There are such a lot of issues I look ahead to throughout Pumpkin Spice Season, however interested by paying Uncle Sam isn’t considered one of them! Nonetheless, as a wealth planner, I do know that dealing with the music in October, with a number of months left to optimize my tax scenario, goes a good distance in managing my tax legal responsibility. It additionally helps me make knowledgeable choices about actions to take which can be in keeping with my broader monetary targets.

Too typically, we deal with minimizing taxable revenue in any respect prices in a single tax yr, whether or not it advances our long-term priorities or not. However with somewhat planning, it doesn’t must be this manner. Take a look at these easy ideas for strikes to make earlier than year-end to ease the ache come April fifteenth and past, whereas holding your large image targets in thoughts.

1. Keep away from Surprises with Your Funding Portfolio – Examine Out Realized Beneficial properties & Revenue to Date

Figuring out what you’re incomes at work is fairly clear. Figuring out what’s happening within your funding portfolio is a special story for a lot of busy professionals. Ideally, it’s best to hold tabs on this all year long to see if estimated taxes must be paid, however I’m a realist.

In case you are simply coming to phrases with tax planning for the yr, ask your advisor for a report displaying realized positive factors/losses for non-tax-deferred accounts in addition to a report displaying revenue out of your investments which may be taxable (like curiosity and dividends). Don’t have an advisor? You could possibly generate studies your self displaying this info or test your most up-to-date assertion for year-to-date exercise. Right here are some things to concentrate to:

Curiosity-Bearing Financial savings & Cash Market Accounts

Although rates of interest are coming down, most financial savings and cash market accounts are nonetheless paying larger charges of curiosity than prior to now. Don’t overlook to test these out, as usually, the curiosity can be taxed at your extraordinary revenue tax charge (not the advantageous charge for certified dividends or long-term capital positive factors).

Actively Managed Accounts and Mutual Funds

Simply since you didn’t promote any investments all year long or request a sale in your account, doesn’t imply that you just gained’t have realized capital positive factors. If in case you have an account managed by an advisor or personal mutual funds, you could have realized positive factors due to this energetic administration or redemption requests from different buyers in mutual funds.

Mutual funds typically pay out any capital positive factors towards the top of the yr. For those who personal mutual funds, it’s best to be capable of get a projection of capital positive factors that can be handed by means of to you as an proprietor of the fund (separate from any acquire or loss you’ve on the precise shares of the fund on account of promoting them).

The excellent news is, there are choices for tax effectivity within your portfolio by means of methods like direct indexing in case you are involved about realized positive factors including to your taxable revenue.

Funding Revenue from Dividends and Curiosity

Funding revenue generated by simply proudly owning an funding in a non-tax-deferred account is usually ignored, particularly if dividends or curiosity are reinvested. Reinvesting doesn’t imply that you just gained’t owe taxes the yr that the revenue was generated so don’t overlook to have a look!

In reviewing the taxable revenue out of your portfolio, it is possible for you to to get a way when you’ll be topic to the Web Funding Revenue Tax. It is a 3.8% tax utilized to internet funding revenue for single filers with greater than $200,000 in modified adjusted gross revenue ($250,000 for married {couples} submitting collectively). The tax is barely utilized to the lesser of your internet funding revenue or the portion of your modified gross revenue that exceeds the thresholds famous above. That is typically an disagreeable shock in April – there could also be time to take motion earlier than the top of the yr to attenuate internet funding revenue (learn on to quantity 2).

2. Assessment What’s Lurking Underneath the Floor in Your Funding Portfolio

Did you uncover extra realized revenue out of your portfolio than you anticipated? The excellent news is you’ve a number of months left to attempt to cut back that. Request an unrealized acquire/loss report out of your advisor or try your unrealized positive factors/losses on-line in your non-retirement accounts. Even in case you are snug with the place your realized positive factors are, there could also be alternatives to raised your tax scenario over the long-term.

Search for positions which can be displaying an unrealized loss. By leveraging the apply of tax-loss harvesting, buyers can promote any securities which have declined at a loss, offsetting the tax burden of positive factors from different investments. Subsequently, the proceeds of a sale will be reallocated to the same safety, permitting people to decrease their tax invoice whereas on the identical time sustaining their desired asset allocation.

The inevitable caveat

There are some restrictions to this technique. For instance, losses have to be utilized in sequence—long-term losses should first be utilized to long-term positive factors, whereas short-term losses should first be utilized to short-term positive factors. Moreover, the IRS stipulates that these trades shouldn’t violate the “wash sale” rule, which means that losses can’t be claimed if the safety repurchased is “considerably an identical” to the safety offered (and acquired inside a 61-day window).

Tax-loss guidelines are comparatively complicated and would require cautious consideration of claims and their {qualifications}. When deployed strategically, nevertheless, tax losses will be fairly invaluable over the long-term as they are often indefinitely carried ahead and utilized till they’re exhausted.

Generally you could need to harvest positive factors

If in case you have much less revenue than is typical, have internet realized losses, or end up in a decrease tax bracket than anticipated, it could make sense to reap long-term capital positive factors earlier than year-end to attenuate taxes paid on these positive factors. Appears counterintuitive, however I’ll clarify.

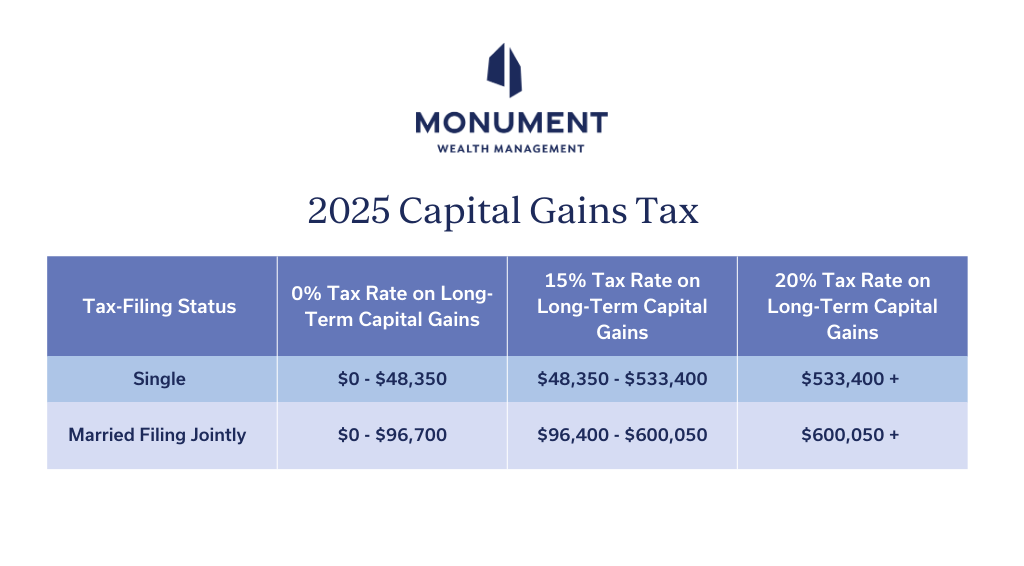

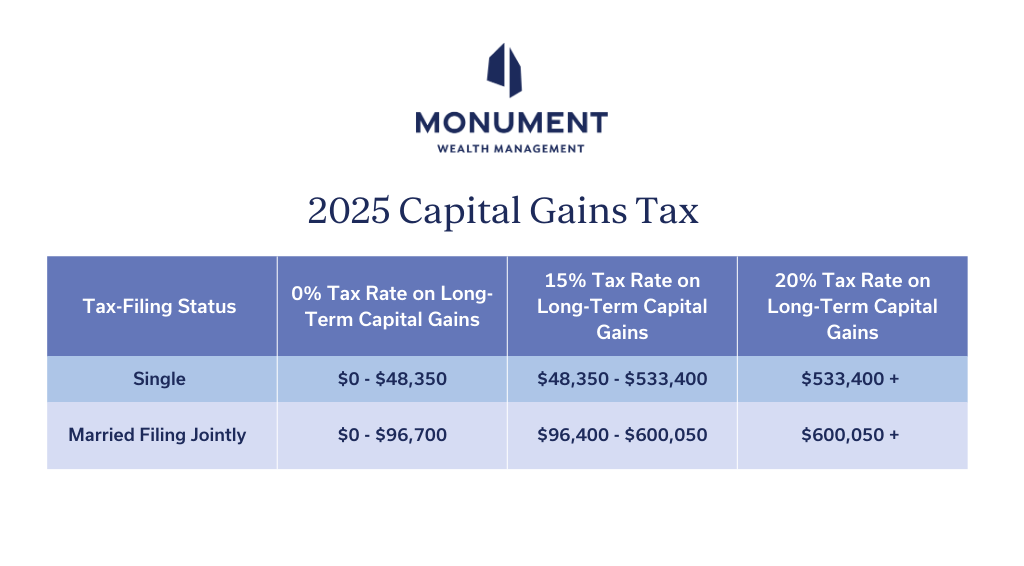

In contrast to your W2 revenue and different kinds of funding revenue, long-term capital positive factors are taxed at decrease charges pushed by your taxable revenue.

Right here’s how capital positive factors are taxed in 2025:

It is a nice instance of how tax-planning requires forward-thinking of the large image. By promoting a winner, you possibly can re-set your value foundation within the place and probably pay much less in taxes than you’ll sooner or later on the acquire underneath the best circumstances.

3. Get a Deal with on Contributions Made to Tax-Deferred Accounts

If you wish to decrease your taxable revenue earlier than the top of the yr, taking up the complete spectrum of tax deductions can really feel like an amazing process. A straightforward place to begin is with tax-deferred accounts to be sure you’re maximizing these alternatives.

