It’s Wednesday and as normal I cowl just a few subjects briefly fairly than present a deeper evaluation of a single difficulty. Right this moment, I contemplate yesterday’s RBA financial coverage choice which held rates of interest at elevated ranges regardless of the inflation price dropping in the direction of the decrease vary of its targetting band. The RBA has misplaced credibility and the federal authorities ought to sack the RBA Board and Governor. The issue is that the federal authorities is simply too busy leaping at its personal shadow to really take any significant choices about nearly something. I additionally replicate on the latest choice by the Nobel Committee to award the Peace Prize to the – Hibakusha – which reminds us of the devastation that nuclear arms can (and did) trigger. Another issues then precede as we speak’s nice music phase.

RBA continues to defy actuality

As common readers know, I’m a long-term critic of the Reserve Financial institution of Australia’s method to macroeconomic coverage setting.

Yesterday, they didn’t disappoint me.

The Board held rates of interest fixed regardless that inflation has fallen to be properly inside their so-called targetting vary of 2-3 per cent.

The newest month-to-month indicator (launched November 27, 2024) – Month-to-month Client Value Index Indicator – noticed the annual inflation price drop to 2.1 per cent in October 2024.

I analysed that knowledge launch on this weblog submit – Australian inflation episode properly and really over – please inform the RBA to cease attempting to push unemployment up additional (November 27, 2024).

The message was clear – there was no justification for holding the rate of interest at its present elevated stage when unemployment is rising and the non-government economic system is in recession – given the inflation price has declined considerably and the remaining drivers are usually not delicate to rate of interest modifications anyway.

Properly, the RBA disagrees and of their – Assertion by the Reserve Financial institution Board: Financial Coverage Determination – which was launched to accompany yesterday’s choice to carry the money price goal at 4.35 per cent and the assist price on reserves (Change Settlement Balances) at 4.25 per cent, it claims that:

Measures of underlying inflation are round 3½ per cent, which remains to be a way from the two.5 per cent midpoint of the inflation goal.

Their underlying inflation measure is the so-called – trimmed imply – which “excluded the numerous falls in each electrical energy and automotive gasoline, alongside different massive worth rises and falls” within the newest quarterly knowledge launch (Supply).

The exclusion is predicated on the statistician assessing “irregular or short-term worth modifications” and is subjective.

The exclusion, for instance, of the electrical energy reduction assist supplied by the Federal and State governments is just not justifiable.

The excessive electrical energy costs, are largely because of the revenue gouging by the anti-competitive and privatised electrical energy corporations that manipulate prices and provide to maximise their returns.

Why does the ABS not classify that behaviour, which escalates the CPI considerably, as being irregular when it simply concludes that when the federal government counteracts it to drive costs down the modifications within the CPI are thought of short-term or irregular.

The so-called ‘underlying inflation’ measure is thus ideological and political, but is a handy idea for the RBA to cover behind whereas screwing the low revenue households with debt.

Additional, the RBA claimed that there have been nonetheless ‘upside dangers’, though they didn’t justify that evaluation.

Their solely supporting assertion was that:

… the extent of combination demand nonetheless seems to be above the economic system’s provide capability, that hole continues to shut.

That could be a very curious declare when there are over 10 per cent of the accessible labour at present underutilised (both unemployed or underemployed) and GDP development is at its lowest stage for the reason that large 1991 recession.

There may be thus no proof that the supply-side of the economic system (how a lot it could possibly produce) has shrunk extra shortly over the previous couple of years than combination spending has contracted.

The RBA are merely making that up.

The Governor must be sacked and the Board reconstituted.

Besides that might take some braveness from the Federal authorities who makes these appointments and it’s too frightened of its personal shadow to really do very a lot to enhance the well-being of the individuals in Australia.

The Hiroshima and Nagasaki atrocities remembered

The – Hiroshima and Nagasaki bombings – occurred on August 6 and 9, 1945, so the approaching yr is the eightieth anniversary of the US aggression which “killed between 150,000 and 246,000 individuals, most of whom had been civilians” and stays the one act of nuclear aggression in human historical past.

The long term penalties of the bombings have been large:

… most of the survivors would face leukemia, most cancers, or different horrible unintended effects from the radiation.

We all know that:

In Hiroshima and Nagasaki, most victims died with none care to ease their struggling. A few of those that entered the cities after the bombings to supply help additionally died from the radiation.

This was as a result of the size of the harm worn out (killed or injured) “90 per cent of physicians and nurses” in Hiroshima.

