The Economist has piece in regards to the rising significance of the inventory market on family stability sheets.

Right here’s the chart that issues:

By the top of 2024, People owned shares value 170% of disposable revenue which is again at file ranges and far greater than in earlier many years.

The fear right here is {that a} sustained drop in inventory costs might ultimately have an effect on the true financial system.

I’m gonna either side this one.

The highest 10% of households by internet value personal practically 90% of shares. This group additionally accounts for 50% of shopper spending. If shares go into a chronic downturn, that might trigger this cohort to cut back their consumption in an enormous manner.

If that occurs, the speculation goes that the inventory market might trigger a slowdown within the financial system.

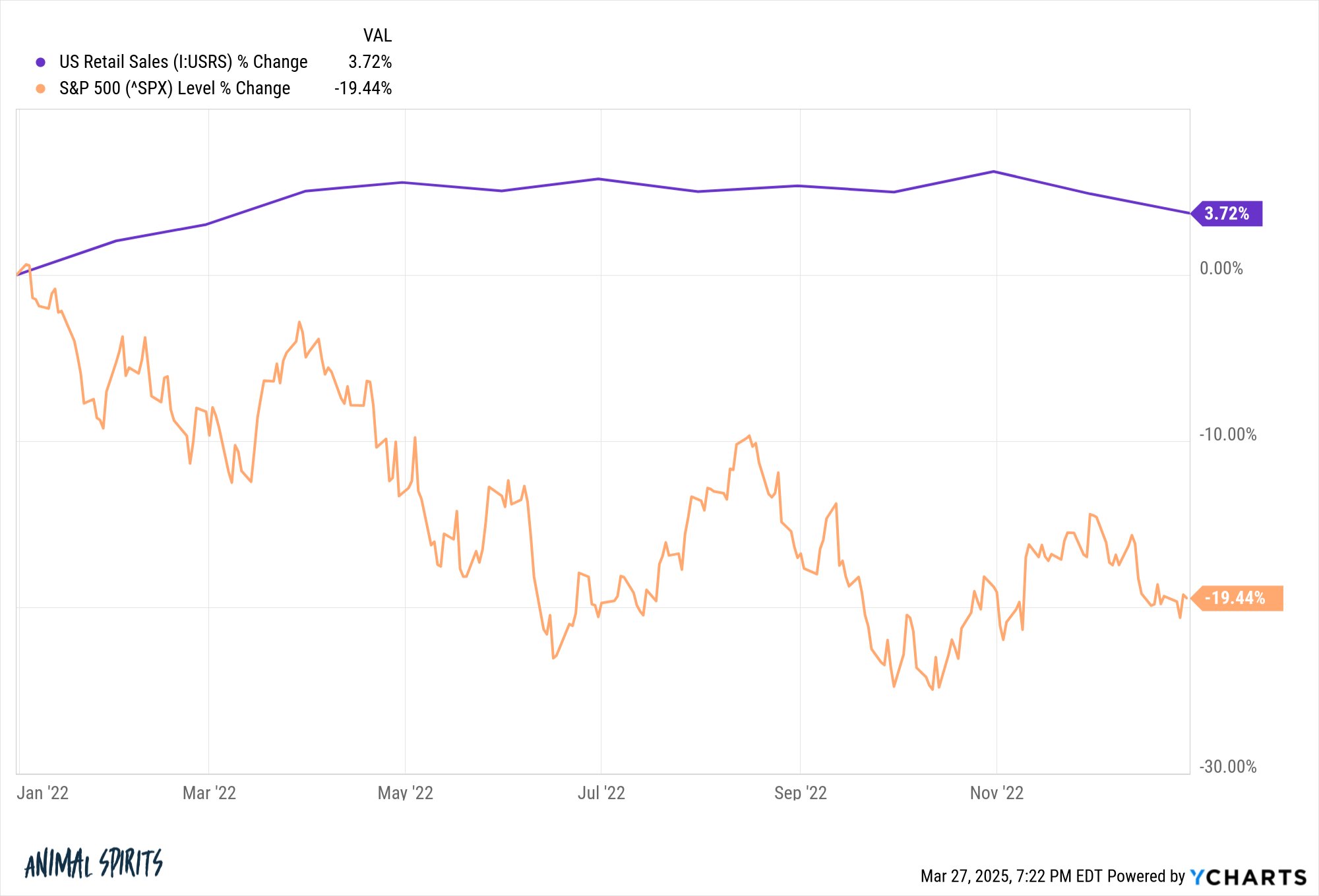

Alternatively, we already had a bear market just a few years in the past but folks stored on spending cash proper by the downturn:

The inventory market acquired hammered in 2022 whereas retail gross sales had been up.

