A reader asks:

Is it factor or dangerous factor if somebody began investing in that misplaced decade?

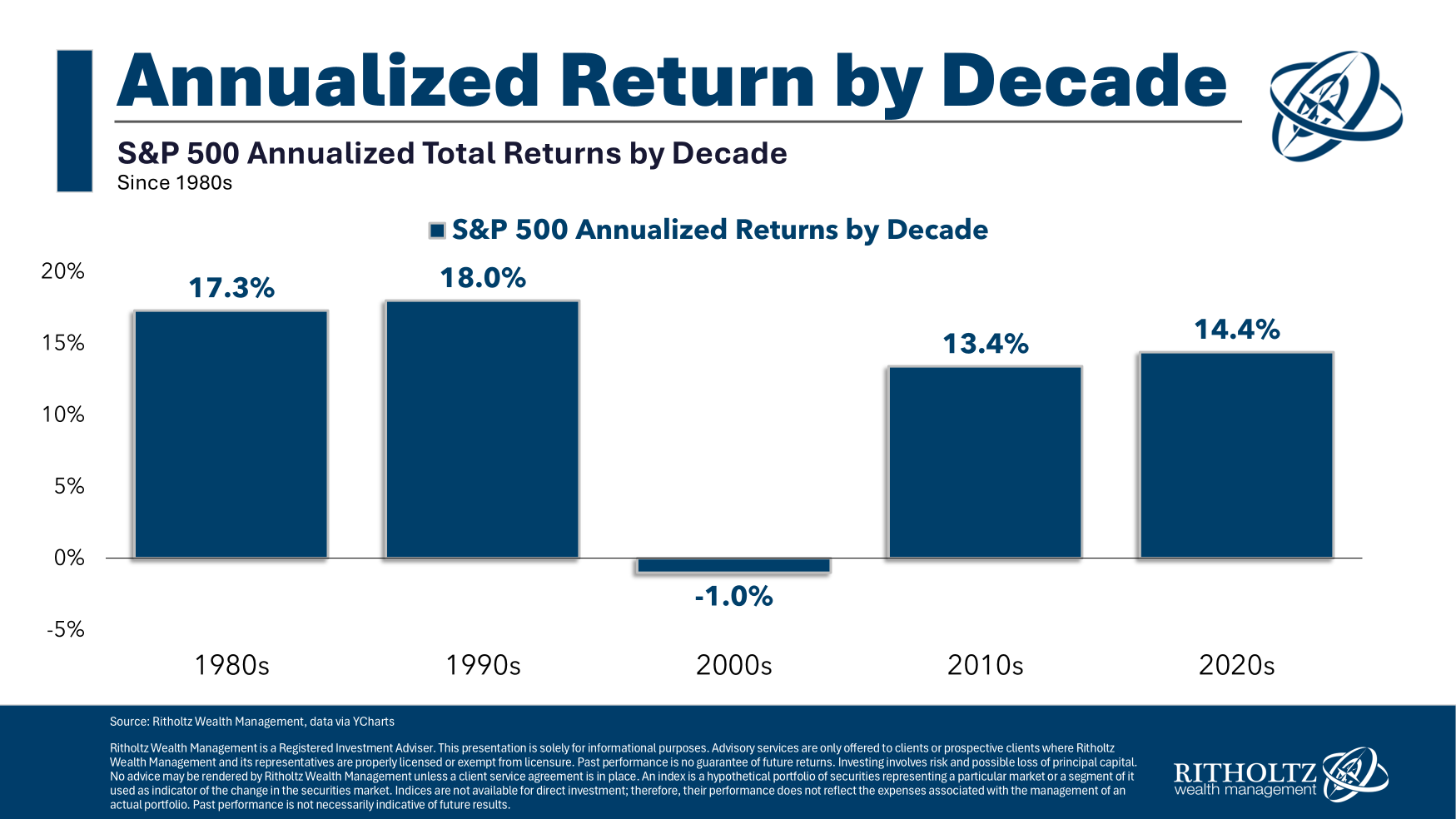

This was a follow-up query to this current chart I wrote about:

One among this stuff isn’t just like the others.

It could possibly be a foul factor to begin investing throughout a misplaced decade if it ruins your notion of threat and scares you away from the inventory market. That actually occurred to an honest variety of traders following the back-to-back crashes within the first decade of this century.

However for anybody who’s a internet saver for years to return a misplaced decade is a perfect solution to common into the inventory market by constantly shopping for at decrease costs.

