Corporations usually reward their workers with their inventory, both within the type of worker inventory choice plans (ESOP),Restricted Inventory Items(RSU), or worker inventory buy plans (ESPP). This text covers ESOPs intimately. It explains What are Worker Inventory Choices, what’s granting & vesting of ESOP, How are ESOP taxed? Capital good points of ESOPS?

What are Worker Inventory Choices or ESOPs?

An ESOP is an worker profit plan supplied by an organization to its workers. ESOPs present a possibility to workers to amass a stake within the firm. ESOPs confer a proper and never an obligation on the staff to purchase shares of the corporate at a future date at a pre-determined worth.

Why are ESOPs given?

Other than giving monetary good points to the staff, ESOP additionally creates a way of belonging and possession amongst the staff. The target of ESOP is to encourage the staff to carry out higher and enhance shareholders’ worth. For Employers ESOPs are a instrument to draw expertise and in addition to retain and compensate workers.

What number of ESOPs can one get?

It relies upon upon the corporate’s administration to determine what number of choices to offer to an worker. These choices are allotted to particular person workers primarily based on efficiency, pay construction, seniority, and so forth.

What are the phrases or actions related to ESOPs?

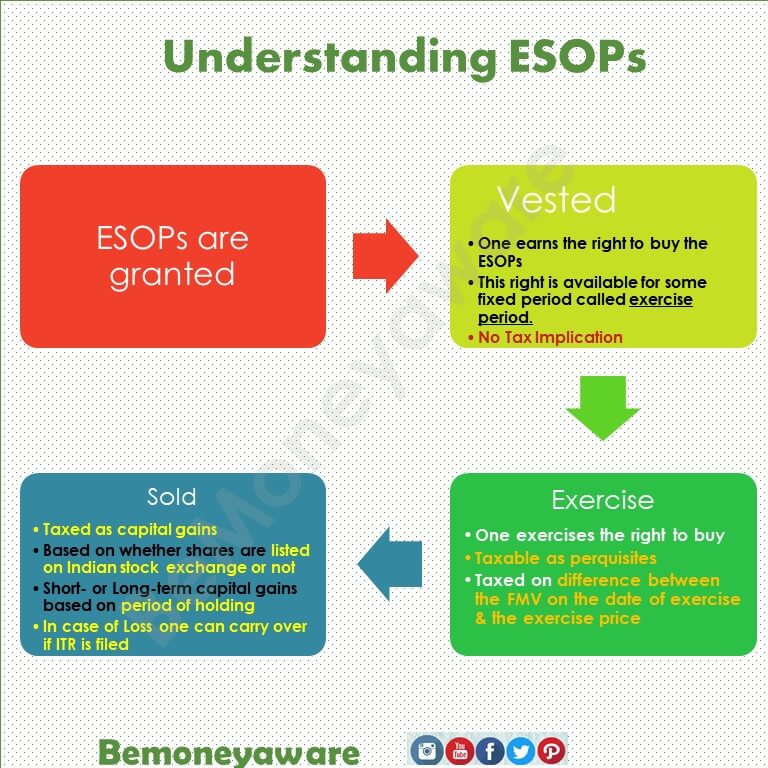

Granting of ESOPs, Vesting, Exercising, and promoting are the actions related to Worker Inventory Choices (ESOPs).

- Grant is a course of by which an worker is given an choice. It’s the delivering of the choices to the worker. The grant shall specify the variety of choices given, the time of vesting, and so on

- Vesting is a course of whereby the worker acquires the appropriate to train the choices

- Exercising: The exercise of changing the choices granted to worker into shares by paying the required train worth is named train of choices. It’s like shopping for of shares.

- Promoting: It’s the promoting of shares like regular shares.

In most firms in India, choices vest for a interval of 3-4 years from the date of grant of choices and could be exercised anytime inside a interval of 2-5 years from the date of every vesting. ESOPs are structured in a manner that they’re exercised over three-five years. That is to make sure that the staff stay with the corporate for an extended interval.

Instance of ESOP

On April 1 2022, an organization grants an worker 100 ESOP, at an train worth of Rs 100 per share, which can also be the market worth that day with the vesting interval is 2 years and train interval of 1 12 months.

- At any level between 1 April 2024 – 31 Mar 2025, he will pay Rs 100 a share and get the shares.

- If the market worth on 1 June 2024 is Rs 200, he can promote the shares and make a neat revenue.

- Nonetheless, if the market worth is Rs 50, he needn’t train the choice. He can as a substitute wait until 31 Mar 2025 to purchase the shares.

What’s Granting of ESOPs?

Grant is a course of by which an worker is given an choice. It’s the supply of the choices to the worker. The grant shall specify the variety of choices given, the time of vesting, and so on. There are no tax implications when the shares are granted.

