At the moment, I contemplate the Greek scenario, the choice by the UK Chancellor to additional decontrol the monetary companies sector after which to calm everybody down or not, some music. The Monetary Instances printed an article (December 12, 2024) – The astonishing success of Eurozone bailouts – which mainly redefines the which means of English phrases like ‘success’. Apparently, Greece is now a profitable financial system and that success is because of the Troika bailouts in 2015 and the imposition of harsh austerity. The info, sadly, doesn’t help that evaluation. Sure, there may be financial development, albeit from a really low base. However different indicators reveal a parlous state of affairs. Not less than, this weblog put up finishes on a excessive word. Please word there can be no put up tomorrow (Wednesday) as I’m travelling all day. I’ll resume on Thursday.

The which means of the phrase success

The FT article tells the reader that:

Slightly than struggling in “debtors’ jail”, condemned to the everlasting austerity and poverty forecast by the 2015 Greek finance minister Yanis Varoufakis, the nation’s financial system has not solely grown a lot quicker than the Eurozone common, it has additionally been in a position to run the first price range surpluses demanded by its collectors beneath its bailout plans. Simply final month, the Greek authorities repaid a part of its money owed beneath an early bailout programme from 2010 as a result of its investment-grade standing allowed it to borrow extra cheaply in monetary markets.

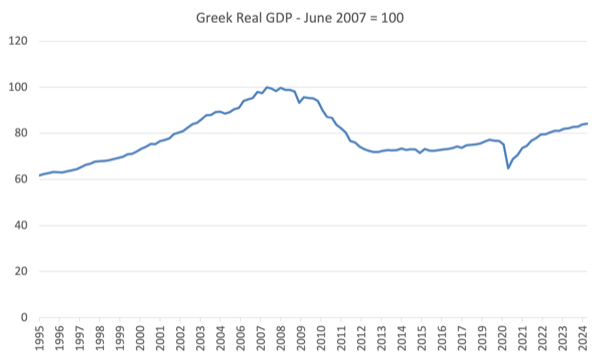

GDP development is definitely occurring from a really low base.

However the financial system stays 15.9 per cent smaller than it was within the June-quarter 2007, earlier than the GFC.

The FT journalist then wrote:

Between the eve of the Covid disaster in 2019 and 2024, IMF information exhibits GDP per head may have grown greater than 11 per cent in Greece …

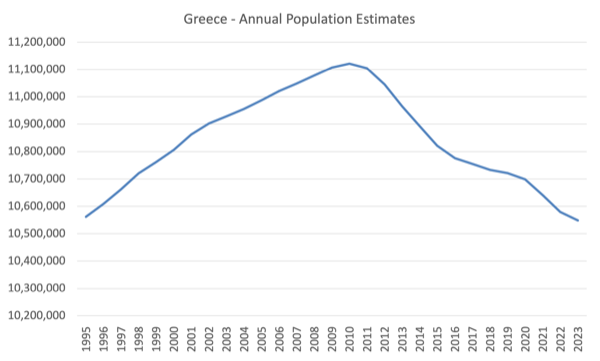

It’s not arduous to extend GDP per capita when the nation’s inhabitants has contracted sharply because the austerity started.

Right here is the evolution of the full inhabitants.

Since 2010, the Greek inhabitants has declined by round 5.2 per cent and a big proportion of that decline has been pushed by youthful, educated Greeks leaving for distant shores.

A expertise loss that can hang-out the nations for many years to return.

Had the Greek inhabitants development pre-GFC continued, the present inhabitants can be nearer to 11.6 million moderately than 10.5 million.

That truth is ignored by the FT article and by all of the Eurozone boosters once they speak concerning the ‘astonishing success’ of the bailouts.

The present GDP figures would look fairly wan if a big proportion of the inhabitants had not been pushed out of the nation by the austerity.

Actually, GDP per capita would stay under the height in 2010 regardless of the latest GDP development.

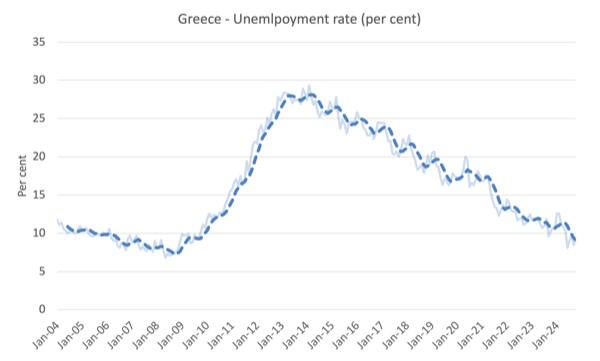

Additional, unemployment stays excessive.

Right here is the most recent unemployment price graph (to October 2024) with the dashed line being the transferring common given the information isn’t seasonally adjusted.

In October 2024, there have been 9.2 per cent of obtainable employees unemployed.

A nation that can’t generate sufficient jobs to satisfy the needs of the workforce can hardly be referred to as a ‘success’.

The final ‘Danger of Poverty’ Report printed by the Hellenic Statistical Authority (September 23, 2021) was for the interval 2010 to 2020, so we’ve no more moderen information.

