds supply a observe report of long-term outperformance at industry-low prices.See the proof |

In the present day's Speak Your Ebook is sponsored by JP Morgan:

-

See right here for extra data on JP Morgan and its 2026 Lengthy-Time period Capital Market Assumptions

On as we speak’s present, we focus on:

-

Shifting Landscapes and Silver Linings

-

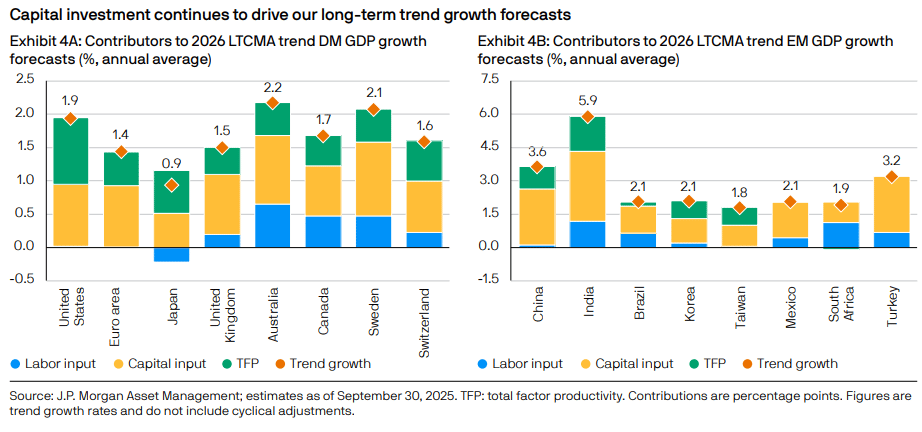

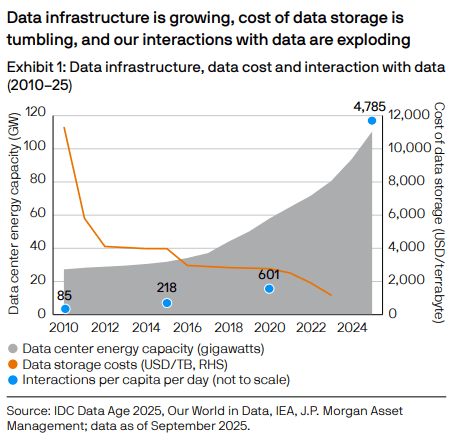

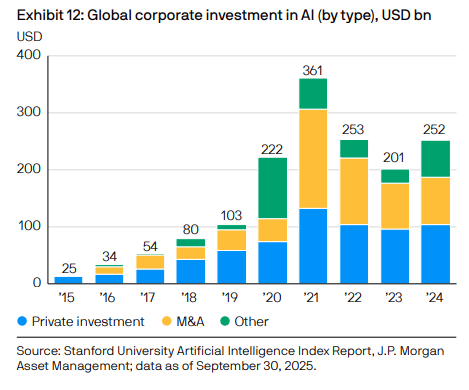

Three interconnected themes: financial nationalism, fiscal activism and company funding; AI innovation and adoption

-

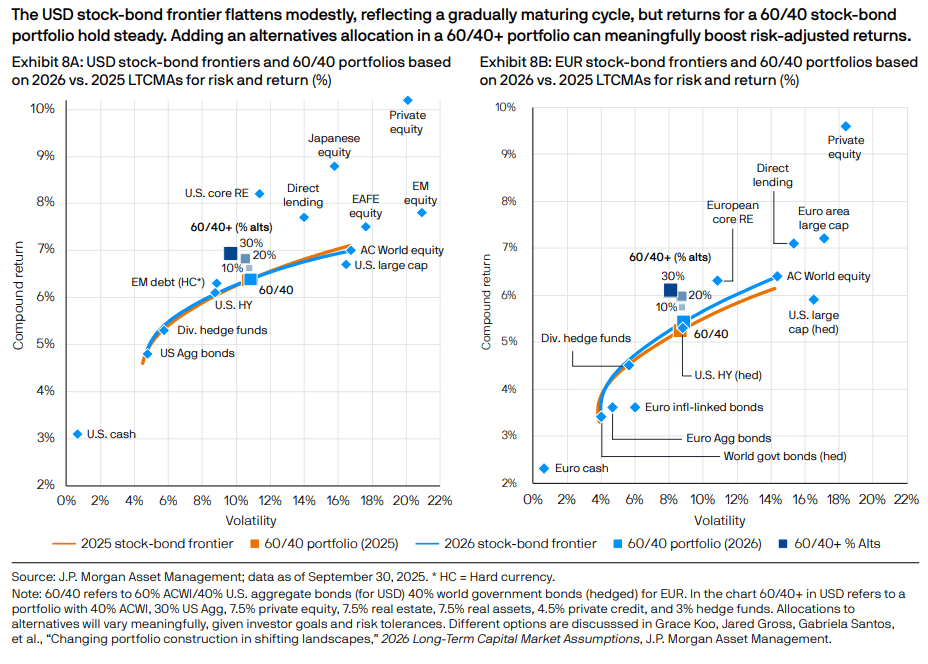

Diversifying the diversifiers with options, the 60/40 Plus portfolio

-

The place are we within the evolution of personal markets and anticipated returns

-

Addressing the challenges of forecasting non-public markets

-

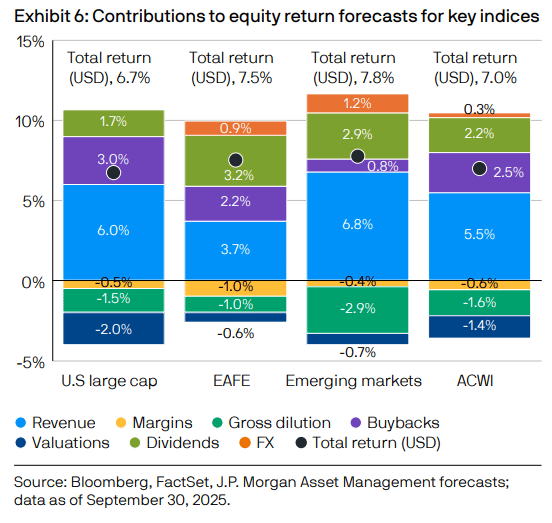

Is worldwide fairness outperformance in 2025 right here to remain?

-

Competing forces within the economic system, and why there's cause to be optimistic

-

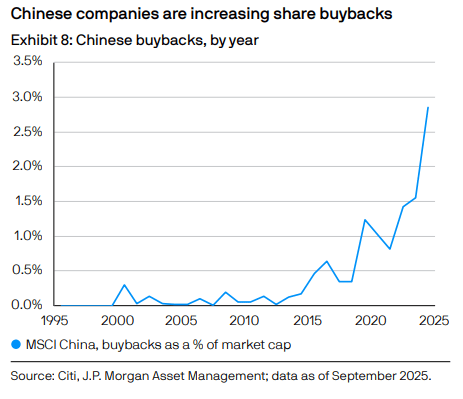

A rising concentrate on shareholders in worldwide markets and the rise of buybacks overseas

Animal Spirits:

Charts:

Contact us at animalspirits@thecompoundnews.com with any suggestions, suggestions, or questions.

Observe us on Fb, Instagram, and YouTube.

Take a look at our t-shirts, espresso mugs, and different swag right here.

Subscribe right here: