I don’t have a lot time at the moment for writing as I’m travelling loads on my method again from my quick working journey to Europe. Whereas I used to be away I had some glorious conversations with some senior European Fee economists who offered me with the newest Fee considering on fiscal coverage inside the Eurozone and the perspective the Fee is taking to the macroeconomic surveillance and enforcement measures. It’s a pity that some Trendy Financial Principle (MMT) colleagues didn’t have the identical entry. If they’d they might not preserve repeating the parable that for all intents and functions the 20 Member States aren’t any totally different to a foreign money issuing nation. Such a declare lacks an understanding of the institutional realities in Europe and sadly serves to present false hope to progressive forces who assume that they’ll reform the dysfunctional structure and the inbuilt neoliberalism to advance progressive ends. There may be practically zero chance that such reform might be forthcoming and I despair that a lot progressive power is expended on such a misplaced trigger.

The next declare was rehearsed by two MMT economists in an article they’d printed within the Evaluation of Political Economic system (printed February 2024):

… whereas there was an issue with the unique set-up of the Euro system, this has been resolved within the aftermath of the worldwide monetary disaster and the newer COVID pandemic. The Euro space’s establishments enable some flexibility, permitting nationwide governments to behave as unconstrained foreign money issuers in occasions of disaster.

In conversations final week with some progressive non EC researchers and lecturers, I stored listening to the identical narrative – ‘the European establishments work’, ‘the fiscal guidelines are versatile’, and so on.

And that got here from progressives voices quite than the technocrats within the European Fee, who reliably knowledgeable me that they had been closing down the flexibleness and reinforcing the self-discipline.

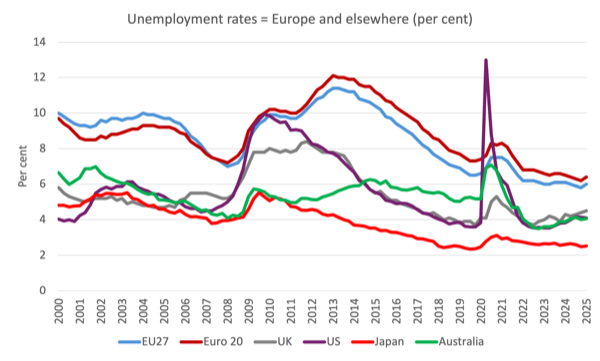

Simply to set the scene here’s a graph exhibiting the relative unemployment charges for the EU27 international locations, Euro20 international locations, the UK, US, Japan, and Australia from the first-quarter 2000 to the first-quarter 2025.

The relative efficiency of the European labour markets is clearly inferior – and there’s a motive for that.

The Eurozone Member States, after all, dominate the general EU27 consequence.

The efficiency of the person Member States can be typically poor.

In Could 2025 the unemployment charges for 20 Member States of the Eurozone had been:

Euro space 6.3 per cent

EU 5.9 per cent

Belgium 6.5 per cent

Czechia 2.8 per cent

Germany 3.7 per cent

Estonia 7.8 per cent

Eire 4.0 per cent

Greece 7.9 per cent

Spain 10.8 per cent

France 7.1 per cent

Italy 6.5 per cent

Cyprus 3.6 per cent

Latvia 6.9 per cent

Lithuania 6.5 per cent

Luxembourg 6.7 per cent

Malta 2.7 per cent

Netherlands 3.8 per cent

Austria 5.3 per cent

Portugal 6.3 per cent

Slovenia 3.9 per cent

Slovakia 5.3 per cent

Finland 9.0 per cent

These unemployment charges are principally elevated (by some margin) in comparison with most currency-issuing international locations.

There’s a motive for that.

Given time is brief at the moment, here’s a transient abstract of why the claims that the Eurozone Member States now get pleasure from fiscal flexibility such that they’re indistinguishable from currency-issuing international locations are unfounded.

First, the 20 Eurozone Member States use a international foreign money – the euro – on account of surrendering their very own capability after they joined the Financial and Financial Union.

The foreign money is issued by the European Central Financial institution, which is separate from anyone Member State (see under).

That implies that as a way to spend the euro, a Member State authorities has to first elevate taxes.

It additionally means, extra considerably, that if a Member State desires to run a fiscal deficit, then they must difficulty debt and depend on the bond traders offering the specified euros at yields which can be set by the pursuits of the traders quite than any notion of inhabitants well-being.

Crucially, that debt comes with credit score threat and the bond traders know that.

The danger is that the Member State might not be capable of generate sufficient tax income to repay the excellent debt when it matures.

There isn’t any credit score threat hooked up to the debt of Australia, Japan, the US, the UK and so on as a result of these governments can at all times by the financial equipment of presidency meet any liabilities which can be denominated in their very own foreign money.

Spain, Italy and the remainder of the 20 Member States don’t get pleasure from that standing.