- Possibility: An choice is a proper however not an obligation granted to an worker below the ESOP to use for and be allotted shares of the corporate at a worth decided earlier, throughout or inside a selected time frame

- Grant: Grant is a course of by which an worker is given an choice. It’s the delivering of the choices to the worker. The grant shall specify the variety of choices given, the time of vesting, and so on.

- Grant date – The date on which the corporate grants an choice to its worker.

- Possibility worth – The value at which the shares are supplied. It’s also often known as strike worth or grant worth. The grant worth is set be employers in several methods akin to averaging the inventory’s market worth for a interval, for instance, a month earlier than the difficulty date OR It is also the common market worth on the difficulty date.

What’s the Vesting of ESOP?

Vesting is a course of whereby the worker acquires the appropriate to train the choices. It has two parts:

- Vesting proportion: portion of complete choices granted, which worker will probably be eligible to train.

- The vesting interval refers back to the minimal interval for which an choice should be held earlier than it may be exercised. It supplies incentives to the grantees of an choice to stay employed with the corporate throughout such interval. The vesting interval could be a single time interval or a sequence of time durations.

- There are not any tax implications when the shares are vested.

What’s Exercising of ESOP?

Train :The exercise of changing the choices granted to worker into shares by paying the required train worth is named an train of choices. Largely the corporate fixes train worth primarily based in the marketplace worth of that individual share on the date of grant. An worker sometimes buys the shares provided that the market worth is larger than the train worth.

- The train interval is the interval inside which you’ll determine to train your choices. i.e purchase the shares by fee of the choice worth on the choices vested in him. This era begins from the date of vesting.

- If the train interval lapses the vested choice lapses and no proper shall accrue to the worker thereafter.

- The worker might train all of the choices vested in him in a single stroke or select to train a variety of choices inside the train interval.

- The date the worker workout routines his shares is the day thought of the day of shopping for the shares.

- Within the occasion of resignation or termination of employment, all choices not vested within the worker as on that day shall expire. Nonetheless, the worker can train the choices granted to him that are vested inside the interval specified on this behalf, topic to the phrases and situations below the scheme granting such choices as authorized by the Board.

- The worth of a inventory choice is the distinction between the inventory’s present market worth and its choice worth or the value at which an worker acquires the inventory choice.

- Esops are taxable as perquisites within the fingers of the staff. The tax implication in the course of the exercising of choices is mentioned under.

What are tax implications in the course of the exercising of ESOPs?

At the moment Esops are taxable as perquisites within the fingers of the staff. Earlier in Fringe Profit Tax regime, an employer was required to pay a fringe-benefit tax on the profit derived by workers from Esops, which in flip could possibly be recovered from workers.

- The perquisite worth is derived because the distinction between the Truthful Market Worth (FMV) of the share on the date of train and the train worth.

- For listed firms, the market worth on the train day is often thought of because the truthful market worth.

- For non-listed firms, the truthful market worth is set by a Class I service provider banker registered with the Securities and Change Board of India, the inventory market regulator.

- The perquisite tax must be paid on date of train though the shares aren’t offered.

- The perquisite tax relies on the tax bracket of the worker.

- Though the taxable occasion can be triggered by the precise date of allotment of shares, the perquisite can be valued just about its date of train.

- The employer has to compute and deduct the tax on prerequisite ensuing from allotment of shares below ESOP. Both by withholding the quantity from the wage revenue or by disposing of off the desired variety of shares to satisfy the tax legal responsibility, topic to the phrases and situations below the plan.

- The revenue and the perquisite tax deducted by the corporate are mirrored in Type 16 and the worker ought to report the identical as a part of his wage in his private tax return.

Ideally ESOP ought to be exercised when the corporate’s shares are buying and selling at a low worth, however the worker is assured of the corporate’s long-term prospects. Since it’s tough to foretell the inventory worth motion, it additionally advisable to train the ESOPs in a phased method.

Quiz on ESOP

How are ESOP taxed on Promoting?

Promoting the shares: As soon as the worker workout routines the choices these shares turns into his. He can promote them at any time he needs similar to the common shares.

The good points arising from the distinction between sale consideration and the FMV on the date of train are taxable within the fingers of workers as capital good points similar to common shares on sale and buy of shares from the market.

The capital good points tax therapy relies on the holding interval and whether or not the shares are offered on a acknowledged inventory alternate in India. Taxation guidelines are

- Price of acquisition is taken because the market worth on the date of train.

- Listed Firm Shares (STT paid)

- If the holding interval is greater than 12 months for a listed firm, it’s thought of as long run and attracts 12.5% on good points exceeding ₹1.25 lakh.

- Nonetheless, if the identical is held for lower than 12 months, it’s thought of as short-term and taxed accordingly (at present at 15%).

- Unlisted Firm Shares: When you don’t pay STT (for overseas shares and off-market transactions)

- If the holding interval is greater than 24 months it’s thought of as long run and attracts 12.5% on good points.

