In my commissioned analysis actions, that are separate from the essential tutorial analysis that occupies most of my time, I come throughout attention-grabbing conditions which bear on the way in which financial programs function and the kind of constraints confronted by completely different ranges of presidency. In Australia, we’ve got three ranges of presidency: Federal (forex issuer), State and Territories (forex customers), and Native authorities (forex customers). Our structure additionally confers the foremost spending obligations – schooling, well being, transport, and many others on the states and territories regardless of them having few authorized means to lift income, which has been a serious drawback since Federation. If one then embeds that constitutional reality into the fictional mainstream economics narrative that claims the currency-issuing federal authorities is financially constrained in its spending like a family, public debt turns into a media difficulty. After the pandemic, the federal and state governments have been left with vital will increase in debt liabilities that has led the state governments to impose austerity cuts and hike taxes. The Victorian state authorities has not too long ago hiked a levy on land ostensibly to offer additional funding for emergency companies. The issue is that the marketing campaign towards this tax hike is bringing collectively an array of anti-progressive parts who simply desire a change of presidency. Their marketing campaign, which is roping in progressives who don’t appear to grasp the problems, can’t reply how the hearth companies, which have been underfunded for years on account of an austerity mindset and going through main gear deficits and wage calls for, will be capable to present enough companies with such a tax hike. The land tax is a progressive tax and the very best income to enhance the hearth companies that are important to the neighborhood. As soon as once more the buy-in to the anti-tax marketing campaign is a case of progressives capturing themselves within the foot.

Background

When the Pandemic hit Australia in March 2020, the Federal and State (I’ll simply use State for State and Territories) governments launched relatively wide-ranging restrictions of exercise and motion whereas well being authorities labored out what was occurring and whereas they waited for a viable vaccine to be made out there.

Accompanying these restrictions, have been vital fiscal interventions – earnings assist and different measures – which noticed the fiscal balances of the varied ranges of presidency transfer into bigger deficits.

Between 2018-19 and 2020-21, the federal fiscal stability went from zero per cent of GDP to 4.3 per cent in 2019-20, then 6.4 per cent in 2020-21.

Between 2018-19 and 2019-20, the entire All states working stability went from a surplus of $A5,219 million to a deficit of $A26,337 million.

These have been fairly beautiful fiscal shifts at each federal and state ranges of presidency.

The federal authorities and the governments of the three largest states recorded the next fiscal stability shifts between 2018-19 and 2019-20:

| Authorities | 2018-19 $m |

2019-20 $m |

| Australia | +4,252 | -89,116 |

| NSW | +1,459 | -8,111 |

| Victoria | 1,488 | 8,701 |

| Queensland | 734 | 6,235 |

Once more, I emphasise the big scale of those shifts.

The residual state debt balances are being attacked by conservatives as being proof of fiscal profligacy, however the actuality is that they mirrored sound well being and labour market coverage choices taken at a time when uncertainty was excessive and no-one knew the place the pandemic was going to take us.

Had the governments did not intervene on this scale, the earnings losses for residents and the adverse well being penalties would have been a lot larger than they have been.

In 2018-19, web debt as a share of GDP for all Australian governments was 24.5 per cent.

By 2020-21, it had risen to 37.8 per cent.

By June 2024, Federal debt as a per cent of GDP was 25.7 per cent and complete state debt was 11.2 per cent.

Now I don’t use that knowledge to counsel an issue – relatively for instance the size of the emergency fiscal response to the well being disaster.

As a part of this response, the Reserve Financial institution of Australia (successfully a part of the federal governmental equipment, even when most individuals mistakenly suppose in any other case) launched a really giant bond-buying program.

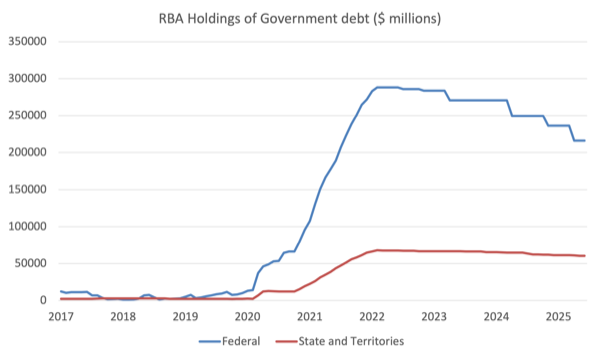

The next graph reveals the shift in RBA debt holdings of federal and state debt between January 2017 and June 2025.

After February 2022, this system was tapered and the RBA has been reversing its purchases in phases.

On September 14, 2021, within the midst of the disaster, the RBA governor gave a speech – Delta, the Financial system and Financial Coverage – the place he stated:

… protecting funding prices and lending charges low throughout the economic system; guaranteeing that the monetary system could be very liquid; supporting family and enterprise stability sheets; and contributing to an trade charge that’s decrease than it will be in any other case. It’s by these transmission mechanisms that our insurance policies are supporting, and can proceed to assist, the restoration of the Australian economic system over the months forward.

The states had no choice however to difficulty debt to fund the will increase in web spending as a result of they’re forex customers.

The federal authorities, because the currency-issuer, faces no such monetary constraint and so its voluntary follow of issuing debt to match its web fiscal spending in every interval is absolutely pointless.

However it’s the actuality, given the dominance of the fiscal fictions that fake the federal authorities is sort of a massive family and financially constrained.

Difficult that fiction shouldn’t be the subject of immediately although.

Provided that actuality, the RBA knew that if it entered the secondary bond market and bought a dominant share of the brand new debt coming into that market then it will drive yields down and insulate the economic system from harmful (and grasping) speculative behaviour from the monetary markets.

The explanation the yields fell to very low ranges is as a result of the yield is inversely associated to cost (in a set earnings asset market) and the RBA pushed the demand for the bonds up, which pushed the costs up and the yields down.

The truth was that between January 2020 and February 2022, the RBA bought the round 97 per cent of all of the treasury bonds issued by the Federal authorities over that interval.

There was the same share for the shift in state-level debt bought by the RBA, which meant that the RBA was successfully funding the shift in fiscal deficits of the currency-using state and territory governments.

Some extra salient particulars.

The RBA earns curiosity on the federal government debt it holds.

After which transfers web income within the type of dividends to the federal treasury division.

I name this the best pocket of presidency (Treasury) shifting $s into the left pocket of presidency (RBA) by way of the curiosity funds on the debt the RBA holds, after which the left pocket giving it again once more by way of the dividends.

Completely ridiculous.

However for the state and territory debt there may be one other dimension.

The yield (curiosity funds) from the states to the RBA which finally find yourself within the Treasury division signify a large fiscal (earnings) switch from the state degree to the federal degree.

Not many individuals perceive that and the media is completely silent about it.

Why this has change into very vital is that the states at the moment are implementing very damaging austerity as a result of they’ve, as a consequence of the pandemic, what they body as a ‘debt drawback’.

And it’s true that the states, as currency-issuers, have to search out the income to service that debt.

And with the RBA mountaineering rates of interest 11 occasions between Could 2022 and November 2023, bond yields have risen in tandem, rising the proportion of outlays that must be devoted to servicing the debt.

Nonetheless, if you concentrate on it for a second, you’ll realise that the ‘drawback’ emerged as a consequence of the pandemic.

However suppose a bit extra – the RBA holds many of the debt related to that so-called debt drawback.

And it might simply simply kind zero towards that state/territory debt – that’s, write it off – and no-one would blink an eyelid.

Besides the ‘debt drawback’ would disappear like that – a click on of the keyboard and it will be gone.

I’ve been recurrently calling for that to occur – in public displays, in radio interviews, and many others.

There was no proof earlier than the pandemic that the web spending of the states was uncontrolled.

However now, the states are inflicting damaging austerity – scrapping essential labour market applications, delaying important infrastructure enhancements, cancelling essential tasks and many others – due to this ‘drawback’.

So there could be a nationwide achieve if the RBA took that call.

At a time when the federal authorities is taking a look at methods to extend productiveness within the face of rising dependency ratios, having the states reducing spending in schooling, well being, infrastructure, transport and many others shouldn’t be the way in which to go.

Victorian tax difficulty and the emergency companies

Let’s give attention to the State of Victoria for it was the worst hit in fiscal phrases by the Pandemic, given its lengthy lockdown and in depth fiscal assist it offered residents to guard their incomes, well being and property throughout the early years of the Covid catastrophe.

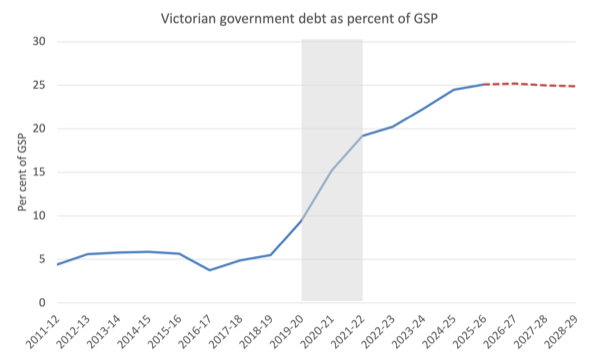

The following graph reveals the Victorian state authorities’s excellent debt as a per cent of Gross State Product (the state degree measure of GDP).

The shaded space is the pandemic response and as famous above the RBA holds a big proportion of the debt that was issued in that interval by the Victorian authorities.