At the moment, 28.9 per cent of the inhabitants have been ‘prone to poverty or social exclusion’, which summed to three,044 thousand individuals

The Hellenic Anti-Poverty Community (EAPN-Greece) launched a report – Poverty Watch 2022 Greece – which famous that:

It’s well-known that in the course of the decade of the disaster 2010-2020 about 25% of incomes have been misplaced however by the top of the last decade a restoration had begun. At the moment, nevertheless, the reverse development has begun and poverty danger indicators are growing. Certainly, it’s estimated that the lack of actual revenue of Greek households because of the vitality disaster, which has set gasoline and electrical energy payments on hearth, can be greater than 10% extra in 2022 …

… the danger of poverty and exclusion within the nation in 2021 amounted to 29.5% of the inhabitants, a rise of 0.6 factors from 28.9% in 2020 (based mostly on the indications of the Europe 2020 programme). Statistically, there are additionally will increase within the charges of revenue poverty (19.6% of the inhabitants in 2021 in comparison with 17.7% in 2020) and in folks dwelling in low-intensity work households (13.6% of the inhabitants in 2021 in comparison with 11.8% in 2020). The will increase in all three poverty indicators, the rise in baby poverty and the present financial and vitality disaster are of specific concern.

Even with the present GDP development part, it’s estimated that 26 per cent of the inhabitants are across the poverty line with 17.4 per cent of the inhabitants thought-about impoverished with 20 per cent of kids in poverty (as at September 2023) (Supply).

Working major surpluses when 25 per cent of the inhabitants reside in poverty doesn’t seem like an final result one ought to boast about.

Hardly the stuff of an ‘astonishing success’ story.

Extra ‘mild contact’ regulation coming

Keep in mind Gordon Brown’s character-defining – Speech – to the Confederation of British Business (CBI) on November 28, 2005, the place he laid out his strategy to the monetary markets:

The higher, and in my view the right, trendy mannequin of regulation – the danger based mostly strategy – is predicated on belief within the accountable firm, the engaged worker and the educated shopper, main authorities to focus its consideration the place it ought to: no inspection with out justification, no kind filling with out justification, and no info necessities with out justification, not only a mild contact however a restricted contact.

The brand new mannequin of regulation could be utilized not simply to regulation of atmosphere, well being and security and social requirements however is being utilized to different areas very important to the success of British enterprise: to the regulation of economic companies and certainly to the administration of tax. And greater than that, we should always not solely apply the idea of danger to the enforcement of regulation, but additionally to the design and certainly to the choice as as to if to control in any respect.

These phrases – “not only a mild contact however a restricted contact” – ought to be etched on his gravestone.

Historical past exhibits that the risk-based strategy badly failed and it was all the time going to fail.

I wrote extra about Brown’s try and reinvent himself after the catastrophe resulting in the GFC on this weblog put up – A former UK Chancellor makes an attempt to avoid wasting face and simply turns into confused (October 3, 2017).

However the British Labour Occasion has a long-history of being stooges for the ‘Metropolis’.

A succession of Chancellors have come to workplace on a narrative line that until the brand new Labour Authorities seeks methods to appease the monetary speculators it is going to be sport over for the nation.

They by no means actually define how the ‘sport’ may finish.

They only depart that however out and the creativeness of the residents is left to weave some lurid and determined story.

Brown failed badly as a result of he put in place a system of oversight that allowed the monetary markets to raise their pursuit of greed to new ranges unfettered by applicable regulative controls.

Then the Authorities rewarded the failure with bailouts and only a few banksters confronted prosecution, not to mention jail sentences for his or her fraudulent and incompetent behaviour.

All beneath Gordon Brown’s watch.

The brand new Labour Chancellor Rachel Reeves is outwardly planning to additional decontrol the monetary markets within the UK.

In her – Mansion Home 2024 speech ((November 14, 2024) – she informed the viewers:

Earlier than we got here into authorities…

… I used to be clear that monetary companies should play a central half in our financial imaginative and prescient…

… and our plans for financial development.

As a result of I do know that this sector is the crown jewel in our financial system.

It employs 1.2m folks, from London to Edinburgh, and from Manchester to Belfast.

It is likely one of the nation’s largest and best sectors, accounting for 9% of our financial output.

And it’s a world success story, because the Lord Mayor has stated: we’re the second largest exporter of economic companies within the G7.

However we can’t take the UK’s standing as a world monetary centre with no consideration.

There’s one other instance of how the English language has been rendered meaningless.

“Productive” isn’t a phrase I might affiliate with the every day operations of the monetary markets.

Actually, I might describe the monetary companies sector as probably the most unproductive sector within the financial system.

It does little greater than present playing alternatives for speculators who wager towards one another to see who can shuffle wealth probably the most.

It distorts the labour market by attracting very brilliant characters at exorbitant salaries and thus diverting this expertise away from extra socially helpful pursuits.

It encourages wealth holders to shift their funds from probably helpful funding alternatives which might really improve materials advantages to the broader society into wealth shuffling workout routines.

And in doing so it creates asset bubbles, which deprive low revenue earners of the chance to entry, for instance, inexpensive housing.

And because it builds momentum over a cycle, the speculators abandon extra conservative choices and ramp up the danger, to the purpose the place there may be failure.

Then they put their arms out to authorities to bail them out and make sure the top-end-of-town keep their standing.

A progressive authorities can be engaged on insurance policies that shut down a lot of this sector moderately than opening the door for additional greed.

Music – White Room

That is what I’ve been listening to whereas working this morning.

The track – White Room – was launched on the 1968 double album – Wheels of Hearth – by British band – Cream.

I used to be at highschool by then and beginning to play in bands and the band was on my favourites iist.

I solely actually preferred the enjoying of – Jack Bruce – and I most well-liked different British guitar gamers to – Eric Clapton.

However whereas they have been collectively they produced some magnificent music.

This track was written by Jack Bruce and the lyrics have been supplied by English efficiency poet – Pete Brown – who contributed lyrics for most of the Cream’s songs.

The story goes that Jack Bruce wrote the music as his tribute to Jimi Hendrix who was suitably impressed.

No matter, it stays a traditional.

As children we tried to play this and whereas we achieved the depth and enthusiasm the music craft in these days was missing.

That’s sufficient for immediately!

(c) Copyright 2024 William Mitchell. All Rights Reserved.