Which implies that the bond markets can finally make issues troublesome for a Eurozone state as we noticed through the GFC.

Those that make the claims outlined within the Introduction declare that the ECB has proven its willingness to offer the foreign money mandatory and management bond yields to preclude any insolvency arising.

It’s apparent that through the pandemic the fiscal guidelines outlined within the – Stability and Development Pact (SGP) – had been put aside in March 2020 by the activation of the so-called ‘basic escape clause’.

There are in actual fact two clauses:

1. The weird occasions clause,

2. The final escape clause.

The European Parliament briefing (March 27, 2020) that was issued when the Fee invoked the escape clause notes that:

In essence, the clauses enable deviation from components of the Stability and Development Pact’s preventive or corrective arms, both as a result of an uncommon occasion exterior the management of a number of Member States has a significant affect on the monetary place of the overall authorities, or as a result of the euro space or the Union as an entire faces a extreme financial downturn. As the present disaster is exterior governments’ management, with a significant affect on public funds, the European Fee famous that it might apply the bizarre occasions clause. Nevertheless, it additionally famous that the magnitude of the fiscal effort mandatory to guard European residents and companies from the consequences of the pandemic, and to help the economic system within the aftermath, requires the usage of extra far-reaching flexibility below the Pact. Because of this, the Fee has proposed to activate the overall escape clause.

Leisure of the fiscal guidelines allowed EU member states to extend spending and incur bigger deficits to mitigate the financial affect of the pandemic, with out instantly going through penalties below the SGP.

Accordingly, for a brief interval the Member States might run larger fiscal deficits with the data that the bond markets wouldn’t drive yields by roof.

Bond traders knew that the ECB can be shopping for just about all of the debt that was being issued by the person Member States as soon as it hit the secondary bond market which took all threat of the first difficulty away and returned the market makers a tidy little, nearly instantaneous capital acquire.

Apparently, in my converations final week, Fee economists instructed me they had been stunned at how tentative the governments had been in benefiting from this short-term freedom.

Their scrutiny revealed that the coverage makers within the Member States understood full nicely that the particular SGP rest was short-term and that they anticipated that in the event that they ran their deficits too far past the three per cent SGP threshold that the next ache that might comply with as soon as the Fee resumed the enforcement of the – Extreme Deficit Process (EDP) – can be troublesome to cope with.

Has this ‘freedom’ endured?

Clearly not.

On March 8, 2023, the Fee launched a memo – Fiscal coverage steering for 2024: Selling debt sustainability and sustainable and inclusive progress – which famous that:

… fiscal insurance policies in 2024 ought to guarantee medium-term debt sustainability and promote sustainable and inclusive progress in all Member States …

The final escape clause of the Stability and Development Pact, which gives for a short lived deviation from the budgetary necessities that usually apply within the occasion of a extreme financial downturn, might be deactivated on the finish of 2023. Transferring out of the interval throughout which the overall escape clause was in pressure will see a resumption of quantified and differentiated country-specific suggestions on fiscal coverage.

So – Protocol (No 12) – of the Treaty on European Union was again.

The operation of the EDP below – Article 126 – of the Treaty on the Functioning of the European Union is obvious sufficient.

On July 26, 2024, the European Council, following the EDP guidelines launched the deficit-based EDP process in opposition to seven nations (deficits then in brackets):

Italy (-7.4%)

Hungary (-6.7%)

Romania (-6.6%)

France (-5.5%)

Poland (-5.1%)

Malta (-4.9%)

Slovakia (-4.9%)

Belgium (-4.4%)

See Council Press Launch for extra particulars – Stability and progress pact: Council launches extreme deficit procedures in opposition to seven member states (press launch, 26 July 2024)Provision of deficit and debt information for 2024 – first notification – that informs the EDP.

We realized that:

Twelve Member States had deficits equal to or larger than 3% of GDP … Twelve Member States had authorities debt ratios larger than 60% of GDP …

So there might be extra Member States added to these lready tied up by the Fee within the EDP and ranging austerity timelines might be imposed on them, which can delay the elevated unemployment ranges but additionally preclude wise local weather coverage pursuits.

Additional, there’s a large infrastructure deficit (disaster) in Europe on account of years of austerity which the person Member States haven’t a hope of addressing given the fiscal straitjacket they function inside that makes them weak to domination by bond markets is as soon as once more being enforced.

Furthermore, the Member States are actually being bullied by the European Fee (and Donald Trump not directly) to ramp up army spending and the proposed – Safety Motion For Europe (SAFE) – below the RaArm Europe Plan will lumber them with extra debt and even much less fiscal latitude.

Second, no particular person Member State within the Eurozone has legislative energy to regulate the central financial institution – the ECB.

It is a very vital deficiency and we noticed simply how vital it was when in return for successfully funding the fiscal deficits of the Member States through the successive crises the ECB imposed crippling austerity situations on the Member States.

The choice would have been chapter with no legislative recourse apart from exit.

After all, through the GFC, the European Fee feared that if one of many Member States was pressured into insolvency as a result of it couldn’t repay excellent debt upon maturity and/or couldn’t afford the yields demanded by the bond markets for ongoing help because the fiscal deficits began growing, the entire rotten system would collapse.

That’s the reason they launched the bond-buying packages.

However it was a political act quite than a progressive present of flexibility.

And we noticed precisely what the ECB’s mentality was when the democratic pattern in Greece in 2015 was indicating defiance of EC austerity stipulates.

The ECB used the specter of pushing the Greek banking system into insolvency, which led to the democratic will of the folks being put aside and the so-called Socialist authorities turning neoliberal lackey and buckling to the oppression.

No such bullying happens in nations which have legislative management of their central banks.

Additional, the ‘once-size-fits-all’ rates of interest spanning 27 economies which can be vastly totally different within the timing and magnitude of their financial cycles implies that financial coverage readily provokes financial stability.

We noticed that clearly within the interval earlier than the GFC, when the ECB lowered charges as a result of Germany and France had been in recession (2004).

The decrease charges, below different coverage settings had been inappropriate for the Southern states which weren’t in recession.

And the deliberate throttling of home demand in Germany meant that the rising commerce surpluses had been invested in property speculations in a few of these Southern states, which got here unstuck within the GFC.

Third, no particular person Member State is ready to management the euro alternate fee.

Nevertheless, the nations with stronger commerce fundamentals – that means with surplus commerce accounts – are inclined to dominate the dynamics of the euro international alternate fee and the weaker buying and selling nations then have to simply accept that parity even when it will be completely at odds with the speed that might prevail if they’d their very own currencies and particular person alternate charges.

This has been a longstanding downside in Europe because the starting of makes an attempt to combine considerably totally different financial constructions and cultures, first by way of the assorted failed makes an attempt to repair alternate charges inside the European group after which, extra lately with the frequent foreign money experiment.

There isn’t any appropriate frequent alternate fee for the 20 Member States within the Eurozone and people with weaker commerce fundamentals regularly undergo competitiveness disadvantages that currency-issuing nations with their very own versatile alternate fee keep away from.

Fourth, those that make the claims within the Introduction then introduce one other non sequitur to justify their unjustifiable assertions.

They are saying, for instance, ‘have a look at the UK, they’ve crippling fiscal guidelines too’.

Or, ‘neoliberalism is in every single place’.

It’s true that many countries exterior Europe have succumbed to the neoliberal ideology and introduce voluntary fiscal guidelines as a political instrument to persuade voters that austerity is of their long-term finest pursuits.

However in contrast to the European scenario, these developments mirror the political vogue and may be various if the style adjustments by a change of presidency.

Within the case of Europe, the Treaties that outline the authorized framework that the EU operates inside have embedded the neoliberalism.

That’s, the ideology is embedded with the authorized construction of the group that every Member State is beholden too.

That’s a wholly totally different scenario.

Article 48 of the Treaty on European Union (TEU) defines the method of treaty change.

The method is excessively inflexible and no Member State can act alone to change the foundations.

And on issues of substance (which the financial guidelines absolutely are) there needs to be a consensus of 27 Member States for any a part of the Treaty pertaining to these issues to be modified.

The problems the place the so-called ‘unanimity rule’ applies and the place any Member State has a ‘proper of veto’ embody fiscal coverage, international coverage, and admitting new international locations to the EU.

The quick reply is that it will be nigh on unattainable to reform the neoliberal financial ideology that’s embedded within the authorized framework of the EU and which governs the conduct of financial coverage.

Forex-issuing international locations like Australia would possibly undertake neoliberalism but when it goes too far the federal government is dumped as we noticed in Could 2022.

Voters can dump their governments in Europe too however there may be no escape from the neoliberal ideology so long as they continue to be members of the EU.

Conclusion

I might (and have) written extra on this matter.

The issue I see is that actual resistance to the capricious and harmful neoliberalism of the EU is compromised by progressives who oppose that destruction however assume that higher days may be had by Treaty reform.

Even worse are those that mislead by claiming that the Treaties themselves are ‘versatile’ sufficient to render the neoliberalism optionally available, which, if true, would see Greece having the identical alternatives as say Australia to enhance the well-being of its residents.

It isn’t true.

Are you able to think about the Socialist Greek authorities holding a referendum because it did in 2015 which overwhelmingly voted in opposition to austerity then telling the Greek folks they had been dumb and that the federal government was going to disregard their needs, if Greece had its personal foreign money and central financial institution and the legislative clout select their very own financial course?

I can’t.

That’s sufficient for at the moment!

(c) Copyright 2025 William Mitchell. All Rights Reserved.