- STCG will probably be taxed as per your tax slab

Key Adjustments from Price range 2024

The LTCG tax price for listed shares was diminished from 20% (with indexation) to 12.5% (with out indexation) efficient July 23, 2024. This modification has made ESOP taxation extra favorable for workers.

Essential Tax Concerns

LTCG Exemption: For listed shares, the primary ₹1.25 lakh of long-term capital good points is exempt from tax every monetary 12 months. This exemption doesn’t apply to short-term good points.

Price Foundation: The price of acquisition for calculating capital good points is the FMV on the train date, not the train worth you initially paid. It is because you already paid perquisite tax on the distinction between FMV and train worth whenever you exercised the choices.

Twin Taxation Construction

ESOPs are topic to taxation at two distinct phases:

-

Train Stage: Perquisite tax on (FMV – Train Value) at your revenue slab price

-

Sale Stage: Capital good points tax on (Sale Value – FMV on Train Date)

Instance Calculation

Let’s say you:

-

Exercised ESOPs at ₹200 when FMV was ₹500

-

Bought shares at ₹800 after 18 months

Capital Positive factors Calculation:

-

Capital Achieve = ₹800 – ₹500 = ₹300 per share

-

Since held > 12 months = Lengthy-term capital good points

-

Tax = 12.5% on good points exceeding ₹1.25 lakh

Particular Provisions for Startups

Eligible startups (below Part 80-IAC) can defer perquisite tax for as much as 48 months or till the worker sells shares/leaves the corporate, whichever is earlier. This supplies important money circulate reduction for startup workers.

Loss Remedy

When you promote ESOP shares at a loss, capital losses could be carried ahead for eight consecutive monetary years and set off in opposition to future capital good points. Lengthy-term capital losses can solely be set off in opposition to long-term capital good points.

The present tax construction makes ESOPs extra enticing than earlier than, notably with the diminished LTCG charges, whereas nonetheless requiring cautious planning round train and sale timing to optimize tax effectivity.

How is capital good points tax calculated for ESOP shares in India

What are the variations in tax charges for listed vs unlisted ESOP shares

When do ESOPs entice short-term versus long-term capital good points tax

How does holding interval have an effect on the tax price on ESOP income in India

What occurs to ESOP taxation when shares are offered overseas by NRIs

Our article RSU of MNC, perquisite, tax, Capital good points, ITR covers it intimately

From Monetary 12 months 2020-21, an worker receiving ESOPs from an eligible start-up will have the ability to defer the fee of perquisite tax till sure occasions happen.

Instance of Tax implication on ESOP for listed firms

The employer has given the ESOP of a complete of 400 shares, for the following 4 years, to his workers. The vesting worth is Rs 100 and the vesting date begins from 1 June 2020. The worker workout routines 100 shares on 1 July 2020, when the value of the share is Rs 500. He sells these shares at Rs 1500 on 1 December 2021

TAX on the time of exercising: (500 – 100) * 100 * Tax bracket of worker = (500-100) * 100 * 20% = Rs 8000

TAX on the time of sale: (1500 – 500)*100*15% = Rs 15000

What if ESOPs are of the corporate overseas?

This relies on whether or not you’re a resident or non-resident Indian. If you’re a non-resident, it won’t be taxable, because the good points happen exterior India, except the cash is acquired in India.

If you’re a resident in India, then you may be taxed on the good points.

- Lengthy-term capital acquire: both you’ll be able to pay 10% revenue tax on good points with out indexation profit Or you’ll be able to pay 20% revenue tax on good points with indexation profit.

- Brief-term capital acquire is added to your total revenue and taxed in accordance with your slab price.

You probably have suffered a loss in ESOP?

You probably have incurred a loss, you might be permitted to deliver ahead short-term/long run capital losses in your tax return and set them in opposition to the good points within the coming durations

What are the alternate options to ESOP?

Options of ESOPs are Restricted Inventory Items (RSU), Worker Inventory Buy Plan (ESPP), Inventory Appreciation Rights Plan (SAR).

What are Restricted Inventory Items (RSUs)?

Just lately, there was a rising development of rewarding workers with Restricted Inventory Items/ shares (RSUs). Restricted Inventory Items characterize an unsecured promise,i.e no strings hooked up, by the employer to grant an worker a set variety of shares (at zero strike worth) on completion of the vesting schedule or different situations.

What’s Worker Inventory Buy Plan (ESPP)?

The worker is allowed to instantly purchase the corporate’s inventory on a month-to-month foundation at a sure low cost to the market worth. For instance, if the market worth is Rs 150, the corporate will supply this to their workers at Rs 135, a ten p.c low cost.

What are Shares Appreciation Rights?

A proper, often granted to an worker, to obtain a bonus equal to the appreciation within the firm’s inventory over a specified interval. Not like worker inventory choices, the worker isn’t required to pay the train worth, however simply receives the quantity of the rise in money or inventory.

Associated Articles :

When you appreciated the article share it with your folks, colleagues, household by way of Fb, twitter, Instagram