Let’s check out an instance utilizing historic market knowledge for instance this level.

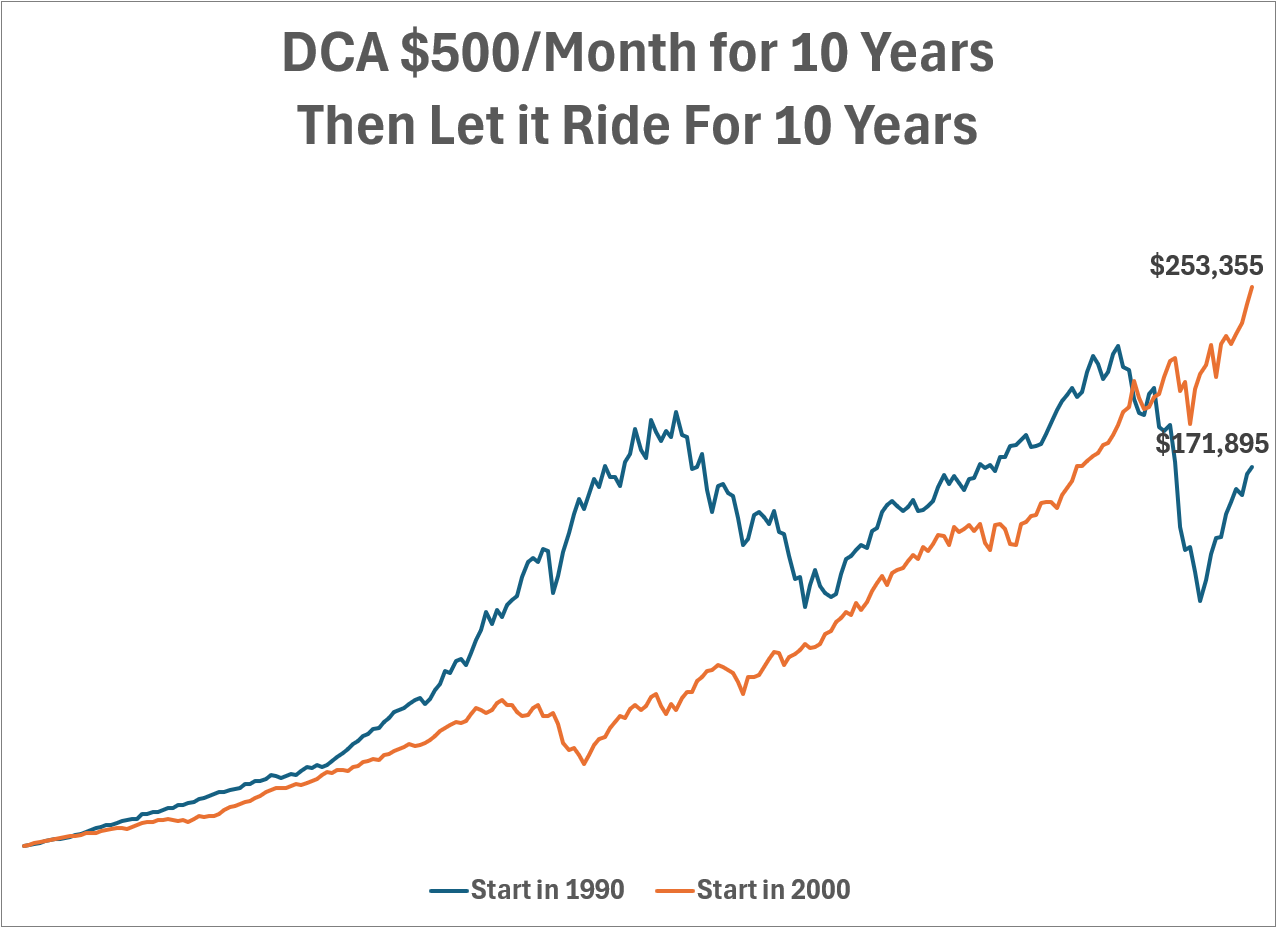

Let’s assume you greenback value common $500/month for 10 years, then let that cash journey for 10 years after that.

I did this situation evaluation initially of 1990 which was a large bull market and initially of 2000 which was the start of the final misplaced decade.

Within the quick run the Nineteen Nineties state of affairs is significantly better. The $60k of complete contributions would have was a bit greater than $170k. Within the 2000s it grew to only $64k (therefore the misplaced decade).