In Kyoto, which was spared from the bombing on the final minute, there’s a little memorial Chinese language parasol tree planted on the – Nijō Citadel – that comes from seeds that survived the bombing in Hiroshima.

You’ll be able to examine that – HERE.

Every year I’m going to go to the citadel and the timber and take into consideration what occurred and hope that humanity can rise above such atrocities, though latest occasions in Gaza don’t encourage a lot confidence.

The Japan Instances article yesterday (December 10, 2024) – Nobel Peace Prize winner Nihon Hidankyo requires a world with out nukes – reported that the survivors’ group – Nihon Hidankyō (日本被団協) – had been in Oslo this week, representing the – Hibakusha (the survivors of the bloodbath), as they accepted the – Nobel Peace Prize – for 2024.

One of many chairs of the group, “92-year-old Nagasaki survivor Terumi Tanaka” was 13 when the bombings occurred and misplaced a number of relations.

It’s a good factor that the Nobel Committee is selling an anti-nuclear message, given the present geopolitical state of affairs.

Episode 9 of our Smith Household Manga is out this Friday, December 13, 2024

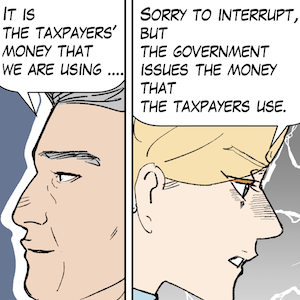

We at the moment are deep into the Second Season of our Manga collection – The Smith Household and their Adventures with Cash.

The purpose of the collection is to a little bit of enjoyable whereas offering a approach of studying Fashionable Financial Concept (MMT).

The Smith Household ise a middle-class household residing in a metropolis someplace on the earth. The second-generation dad and mom are college educated and have skilled occupations. Their two children attend the native public faculty.

In Episode 9, we discover Ryan, who misplaced his job within the austerity-driven recession and is now in a state of depressiond as one of many long-term unemployed, reflecting on his assist for Professor Noitawl’s advocacy of presidency cutbacks.

Additional, with the recession deepening, the progressive TV station now has a brand new anchor – Mary Winter – who was sacked by Fact TV when she dared to problem Professor Noitawl throughout a finance phase.

Mary Winter interrogates the more and more unpopular authorities chief who reveals his ignorance and lack of health for workplace.

And Japanese alternate pupil Minako Ode learns some harsh truths from Daniel, which makes her extra decided to face up as a local weather activist.

In case you have any suggestions we’ll respect it, apart from ‘this sucks’.

The manga is accessible in each English and Japanese.

Migration from Twitter to Bluesky

I’ve now give up Twitter (X) and am utilizing Bluesky to submit details about my work.

My Bluesky deal with is: @williammitchell.bsky.social

That must be straightforward to seek out.

Many Twitter followers have come throughout however there are nonetheless some 20 thousand to make the transfer.

Please assist to destroy Twitter and construct Bluesky right into a viable platform that values open dialogue.

So please come throughout and proceed to comply with my work on Bluesky.

Music – The Saints

That is what I’ve been listening to whereas working this morning.

It’s a little bit of an uncommon choice given my normal choices however this was one of many early punk recordings from an Australian band – The Saints – that was among the best exponents of that type of artwork.

The tune – Know your product – additionally carries a nice message.

It appeared on the 1978 album – Eternally Yours – the band’s second album.

A November 13, 2013UK Guardian reflection – The Saints: their 5 biggest moments – wrote:

This opened Eternally Yours and confused just about everybody: what the hell was a brass part doing on a punk report? The punchy horns are the proper counterpart to Bailey’s drawled vocals and Kuepper’s buzzsaw guitar, but it surely did the band no favours within the more and more inflexible British punk scene. It’s additionally one of many biggest Australian singles ever made. Crank up the audio system earlier than you press play: it deserves to be heard loud.

Ed Kuepper – the band’s guitarist and co-writer of the tune with lead singer – Chris Bailey – advised an viewers as soon as that the tune had in all probability employed extra brass gamers than some other tune in Australian music historical past.

He was joking however using a brass part in a punk tune was actually revolutionary and the road they got here up with is a superb instance of melody and drive.

Anyway, it fits my temper as we speak.

Flip up the quantity!

And as a bonus as we speak, listed here are the would possibly oils – Midnight Oil – doing a canopy of the tune on the 2022 Byron Bay Bluefest.

Glorious model.

Now, some deep respiratory isometric contractions to revive calm.

That’s sufficient for as we speak!

(c) Copyright 2024 William Mitchell. All Rights Reserved.