Since 2022, business actual property (CRE) buyers have been slogging by means of a tough downturn. Mortgage charges spiked as inflation ripped larger, cap charges expanded, and asset values fell throughout the board. The rally cry grew to become easy: “Survive till 2025.”

Now that we’re within the again half of 2025, it looks as if the worst is lastly over. The business actual property recession seems to be to be ending and alternative is knocking once more.

I’m assured the subsequent three years in CRE will probably be higher than the final. And if I’m fallacious, I’ll merely lose cash or make lower than anticipated. That’s the worth we pay as buyers in threat belongings.

A Tough Few Years for Industrial Actual Property

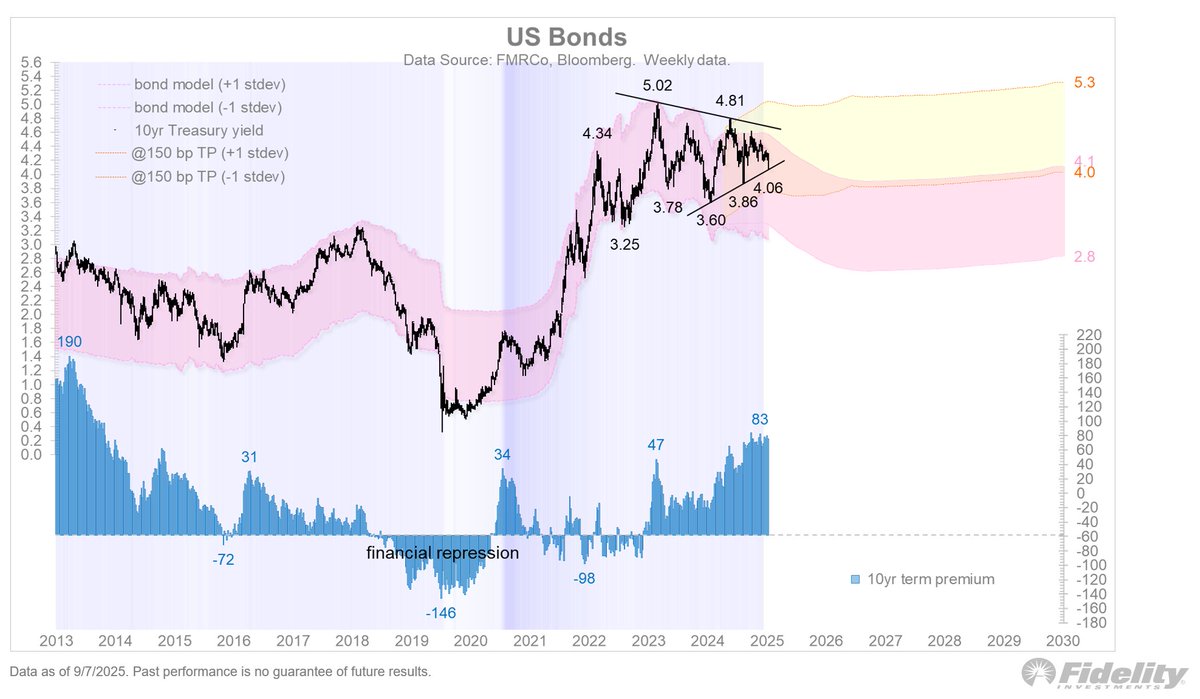

In 2022, when the Fed launched into its most aggressive rate-hiking cycle in a long time, CRE was one of many first casualties. Property values are extremely delicate to borrowing prices as a result of most offers are financed. Because the 10-year Treasury yield climbed from ~1.5% pre-pandemic (low of 0.6%) to ~5% on the 2023 peak, cap charges had nowhere to go however up.

In the meantime, demand for workplace house cratered as hybrid and distant work caught round. Condominium builders confronted rising development prices and slower lease progress. Industrial, as soon as the darling of CRE, cooled as provide chains froze after which normalized.

With financing prices up and NOI progress flatlining, CRE buyers needed to hunker down. Headlines about defaults, extensions, and “lengthen and faux” loans dominated the house.

Indicators the Industrial Actual Property Recession Is Ending

Quick-forward to right this moment, and the panorama seems to be very totally different. Right here’s why I consider we’re on the finish of the CRE downturn:

1. Inflation Has Normalized

Inflation has cooled from a scorching ~9% in mid-2022 to beneath 3% right this moment. Decrease inflation provides the Fed cowl to ease coverage and buyers extra confidence in underwriting long-term offers. Value stability is oxygen for business actual property, and it’s lastly again.

2. The ten-Yr Yield Is Down

The ten-year Treasury, which drives most mortgage charges, has fallen from ~5% at its peak to ~4% right this moment. That 100 bps drop is significant for leveraged buyers. A 1% decrease borrowing price can translate into 10%+ larger property values utilizing widespread cap price math.

If the 10-year Treasury bond yield can get to three.5% and the common 30-year fastened price mortgage can get to five.5%, I count on to see a big uptick in actual property demand. We’re not that far-off, particularly if the Fed cuts by 100 foundation factors (1%) over the subsequent 12 months.

3. The Fed Has Pivoted

After greater than 9 months of holding regular, the Fed is chopping once more. Whereas the Fed doesn’t instantly management long-term mortgage charges, cuts on the quick finish usually filter by means of. The psychological shift can also be vital: buyers now consider the tightening cycle is actually behind us.

The beneath chart signifies about six Fed price cuts till the tip of 2026, totaling ~1.5%. Such market expectations will change over time, however that is the place we’re at proper now.