Everybody thought we had been going right into a recession. Inflation was uncontrolled. Individuals stored spending cash.

Now, you would say that was a pandemic outlier occasion. Family stability sheets had been in superb form heading into that surroundings. That 2022 interval could possibly be a pandemic outlier it’s a must to throw out the window.

I’m undecided individuals are promoting their shares to fund consumption so the wealth impact is usually psychological in nature. You can make an analogous case for housing market wealth. On the finish of 2024, American households owned $47 trillion in equities and $48 trillion in actual property.

Do folks spend extra money as a result of their home is value extra? Some may.

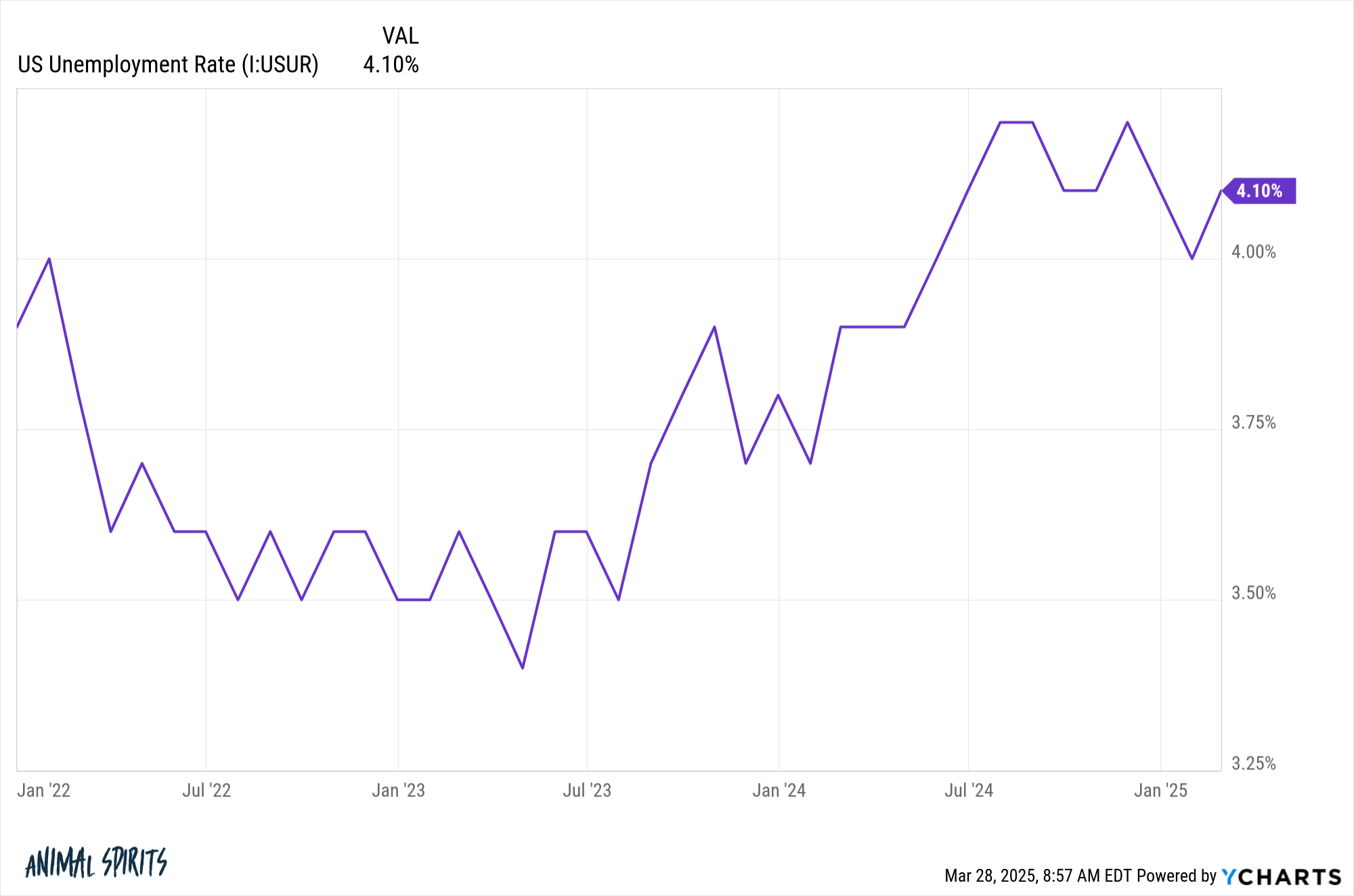

I believe the financial system is extra vital than the inventory market on the subject of consumption. One of many huge causes we didn’t see a big pullback in spending throughout 2022 is the unemployment fee remained low:

If folks begin dropping their jobs throughout an financial slowdown, that’s going to have a a lot better influence on financial progress than falling inventory costs.

The wealth impact as a concurrent indicator. When issues are going effectively, inventory costs shall be up and other people shall be feeling good however that each one goes hand-in-hand.

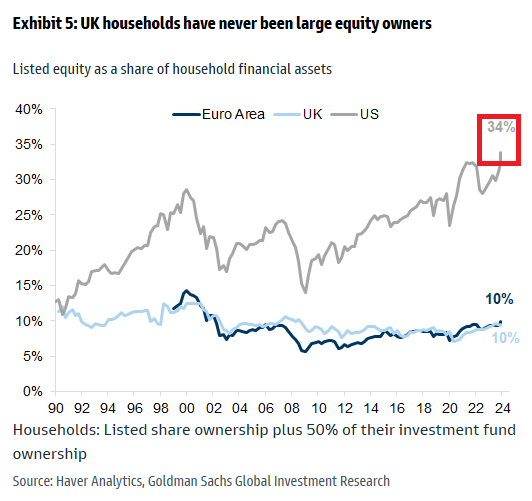

It’s additionally attention-grabbing to have a look at inventory market holdings as a proportion of all family monetary property:

This quantity is way greater than it was up to now but it surely is smart. Buyers have by no means had extra entry to the inventory market by 401ks, IRAs, robo-advisors, brokerage accounts with zero-dollar trades the place the whole lot will be automated. The obstacles to entry had been a lot greater up to now.

American households are in significantly better monetary form than the remainder of the world partially due to the inventory market. We have to get extra traders within the Euro Space and UK to put money into shares for the long term.

I don’t assume extra wealth within the inventory market makes the financial system extra susceptible to booms and busts. There have been 8 double-digit corrections up to now 15 years which incorporates two bear markets (in 2020 and 2022) together with two close to bear markets (in 2011 and 2018).

There has solely been one recession in that very same decade-and-a-half and it lasted for simply two months.

I don’t assume the inventory market can ship us right into a recession.

I do assume a recession can ship shares right into a bear market.

Michael and I talked in regards to the implications of the wealth impact and way more on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

The Inventory Market is All the time Altering

Now right here’s what I’ve been studying recently:

Books:

This content material, which accommodates security-related opinions and/or info, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There will be no ensures or assurances that the views expressed right here shall be relevant for any specific info or circumstances, and shouldn’t be relied upon in any method. You must seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “put up” (together with any associated weblog, podcasts, movies, and social media) displays the non-public opinions, viewpoints, and analyses of the Ritholtz Wealth Administration workers offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments shopper.

References to any securities or digital property, or efficiency information, are for illustrative functions solely and don’t represent an funding suggestion or supply to supply funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding determination. Previous efficiency just isn’t indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to alter with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from varied entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its workers. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.