Individuals are carefully watching the US information at current to see what the impacts of the latest tariff choices by the brand new US President may need. I’m no exception. Yesterday (April 30, 2025), the US Bureau of Financial Evaluation revealed the newest US Nationwide Accounts figures – Gross Home Product, 1st Quarter 2025 (Advance Estimate) – which gives us with the primary main information launch because the new regime took workplace. The actual fact although is that this information can’t inform us a lot concerning the tariff choices, on condition that Trump’s – Govt Order 14257 – solely actually turned operational on April 4, 2025, though there had been some earlier tariff adjustments earlier than then.

An Apart

Final week, I detected the primary impacts of what I assume are the DOGE impact.

I usually use US Division of Well being information and stories for work that I do on occupational well being dangers and many others.

Final week, I returned to that information supply to get some info and I discovered that every one the stories have disappeared and I simply acquired Apache server 404 error notices.

Just some months in the past all that info was obtainable.

In the present day, I sought out the long-standing ‘interactive information’ capability from the US Bureau of Financial Evaluation, the physique that publishes all of the Nationwide Accounting information.

That is what I discovered:

I feel these two cases in my interplay with the US information sources within the final week sign that there are issues forward for researchers.

Introductory Nationwide Accounts feedback

The US Bureau of Financial Evaluation media launch – Gross Home Product, 1st Quarter 2025 (Advance Estimate) mentioned that:

The lower in actual GDP within the first quarter primarily mirrored a rise in imports, that are a subtraction within the calculation of GDP, and a lower in authorities spending …

In comparison with the fourth quarter, the downturn in actual GDP within the first quarter mirrored an upturn in imports, a deceleration in client spending, and a downturn in authorities spending that have been partly offset by upturns in funding and exports.

That is the primary attention-grabbing level that confuses individuals.

Imports are what economists seek advice from as a ‘leakage’ from the home income-expenditure cycle.

So incomes are earned by supplying productive inputs to the companies and many others and if all that revenue was recycled again every interval within the type of home expenditure then the cycle would perpetuate.

Producers’ choices to supply and pay inputs can be realised by gross sales.

Nevertheless, imports characterize home revenue earned that’s being spent on items and companies produced overseas, in order that they represent a ‘leakage’ from that home income-expenditure cycle.

Until they’re offset by an ‘injection’ from outdoors that cycle – for instance, enterprise funding, export revenue, and/or authorities spending, then the financial system contracts as a result of not all of the home revenue generated comes again to native producers within the type of gross sales.

That’s the reason import expenditure is a unfavourable contributor to GDP progress and that’s precisely what has occurred within the March-quarter 2025 within the US.

The decline in GDP because of the numerous progress in import expenditure clearly displays the expectations of importers of the tariff rises that have been to come back.

That’s prone to be a one-quarter impact, and, as such, doesn’t signify {that a} recesion is imminent.

To make a case that there’s an impending recession, we have to look into the most important spending aggregates: family consumption, funding spending, and authorities spending (see under).

The BEA additionally famous that the bushfires in California in January 2025 “disrupted client and enterprise actions and prompted emergency companies and remediation actions” though they mentioned it was “not attainable to estimate the general affect of the California wildfires on first-quarter GDP

That is an attention-grabbing level.

Nationwide accounts cowl flows of expenditure, not asset shares (actual or monetary).

So whereas the bushfires have been devastating by way of property loss the BEA word that the “destruction of mounted belongings, reminiscent of residential and nonresidential buildings, doesn’t straight have an effect on GDP or private revenue”.

The abstract outcome from the March-quarter advance estimates are:

- The BEA say that actual GDP declined by 0.3 per cent on an annualised foundation and 0.1 on the quarterly charge.

- The March-quarter 2024 to March-quarter 2025 progress charge was 2.1 per cent.

- Quarterly progress in private consumption expenditure was 0.4 per cent (down from 1 per cent final quarter), whereas the annual progress was regular at 3.1 per cent.

- Enterprise funding grew by 5.1 per cent (up from -1.4 per cent); Annual progress was 3.8 per cent (up from 3.4 per cent).

- Authorities spending progress was minus 0.4 per cent (down from 0.8 per cent); Annual progress was 5.3 per cent (down from 5.8 per cent).

- Exports grew by 0.4 per cent for the quarter (up from zero); Annual progress was 2.7 per cent (down from 3 per cent.

- Imports grew by 9 per cent for the quarter (up from -0.5 per cent; Annual progress was 5.9 per cent (up from 1.7 per cent).

Notice that the BEA usually quotes the ‘annualised quarterly determine’, which is calculated by merely multiplying the Narch-quarter final result of -0.1 per cent by 4.

The choice, that the majority companies quote, is the precise annual (year-on-year) progress charge which is the proportion shift from the Narch-quarter 2024 to the Narch-quarter 2025.

That mixture was 2.1 per cent down from 2.5 per cent within the December-quarter 2024.

Whereas private consumption expenditure slowed a bit and authorities spending contracted, enterprise funding was sturdy as have been exports.

