Nick’s Tweet despatched me looking to trace down what ultimately grew to become my favourite unfavourable evaluate of “Bailout Nation.” My first e-book was revealed on Could 26, 2009, however the evaluate in query got here seven years later in 2016, in response to a Washington Publish column I had written: “The actual threat out there is staying out of it.”

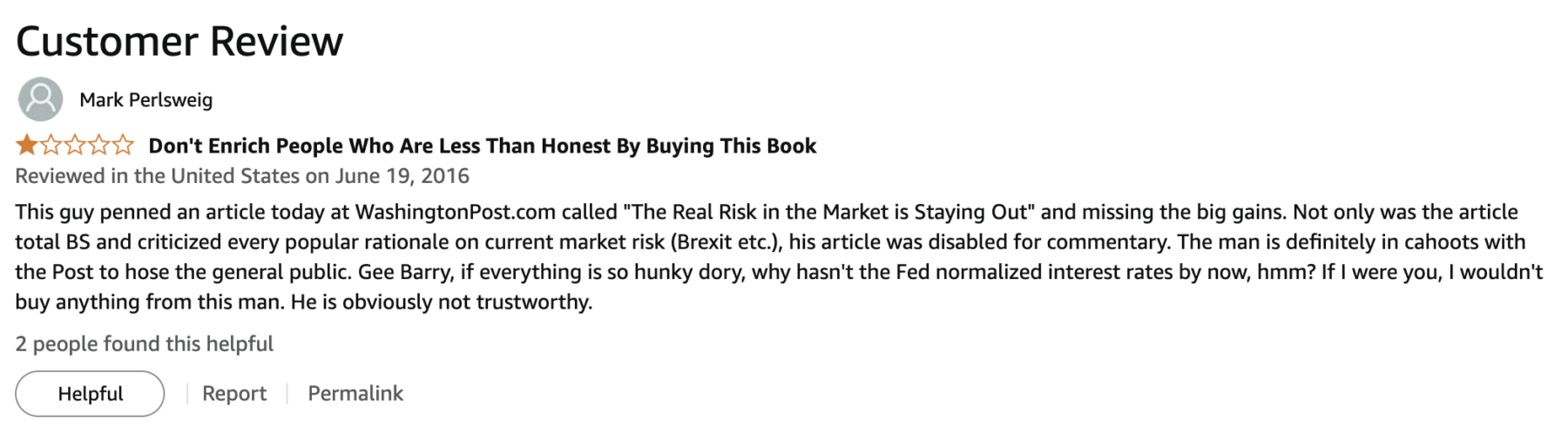

My Fave 2016(!) Evaluate of Bailout Nation (2009!):

Initially, I used to be outraged.

However quickly after, I got here to acknowledge one thing else that was happening. This transition from anger to annoyance to an “Aha!” second occurred quickly after I finished to ask what motivated this particular person.

Finally, it grew to become a teachable second for me.

It pressured me to (eventually) take into account what was happening inside this particular person’s emotional state, their psychology, to say nothing of their portfolio. It made me take into consideration the (not so) apparent ache they will need to have been in. Eight years after the Nice Monetary Disaster, seven years after the market bottomed and the publication of Bailout Nation, and three days after a Washington Publish column, this particular person took the day out of their day, discovered my first e-book, and gave it a 1-star evaluate.

What I first mistook for pettiness, I quickly got here to acknowledge as frustration, anger, and FOMO. I attempted to think about the post-Nice Monetary Disaster PTSD; maybe that they had bought in 2009 and by no means bought again in. And alongside comes this jackass within the Washington Publish telling folks to STAY IN THE MARKET it doesn’t matter what! No surprise this man bought so pissed off.

However I additionally couldn’t assist however surprise: Who did this have an effect on? How typically will we see one thing on TikTok, Twitter, or TV (or something at random) that impacts the reader personally and negatively?