There may be now a way of disaster in Victoria and the federal government is taking a look at varied methods of accelerating income to scale back the excellent public debt.

Observe earlier than the pandemic, the debt ranges have been low and through this era the Authorities was engaged in some giant infrastructure tasks which were of nice profit to the residents of that state (for instance, the elimination of the harmful railway crossings).

Nonetheless, the Victorian authorities has additionally been infested for a few years with the neoliberal austerity mindset – therefore its fiscal surplus pre-pandemic.

One of many casualties of that mindset have been the hearth and rescue companies that are offered by Hearth Rescue Victoria (FRV) and reflecting the excessive urbanisation of the state, FRV offers safety for 65.3 per cent of the Victorian inhabitants, 65 per cent of the dwellings however covers only one.5 per cent of the geographic space of the state).

The rest is offered by the Nation Hearth Authority (CFA), which is essentially a volunteer service in rural areas.

Importantly, FRV offers safety for 92 per cent of the Capital Improved Worth of buildings all through the state of Victoria.

On account of a – Black Saturday bushfires – in Victoria in early 2009, a – 2009 Victorian Bushfires Royal Fee – was established to look at how such a catastrophic occasion might happen (173 individuals died within the fires and a whole lot of property was misplaced).

One of many adjustments launched after that Fee was the creation of a hypothecated income supply for the hearth companies, the so-called – Hearth companies property levy – which was meant to offer higher surety for the companies and permit them to increase infrastructure and personnel.

The Victorian authorities famous in its most up-to-date fiscal papers that:

Levy charges are set annually to focus on an quantity of income to lift … 100 per cent of income from the levy goes to supporting the State’s fireplace companies, together with funding very important life-saving gear, autos, firefighters, employees and volunteers, coaching, infrastructure, and neighborhood schooling.

The Victorian State Income Workplace tells us the levy has been charged yearly and has two parts: (a) a set cost that’s listed to the Client Worth Index, that means it’s largely preserved in actual phrases on an annual foundation; and (b) a variable cost levied on the ‘on the property’s classification and capital improved worth’.

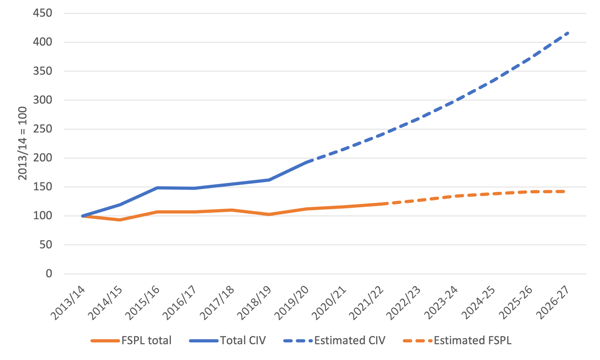

On common, the FSPL income grew by 3.18 per cent each year between the years 2013-14 and 2023-24. The projected annual development for the interval 2024-25 to 2027-28 is 5.82 per cent.

The Victorian authorities units the charges for the levy “to focus on an quantity of income to lift” – that’s, to make sure the funds required by the FRV (and CFA) are enough.

87.5 per cent of FRV’s income necessities are funded by the levy up to now.

The issue is that FRV nonetheless runs at a loss and is below fixed stress to funds its operations and adequately pay its employees.

For instance, a professional firefighter in Victoria has not obtained a pay rise since March 2021.

Over the time that has elapsed, the buying energy of that wage has fallen by 21.4 per cent.

Relative to previous development actual wage development, the firefighter is now 27.2 per cent worse off in actual phrases on account of the wage freeze and the guaranteeing inflation since March 2021.

FRV additionally has main infrastructure deficits (vans, equipment, and many others) on account of failure to adequately fund it previously.

So whereas the FSP levy is perhaps set to generate a sure income, the truth is that it has been levied at charges which are too low – if the aim is to adequately fund the emergency companies.

Furthermore, the funding base – Capital Improved Worth of Victorian properties – has grown in worth.

Residential worth dominates the entire and between 2014 and 2024 elevated by 110.2 per cent at an annual common charge of development of 11.02 per cent.

Complete CIV rose by 110.4 per cent over the interval 2014 to 2024 – an annual common charge of development of 11 per cent.

The next graph reveals the rising discrepancy between FSPL income (precise and projected) and CIV (precise and projected).

FSPL income, precise and estimated and CIV precise and estimated, 2013-14 = 100

Given the numerous development in property wealth – the leviable tax base – there may be enormous scope for the Victorian authorities to make sure the hearth companies have enough monetary sources with out compromising different spending plans or requiring tax will increase on different sources of income.

I say that as a result of the Victorian authorities has been attempting to limit wages development for firefighters (presently zero development since March 2021) by interesting to is alleged ‘debt drawback’.