So this one-off surge in imports – which economists seek advice from as a ‘coverage announcement’ impact just isn’t but a sign of recession.

Some graphs

The next sequence of graphs captures the story.

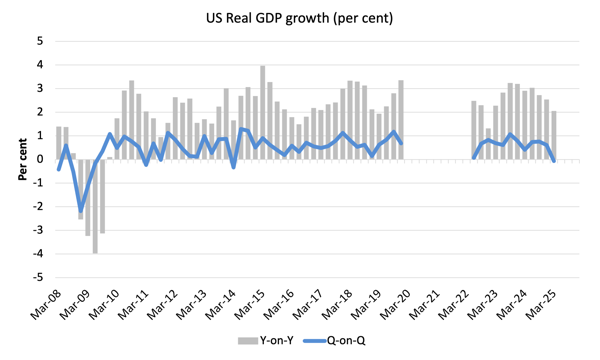

The primary graph exhibits the annual actual GDP progress charge (year-to-year) from the height of the final cycle (December-quarter 2007) to the March-quarter 2025 (gray bars) and the quarterly progress charge (blue line). The quarters March 2020 to March 2022 (inclusive) have been excluded as COVID-19 outliers so that you simply get a greater impression of the relative actions.

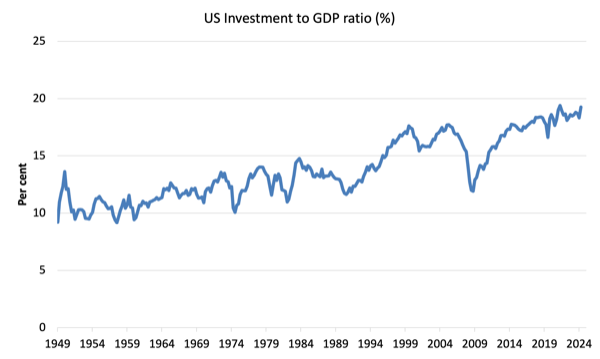

The subsequent graph exhibits the evolution of the Personal Funding to GDP ratio from the March-quarter 1947 to the September_quarter 2023.

The chaos brought on by the pandemic is obvious as is the stalling efficiency after the preliminary GFC restoration.

Nevertheless, the ratio within the March-quarter 2025 was 19.3 per cent, which is 0.1 factors lowest than the very best studying everrecorded within the March-quarter 2020, simply earlier than the pandemic hit. since this collection was first revealed within the March-quarter 1947.

It follows a really sturdy quarterly progress charge in enterprise funding of 5.1 per cent and a 12-month progress charge of 5.9 per cent.

The funding charge is thus not displaying as much as the tip of March any dramatic ‘fall of the cliff’ dynamic.

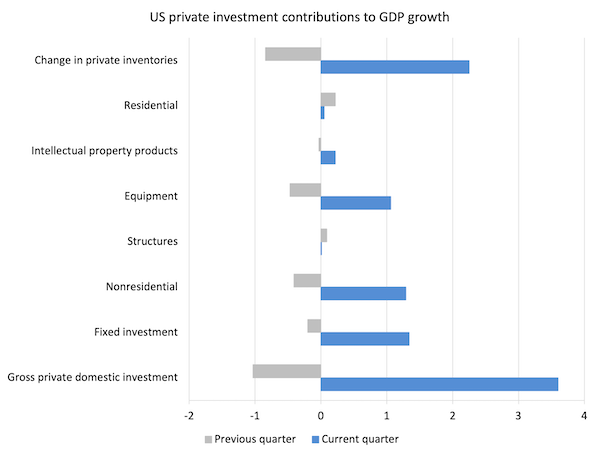

The funding progress was dominated by stock buildup (that’s, unsold items) – see under.

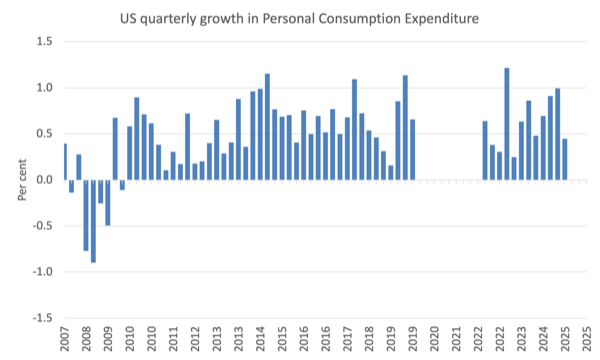

The subsequent graph exhibits the quarterly progress in Private Consumption Expenditure from the December-quarter 2007 to the March-quarter 2025 (with the worst COVID-quarters excluded as above).

Whereas there was a slowing from 1 per cent to 0.4 per cent, the common (excluding the quarters between March 2020 and March 2022) was 0.5 per cent.

And the latter quarters in 2024 have been unusually sturdy by way of personal consumption progress.

So I doubt we will draw something at this stage concerning the affect of the Trump administration on this expenditure mixture.

The Federal Reserve Financial institution of New York publication – Family Debt and Credit score Report – was final up to date for the December-quarter 2024 (revealed February 2025) – (PDF Obtain).