How many individuals react emotionally to inputs like this? How a lot junk is in all places, contributing to unhealthy adjustments in portfolio allocations?

~~~

I’ve been writing in public for over 25 years — I attempt my greatest to be considerate about who would possibly learn what I put out and the way it would possibly have an effect on them. The Hippocratic Oath ought to apply to monetary writers additionally: First, do no hurt.

Too many individuals who publish market opinion and commentary veer into recklessness. Writers often fail to contemplate how their phrases might have an effect on others.

I spill lots of ink in How Not To Make investments discussing the various foolish issues folks imagine about investing, and the way these “earworms” get into our heads. Unhealthy concepts refuse to die, misinformation is in all places, and a really worthwhile industrial advanced has arisen to unfold outrageous, inflammatory concepts — their enterprise mannequin IS clickbait. The mainstream media could also be problematic, however social media is oh a lot worse.

You possibly can add Amazon opinions to the record of locations the place unhealthy data circulates. For no matter purpose, my 2016 WaPo dialogue of some great benefits of compounding and the hazards of market timing upset this particular person a lot that they felt compelled to lash out.

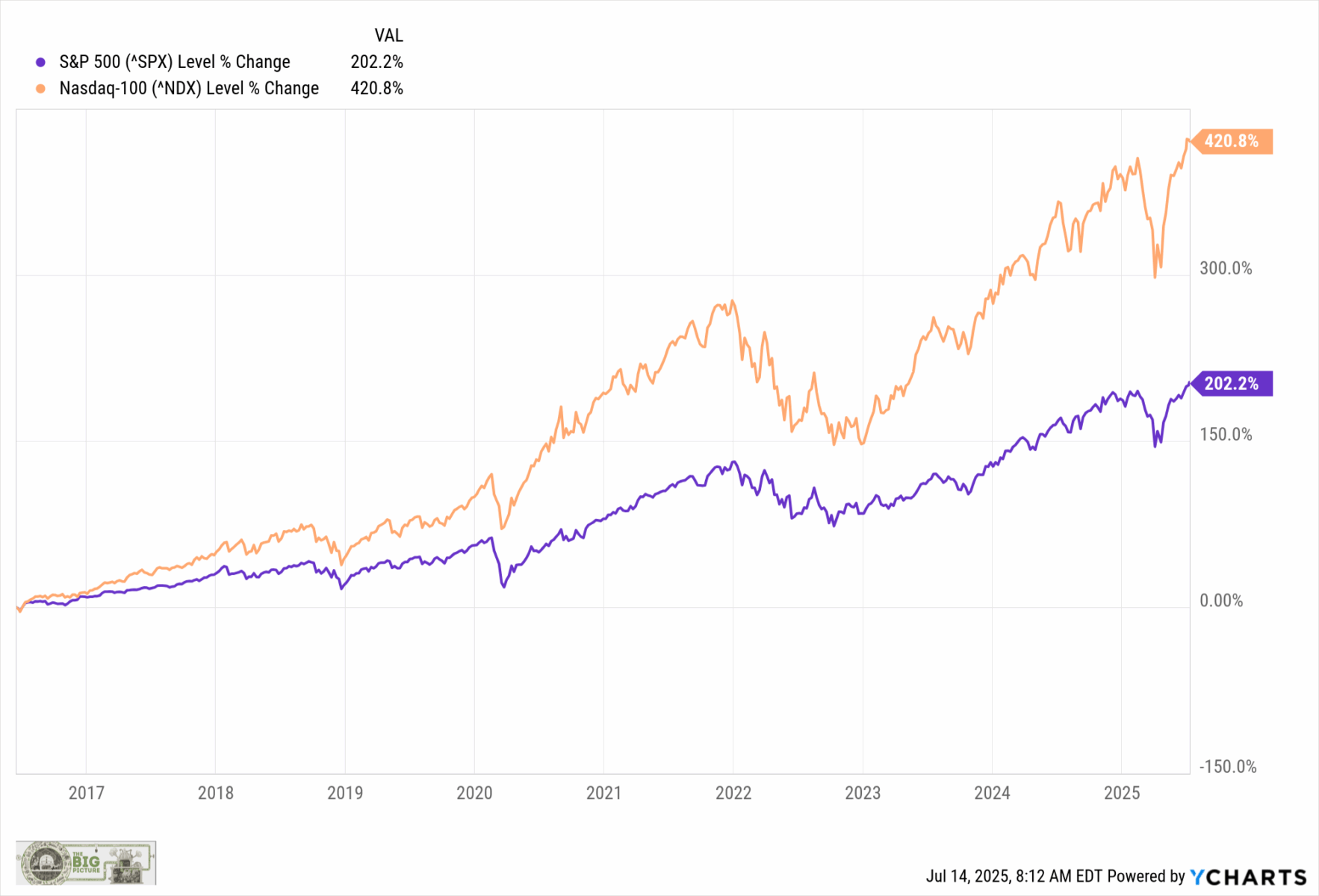

I really feel unhealthy for this man,1 and no matter he was coping with in 2016. However his problematic perception system and lack of expertise of stories headlines appeared to have saved him from taking part in equities. If he stayed along with his beliefs that Brexit and different dangers meant the market was too dangerous, it led him to overlook a run that (as of at this time) is 202% within the S&P 500, and 421% within the Nasdaq 100:

All bull markets ultimately come to an finish, as this one certainly may even. Be sure your investments don’t undergo out of your makes an attempt to time that, or in your elementary misunderstanding of what drives costs over time…

Beforehand:

Priming Your Portfolio for a Disaster? You Could Miss Out on Large Beneficial properties (June 25, 2016)

By no means Take Sweet from Strangers (June 9, 2025)

No person Is aware of Something, The Beatles version (September 26, 2024)

No person Is aware of Something (Full archive)

Sources:

The actual threat out there is staying out of it (free mirror)

Barry Ritholtz

Washington Publish, June 18, 2016

__________

1. Marc Perlsweig, please attain out at HNTI -at-RitholtzWealth.com