4. Misery Is Peaking

We’ve already seen the compelled sellers, the mortgage extensions, and the markdowns. Lots of the weak fingers have been flushed out. Misery gross sales, as soon as an indication of ache, are beginning to appeal to opportunistic capital. Traditionally, that transition marks the underside of an actual property cycle.

5. Capital Is Returning

After two years of sitting on the sidelines, capital is coming again. Institutional buyers are underweight actual property relative to their long-term targets. Household places of work, non-public fairness, and platforms like Fundrise are actively elevating and deploying cash into CRE once more. Liquidity creates worth stability.

The place the Alternatives Are In CRE

Not all CRE is created equal. Whereas workplace could also be impaired for years, different property sorts look compelling:

- Multifamily: Hire progress slowed however didn’t collapse. With little-to-no provide of recent development since 2022, there’ll doubtless be undersupply over the subsequent three years, and upward lease pressures.

- Industrial: Warehousing and logistics stay long-term winners, even when progress cooled from the pandemic frenzy.

- Retail: The “retail apocalypse” was overstated. Effectively-located grocery-anchored facilities are performing, and experiential retail has endurance.

- Specialty: Knowledge facilities, senior housing, and medical workplace proceed to draw area of interest capital. With the AI increase, knowledge facilities is more likely to see essentially the most quantity of CRE funding capital.

As a capital allocator, I’m drawn to relative worth. Shares commerce at ~23X ahead earnings right this moment, whereas many CRE belongings are nonetheless priced as if charges are completely at 2023 ranges. That’s a disconnect price being attentive to.

Don’t Confuse Industrial Actual Property With Your House

One vital distinction: business actual property just isn’t the identical as your major residence. CRE buyers are hyper-focused on yields, cap charges, and financing. Homebuyers, then again, are extra centered on way of life and utility. Because of this, the rise in rates of interest are inclined to have much less of a damaging impression in residential dwelling costs.

For instance, I purchased a brand new dwelling in 2023 to not maximize monetary returns, however as a result of I needed extra land and enclosed outside house for my youngsters whereas they’re nonetheless younger. The ROI on peace of thoughts and childhood reminiscences is immeasurable.

Industrial actual property, in contrast, is about numbers. It’s about money move, leverage, and exit multiples. Sure, feelings creep in, however the market is way extra ruthless.

Dangers Nonetheless Stay In CRE

Let’s be clear: calling the tip of a recession doesn’t imply blue skies eternally. Dangers stay:

- Workplace glut: Many CBD workplace towers are functionally out of date and should by no means get well.

- Debt maturities: There’s a wall of loans nonetheless coming due in 2026–2027, which may take a look at the market once more.

- Coverage threat: Tax modifications, zoning legal guidelines, or one other surprising inflation flare-up may derail progress.

- World uncertainty: Geopolitical tensions and slowing progress overseas may spill into CRE demand.

However cycles don’t finish with all dangers gone. They finish when the steadiness of dangers and rewards shifts in favor of buyers prepared to look forward.

Why I’m Optimistic About CRE

Roughly 40% of my internet price is in actual property, with ~10% of that in business properties. So I’ve felt this downturn personally.

However after I zoom out, I see echoes of previous cycles:

- Panic promoting adopted by alternative shopping for.

- Charges peaking and beginning to decline.

- Establishments shifting from protection again to offense.

I lately recorded a podcast with Ben Miller, the CEO of Fundrise, who’s optimistic about CRE over the subsequent three years. His perspective, mixed with the enhancing macro backdrop, provides me confidence that we’ve turned the nook.

CRE: From Survive to Thrive

For 3 years, the mantra was “survive till 2025.” Effectively, right here we’re. CRE buyers who held on might lastly be rewarded. Inflation is down, charges are easing, capital is flowing again, and new alternatives are rising.

The top of the business actual property recession doesn’t imply straightforward cash or a straight-line rebound. In contrast to shares, which transfer like a speedboat, actual property strikes extra like a supertanker – it takes time to show. Endurance stays important. Nonetheless, the tide has shifted, and that is the second to reposition portfolios, purchase at enticing valuations, and put together for the subsequent upcycle.

The secret is to remain selective, preserve a long-term mindset, and align each funding along with your targets. For me, business actual property stays a smaller, however nonetheless significant, a part of a diversified internet price.

Should you’ve been ready on the sidelines, it could be time to wade again in. As a result of in investing, the perfect alternatives not often seem when the waters are calm—they present up when the cycle is quietly turning.

Readers, do you assume the CRE market has lastly turned the nook? Why or why not? And the place do you see essentially the most compelling alternatives in business actual property at this stage of the cycle?

Make investments In CRE In A Diversified Method

Should you’re trying to achieve publicity to business actual property, check out Fundrise. Based in 2012, Fundrise now manages over $3 billion for 380,000+ buyers. Their focus is on residential-oriented business actual property in lower-cost markets. All through the downturn, Fundrise continued deploying capital to seize alternatives at decrease valuations. Now, because the CRE cycle turns, they’re well-positioned to learn from the rebound.

The minimal funding is simply $10, making it straightforward to dollar-cost common over time. I’ve personally invested six figures into Fundrise’s CRE choices, and I recognize that their long-term strategy aligns with my very own. Fundrise has additionally been a long-time sponsor of Monetary Samurai, which speaks to our shared funding philosophy.

To expedite your journey to monetary freedom, be a part of over 60,000 others and subscribe to the free Monetary Samurai e-newsletter. You too can get my posts in your e-mail inbox as quickly as they arrive out by signing up right here.