Office Retirement Accounts

Pre-tax contributions to office retirement accounts are one of many greatest methods to scale back taxable revenue whereas saving for long-term targets. Log in to your retirement plan portal to see how a lot you’ve contributed up to now and the way a lot you’re set to contribute by means of year-end. There’s nonetheless time to regulate, probably with out main impression to your money flows as a high-income earner, and these will probably go additional than IRA contributions, whose deductibility is restricted for high-income earners. In contrast to IRA contributions, office retirement plan contributions have to be made by December thirty first. The boundaries for 2025 are:

Well being Financial savings Accounts

With a well being financial savings account (HSA), you possibly can decrease your present taxable revenue and create a supply of tax-free wealth obtainable to cowl present or future medical bills. Not everybody can contribute to those accounts, however in case you are a part of a Excessive-Deductible Well being Plan (see the HSA contribution limits under), be sure you are maximizing this chance! Fortunately, you’ve till your tax submitting deadline to make this contribution, not December thirty first.

529 Accounts

In case you are saving for a cherished one’s future instructional prices and reside in a state with revenue tax, you could profit from making contributions to that state’s 529 plan. Deductibility of contributions varies from state to state, in addition to contribution deadlines for receiving the tax deduction (although most are December thirty first). Decreasing your state revenue tax burden will be particularly useful given the restricted deductibility of state and native taxes on federal revenue tax returns. There are even tax-efficient, long-term wealth advantages related to 529s past training—because of the Safe Act 2.0; learn right here about new alternatives to roll unused 529 funds to a Roth IRA for a similar beneficiary.

4. Have a look at Different Deductible Buckets

You don’t must be a tax knowledgeable to have an concept of whether or not an expense you paid could decrease your taxable revenue, or if it is smart to take sure actions only for the sake of lowering your taxable revenue earlier than year-end. Glancing on the federal Schedule A might help jog your reminiscence on what you’ve performed all year long, from charitable contributions to medical bills, and offer you a place to begin for figuring out if you have already got sufficient deductions to recover from the usual deduction ($15,000 for single filers and $30,000 for married {couples} submitting collectively in 2025).

In case you are near exceeding the usual deduction restrict AND have charitable intentions, or different elective deductible bills you could incur earlier than year-end, you possibly can act earlier than December thirty first to get above the usual deduction and additional cut back your taxable revenue.

There are tax-savvy methods to present to charitable organizations past simply writing a test:

- Donating appreciated shares of inventory could take away the potential for future capital positive factors tax on appreciated property.

- Establishing a Donor Suggested Fund (DAF) could help you lock in a big charitable deduction whenever you want it (similar to a yr the place you’ve exceptionally excessive revenue on account of vesting stock-based compensation or a big capital acquire) whereas permitting you to grant cash to your favourite charitable organizations over time.

That is after all no alternative for talking together with your staff of advisors, like your wealth advisor and tax skilled! Nonetheless, it’s at all times useful to begin a dialog with them from a spot of understanding your large image.

5. Examine Out Present Tax Credit Out there—No matter Revenue Stage

Many high-income earners are unable to make the most of tax credit obtainable for having youngsters, paying for childcare bills, or pursuing larger training for themselves or dependents. For these contemplating energy-efficiency upgrades to their houses, that is the final yr that tax credit obtainable underneath the Inflation Discount Act could also be taken so now’s the time to behave.

The Power Environment friendly House Enchancment Credit score presents a credit score of as much as 30% of prices for enhancements, capped at $3,200 although the cap could also be decrease relying on the sort of enchancment. Issues like home windows, exterior doorways, home equipment, and insulation could also be certified if positioned in service by December 31, 2025. The Residential Clear Power Credit score could permit householders to obtain a tax credit score equal to 30% of the fee to put in qualifying renewable vitality tools, similar to photo voltaic, wind, or geothermal, in addition to battery storage expertise. Once more, the mission have to be accomplished by December 31, 2025, to be eligible, so there’s much less runway with this tax credit score. The IRS and your CPA will be the authority on this subject in case you are interested by residence upgrades however make sure all the pieces will be accomplished by December thirty first if the tax credit score is a big consider your decision-making!

Work with an Advisor Who Understands Your Large Image

Because the yr winds down, it’s vital to know the large image with regards to your taxable revenue. When seen from a broader perspective, you could possibly establish alternatives to decrease your tax burden. Excessive-income earners should additionally stay cognizant of timing with regards to these alternatives, making certain you’re ready to take applicable actions earlier than the yr ends.

This may occasionally all seem to be a frightening problem to tackle, and when you’re hoping to create a long-term tax optimization technique, it gained’t be straightforward to go it alone, particularly as your property and monetary image develop in measurement and complexity. In relation to metabolizing complexity for high-earning people like enterprise house owners and executives, the Group at Monument is properly suited to assist. We act as your “second mind” that will help you spot alternatives for tax effectivity—or for reaching your different wealth targets. We analysis you simply as deeply as we analysis the markets and ship clear, concise suggestions that show you how to make high-impact choices with confidence.

Study our Complimentary Wealth Examine.