It exhibits:

Whole family debt elevated by $93 billion to achieve $18.04 trillion within the fourth quarter … Mixture delinquency charges ticked up 0.1 share level (ppt) from the earlier quarter to three.6 p.c of excellent debt in some stage of delinquency. Mortgage balances rose by $11 billion to face at $12.61 trillion on the finish of December. Transition into severe delinquency, outlined as 90 or extra days overdue, remained secure for mortgages, however edged up for auto loans, bank cards, and HELOC balances. Auto mortgage balances noticed an $11 billion improve to $1.66 trillion within the fourth quarter, whereas bank card balances elevated by $45 billion from the earlier quarter to achieve $1.21 trillion on the finish of December.

There doesn’t seem like an enormous decline in client borrowing brewing but.

Contributions to progress

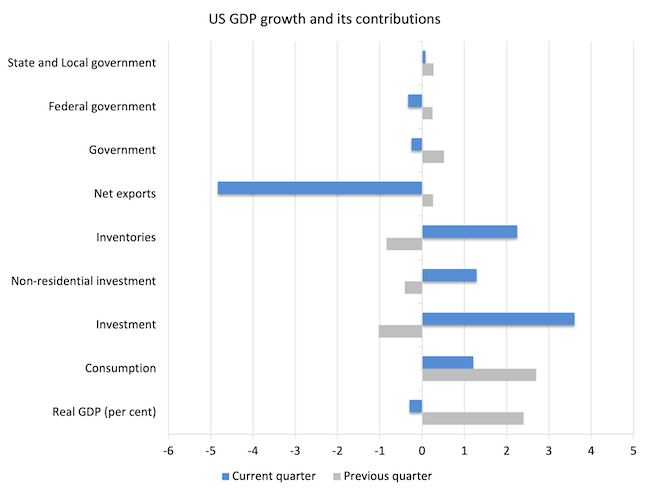

The subsequent graph compares the June-quarter 2022 (gray bars) contributions to actual GDP progress on the stage of the broad spending aggregates with the March-quarter 2025 (blue bars).

The affect of the rise in import expenditure (by way of internet exports) is dominant.

Additional, the funding determine was pushed by stock progress.

The BEA famous that:

The most important contributor to the rise in funding was personal stock funding, led by a rise in wholesale commerce (notably, medication and sundries). The estimates of personal stock funding have been based mostly totally on Census Bureau stock ebook worth information and a BEA adjustment in March to account for a notable improve in imports.

In order that outcome could also be revised subsequent quarter.

Nevertheless, what we would anticipate is that the once-off growth in imports will reasonable in subsequent quarter’s information (thus decreasing the drain on progress), whereas, the stock accumulation may also decline (thus lowering the funding contribution to progress).

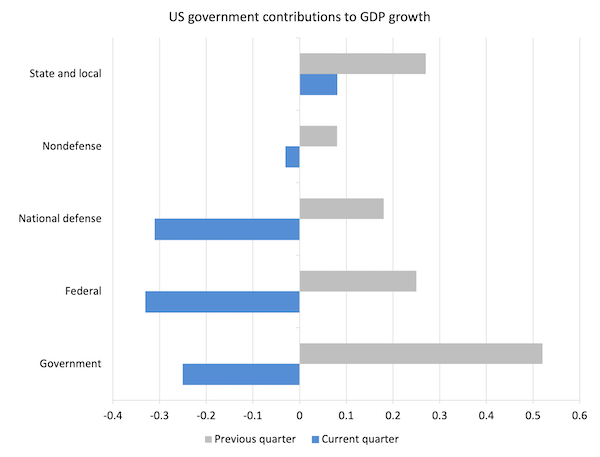

The subsequent graph decomposes the federal government sector and exhibits that the unfavourable progress contribution from authorities was largely as a result of declines in protection spending on the federal stage.

I have no idea what was behind that.

To higher perceive what is occurring with funding expenditure, the subsequent graph breaks down the contributions to actual GDP progress of the varied parts of funding.

Clearly stock accumulation was dominant but additionally there was important funding contributions coming from Tools and Non-residential general.

Conclusion

The US nationwide accounts information for the March-quarter doesn’t inform us very a lot concerning the doubtless trajectory of the US financial system.

Yesterday’s US nationwide accounts information appears to confirm that expenditure behaviour was modified in anticipation of the April tariff bulletins – given the surge in imports.

Development contracted nevertheless it was all all the way down to a surge in imports which rendered the contribution to GDP progress of internet exports of minus 4.83 factors for the quarter – fairly dramatic.

The opposite personal spending aggregates have been nonetheless fairly strong, whereas the decline in authorities spending undermined progress.

It’s thus too early to say something definitive concerning the Trump interval aside from import spending was undoubtedly introduced ahead, which is prone to be a once-off surge (maybe with some modest affect within the second-quarter as nicely, given the April choices).

That’s sufficient for right this moment!

(c) Copyright 2025 William Mitchell. All Rights Reserved.