However the fireplace companies are funded from the hypothecated levy which is separate from consolidated income.

The purpose is that there’s appreciable additional capability to lift income by way of a levy to appropriately scale the extent of presidency assist for FRV to the worth of safety it offers Victorian

The opposite level is that the levy itself is a extremely progressive income for the state authorities.

A – Land worth tax:

… is a progressive tax, in that the tax burden falls on land house owners, as a result of land possession is correlated with wealth and earnings.

It is usually an ‘environment friendly’ tax as a result of land is fastened and the house owners take pleasure in elevated web value as a consequence of doing nothing.

The Victorian authorities additionally raises income from an assortment of taxes – equivalent to payroll taxes, short-stay levies, and many others which aren’t progressive in incidence.

So on condition that the state is a currency-user and the hearth companies must be funded with income gained from taxation, the hypothecated fireplace companies levy was a superb choice.

For progressive-minded individuals, such a tax can be good for fairness (the wealthy pay extra!).

Now why is that this an issue now?

The State authorities is obsessive about austerity and has determined to lump an entire lot of extra elements of presidency emergency companies into the levy, rename it the – Emergency Companies and Volunteers Fund (ESVF) – and considerably improve the tax charges on property.

I received’t go into all the main points – of which our bodies have change into recipients and many others right here.

The issue is that there’s now appreciable doubt that the additional capability to lift income from the property levy is enough to fulfill the wants of the expanded checklist of recipients within the proposed Modification with out impinging on the funding capability of the FRV and the CFA

My concern is that there won’t be enough funds generated from the levy.

I’ve finished a whole lot of detailed modelling not too long ago on this query and I’ve concluded that the estimated improve within the levy income won’t cowl the estimated income necessities of the recipients checklist, which incorporates FRV, the foremost fireplace and rescue physique in Victoria.

The main points aren’t the problem right here.

A few of the issues I see embrace:

- The Victorian authorities estimates of the required revenues of the completely different emergency our bodies are flaky and fail to incorporate some costly administrative areas throughout the State Management Centre which will likely be funded by the ESVF.

- FRV has been working at a loss. In 2024, its complete income and earnings from transactions was $1.122 million and its complete bills have been $1.223 million. As soon as ‘different financial flows’ have been included within the web end result, the general web loss was $104.2 million. Its collected deficit by 2024 was $247 million. There are excellent funding shortfalls in capital gear and FRV has not elevated wages since March 2021.

- There may be prone to be elevated demand on the emergency companies within the years forward on account of elevated inhabitants, elevated city density, and local weather change.

The issue now although is that a big coalition of unlikely collaborators together with unions have united to oppose the change within the tax charges underpinning the levy.

They’re framing the problem as a giant tax hike by a wasteful authorities.

Even progressive-minded persons are shopping for into the marketing campaign that has simply been launched largely by native governments to power the State authorities to scrap the tax hikes.

The native governments are rallying individuals claiming the State authorities is coercing native governments to change into their ‘debt collectors’.

The issue is that the marketing campaign is convey collectively an array of characters and teams that embrace those that are hostile to commerce unions, those that are anti-government, the Proper-wing parts in our society – together with the extra excessive finish of the Nationwide Celebration and Liberal Celebration, the so-called sovereign citizen sorts, and extra that aren’t the slightest bit involved concerning the funding necessities of FRV and the lack of buying energy by the firefighters.

Their motivation is to eliminate the State Labor authorities at his yr’s election and set up the deplorable Liberal/Nationwide Celebration as authorities.

Progressives are being duped into supporting this marketing campaign and may get up to themselves.

Conclusion

The truth is that the State authorities’s determination in regards to the ESVF is flawed however not for the explanations this marketing campaign is selling.

The Authorities ought to proceed to fund the extra organisations it wishes to be funded from the FSPL (renamed because the ESVF) from consolidated income and make sure the income from the FSPL is enough in order that FRV can proceed to offer the required danger safety to Victorians.

There may be scope (as above) throughout the property tax to generate additional capability which can be utilized to enhance funding for gear and personnel for FRV and the CFA.

It’s the safer choice for presidency and the communities that depend upon the hearth companies for defense and danger abatement.

It can require a tax improve.

There’s a large shortfall of income out there for FRV and the years of austerity have left it with a big infrastructure deficit.

And the firefighters haven’t had a pay rise since March 2021.

So FRV wants income and the property levy is a progressive tax the place these with extra means pay extra.

If this marketing campaign opposing the tax improve is profitable then the funding disaster inside FRV will deepen.

And other people will die and extra homes and buildings will likely be misplaced when the following fireplace comes by.

That’s sufficient for immediately!

(c) Copyright 2025 William Mitchell. All Rights Reserved.