However have a look at what occurs once we lengthen the time horizon 10 extra years:

Greenback value averaging throughout a misplaced decade received by a big margin.

If you happen to’re younger, have the abdomen for it and dollar-cost-average into the market like most traditional folks, a misplaced decade isn’t one thing to worry. They set you up for higher returns sooner or later, which is what tends to occur after a misplaced decade.

You need the bear markets to return early and the bull markets to return afterward.

Talking of misplaced a long time, one other reader asks:

Do you assume that free buying and selling web sites/apps like Robinhood, Constancy, Schwab, and so forth. are serving to the market to keep away from/disrupt longer bear market durations (2-3 years or generally longer relying on financial downfall)? Or do you assume that barring some damaging financial disaster {that a} misplaced decade is one thing that would nonetheless suffice regardless of there being steady influx from retail?

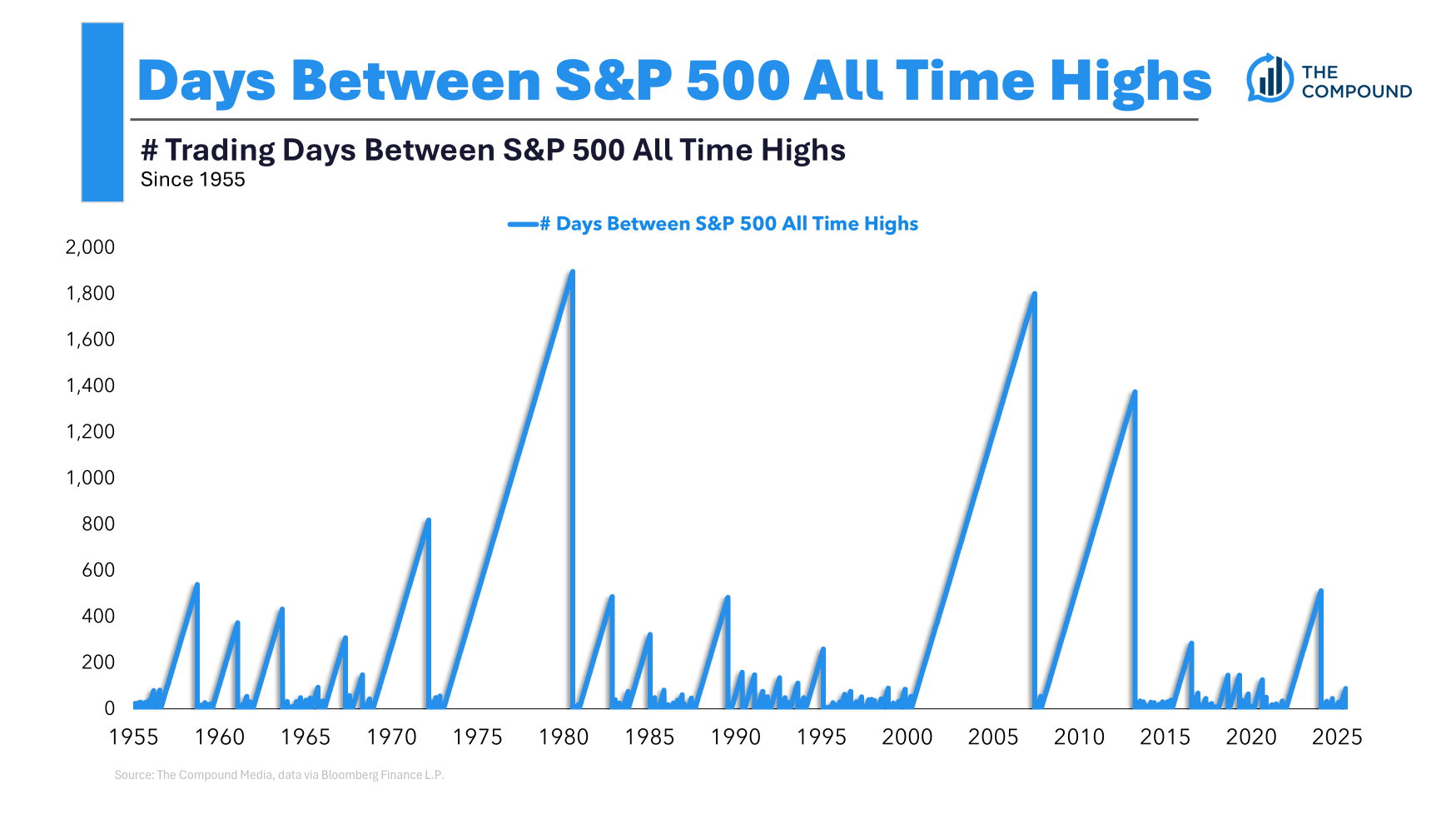

Right here’s a chart that exhibits the variety of days between all-time highs on the S&P 500 going again to the Nineteen Fifties:

To be truthful 2022 was a run-of-the-mill bear market the place you had greater than two years between all-time highs. That wasn’t practically as dangerous as among the different downturns on this chart however it was nonetheless a mean non-recessionary bear market.

However attempt to discover the 2020 and 2025 bears on this chart. They barely even register as a result of they had been over so rapidly.

There’s something to be mentioned concerning the nature of recoveries and the truth that traders are conditioned to step in and purchase. That was a giant motive the April tariff kerfuffle was over so rapidly:

Shopping for the dip is an American pastime.

The knowledge age, social media and algorithms have completely sped up market cycles.

Nonetheless, there are additionally occasions all through historical past when a niche exists between monetary crises.

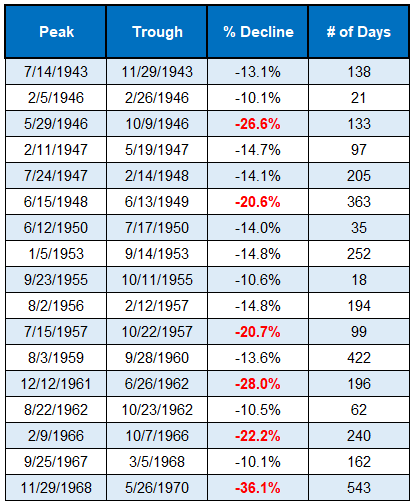

From the backside in World Warfare II via the top of the Go-Go Years within the late-Sixties there wasn’t a single monetary disaster or inventory market meltdown.

There have been corrections. There have been bear markets. There have been a handful of delicate recessions. However there weren’t any bone-crushing crashes that go away an indelible mark on investor psyches.

Have a look:

Beginning with the 1968-1970 crash (which was worse than you assume), you had sky-high inflation within the Nineteen Seventies, a good larger crash in 1973-74 and a usually dreadful decade for threat belongings. So that you had a interval of relative calm adopted by a interval of tough occasions.

And that interval of tough occasions was adopted by a interval of relative calm.

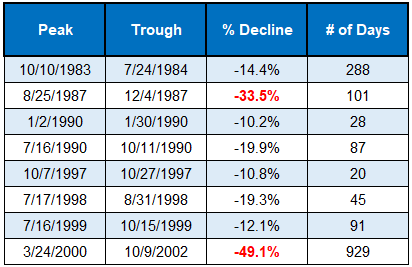

After back-to-back recessions and a nasty bear market within the early-Eighties (attributable to Paul Volcker taking rates of interest to love 20%), you had one other calm setting from basically 1983 to the height of the tech bubble within the spring of 2000:

Certain, you had the 1987 crash however the inventory market nonetheless completed up that yr and it was off to the races instantly following that flash crash. There have been some corrections and a recession in 1990 however no monetary crises that precipitated a misplaced decade or systemwide crash.

That interval of calm led to the misplaced decade. Noticing a sample right here?

You get the misplaced a long time due to deep recessions and/or monetary crises. The misplaced a long time — the Thirties, Nineteen Seventies and 2000s — had been plagued by banking crises, deep recessions, macroeconomic instability and coverage errors.

Retail and automatic investing have actually helped with regards to the size of corrections however we haven’t had an actual recession in over 15 years.1

Market construction is far completely different immediately with automated investing, a purchase the dip mentality and much more authorities intervention than we had prior to now.

However a monetary disaster state of affairs is an entire different ballgame. We have to expertise a type of unlucky occasions to place this idea to the check.

And it’ll occur in some unspecified time in the future…I simply don’t know when.

Intervals of relative calm inevitably result in durations of unrest.

Human nature kind of ensures it.

We mentioned each of those questions in additional element on this week’s Ask the Compound:

We additionally answered questions on taking out 84 month auto loans, my views on Bitcoin as an funding and learn how to automate your well being. My colleague Joey Fishman additionally joined us on the present to reply a query about late-stage non-public firm inventory choices.

Additional Studying:

Investing a Lump Sum at All-Time Highs

1The Covid blip recession doesn’t rely.